This largest tax adjustment in our nation's history since independence will have a positive impact on our nation's economy. The accompanying document contains GST rates and HSN codes for fruits and dry fruits.

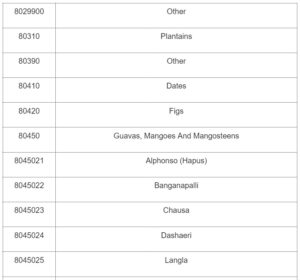

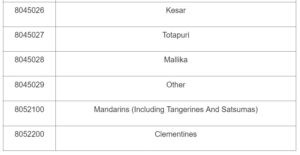

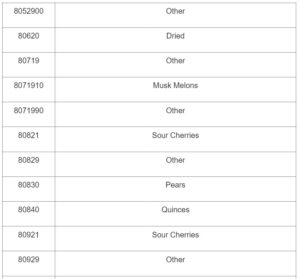

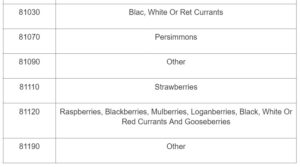

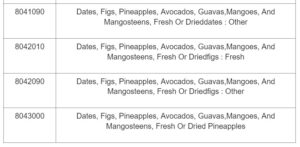

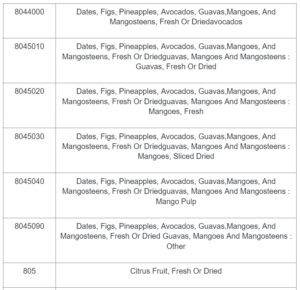

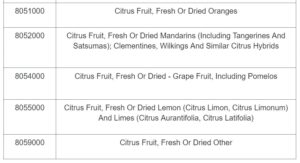

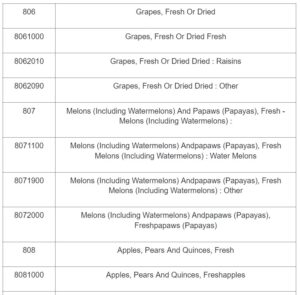

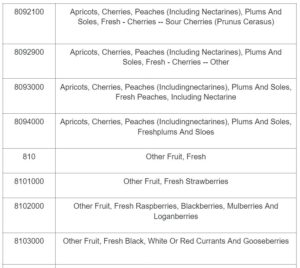

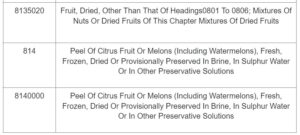

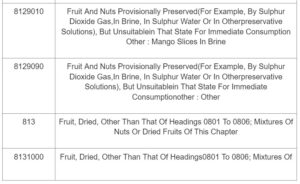

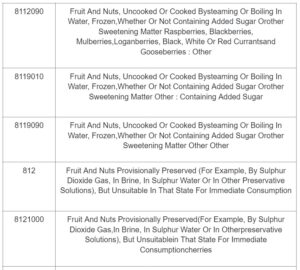

According to section 2 of chapter 8 of the GST Act, the GST tax rate and HSN code for fruit, nuts and peels of citrus fruits and melons are defined as per section-2 of chapter 8 of GST Act. Trader who includes edible fruit and nuts, citrus peels, and melons in their products will be required to list the HSN CODE for edible fruit and nuts, citrus peels, and melons on their invoices and GST returns in order to identify the nuts, citrus peels, and melons as part of the products they sell.

There is no doubt that by the beginning of July 2017, the historic Goods and Services Tax (GST) regime will have already taken effect in the country. According to our Prime Minister, the GST is indeed a major milestone in the development of the country, as well as an important event for the future of the country in terms of its development.

GST-Free Fruits

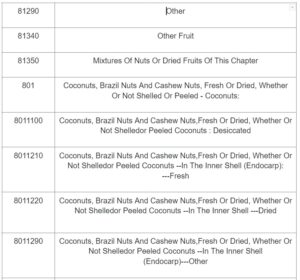

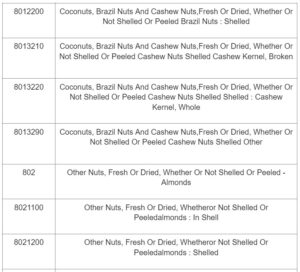

According to the HSN Code, the following types of fruits would fall under the NIL category, attracting no gst rate search

- Those fruits which are not frozen or canned

- Cocoanuts, fresh or dried, shelled or unshaded

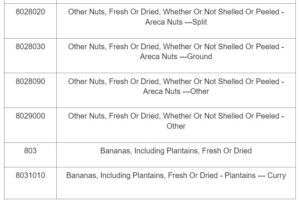

- A variety of nuts, such as almonds, hazelnuts, walnuts, hazelnuts, walnuts, macadamia nuts, kola nuts and areca nuts

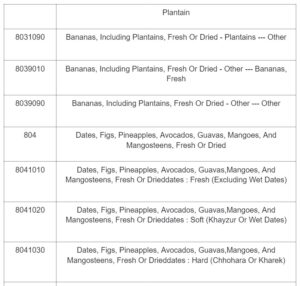

- Bananas, including plantains, may be purchased fresh or dried

- It is important to note that the following fruits and vegetables are available fresh: dates, figs, pineapples, mangoes, avocados, guavas, and mangosteens

- Citrus fruits, including oranges, mandarins, clementines, walkers, and related hybrids, grapefruit, such as pomelo, limes, lemons and limes

Fruits are subject to the 5% GST charge

- Fruits and nuts of the following types are subject to GST rate of 5%

- Areca nuts that have been dried, regardless of whether they have been shelled or peeled

- All goods, other than dry fruits, in a frozen or preserved state

- Uncooked or cooked by steaming or boiling in water, frozen, whether or not sweetened with sugar or another sweetening agent

- Indirectly preserved fruit and nuts, but unfit for direct consumption

- In brine, in sulphur water, or in other preservative solutions, citrus fruit and melons peel can be frozen, dried or provisionally preserved

Fruits liable to the 12% GST Rate

The following fruits and nuts may be assessed to GST based on a rate of 12.5% if they fall into the following categories:

- Brazil nuts and cashew nuts can be bought fresh or dried, regardless of the fact that the nuts are in the shell or have been peeled

- A variety of non-dried nuts other than areca nuts, such as hazelnuts, walnuts, filberts, almonds, macadamia nuts, and coconuts

- It includes dates, figs, pineapples, avocados, guavas, and mangosteen, among other fruits.

- Raisins and dried grapes are some of the most popular dried fruits

- A variety of fruits, dried fruits, and mixtures of dried fruits and nuts are available to customers.

GST Portal – Finding the HSN/SAC Tax Rate by Using the GST Portal

- The GST Portal can be accessed by going to the portal’s homepage and logging in with your valid credentials. From the menu, choose Services > User Services > Search HSN/SAC Code from the drop-down list.

- In order to begin, simply check the box next to the HSN code.

- The tax type should be selected. Under the Tax-Type drop-down list, select the type of tax you are searching for.

- Find HSN Chapters by name or code. In addition, enter the HSN code or the chapter’s name in the ‘Search HSN Chapter by Name or Code box.

- Additionally, in the section labeled ‘Search HSN Code,’ enter the HSN code for the items for which you would like the tax rates to be displayed.

- Select the most suitable dates from the drop-down menu under ‘Effective Period’.

- Select ‘Search’ under the menu. Please finish filling out the form and click on ‘Search’ once all of the details have been entered.

- In addition, for the SGST, it is necessary to select the State for which you would like to investigate the tax rate by selecting Tax Type.

- In light of the standard audio codecs, selecting the SAC checkbox will enable you to begin.

- You may choose the type of tax you wish to pay. From the drop-down menu, select the type of tax.

- You should enter the Service Classification Code (SAC) for the prices that interest you in the field marked ‘Service by Name or Code’.

- Choose an appropriate date. In the ‘Effective Period’ section of the form, select the appropriate dates from the calendar.

- Click on the ‘Search’ button to begin the search process. The drop-down menu will allow you to select the option ‘Search’ from the list of options. Upon successful completion of the previous steps, the user will be able to view the specifics.

HSN Code: How Does It Work

The system consists of more than 5,000 categories of items, each of which is coded with six digits and is categorized logically and legally in a systematic manner. It is underpinned by well-defined rules for the purpose of achieving a uniform categorization.

Conclusion

By using the HSN codes in the GST (Goods and Services Tax), we are able to organize and make the GST (Goods and Services Tax) more transparent and organized. In order to provide a comprehensive description, using HSN codes will be insufficient. The electronic filing of GST reports will simplify the process of filing and save you a lot of time in the long run.

As a result, it is mandatory for the seller or service contractor who is responsible for the sales included in the above slabs to provide a breakdown of the sales, HSN by HSN and SAC by SAC, in his GSTR-1. You can trust Vakilsearch to support your company with experienced professionals as well as assist you in complying with your tax obligations, including GST, HSN, CGST, and more, so you can focus on running your business.