If you wish to know the procedure for converting an agricultural land for commercial or residential purpose you have come to the right place. In this article we will explain the entire procedure to you in detail.

The definition of Converting Agricultural Land varies according to state statutes. Typically, it refers to land that is used for permanent pastures, crops, or is arable. In India, according to the World Bank’s collection of development indicators, agricultural land accounted for approximately 60.41% of the land area in 2014.

Need for Converting Agricultural Land to Non-Agricultural Land

The law prohibits the construction of houses, factories, and industries on agricultural land, regardless of who owns it. Construction should begin only after agricultural land has been converted to non-agricultural land. However, even today, only dry or barren land patches are preferred for conversion on a large scale.

It is critical to exercise extreme caution when purchasing a property for construction/residential purposes.

If a piece of land was originally designated as agricultural land, it should be transformed to non-agricultural land before it can be used for non-agricultural purposes whatever it may be.

Always ensure that the land on which the construction is taking place is non-agricultural, as failure to do so can put you in a lot of trouble. The Land of Agriculture Land Property can be Converted for Commercial Purpose Online.

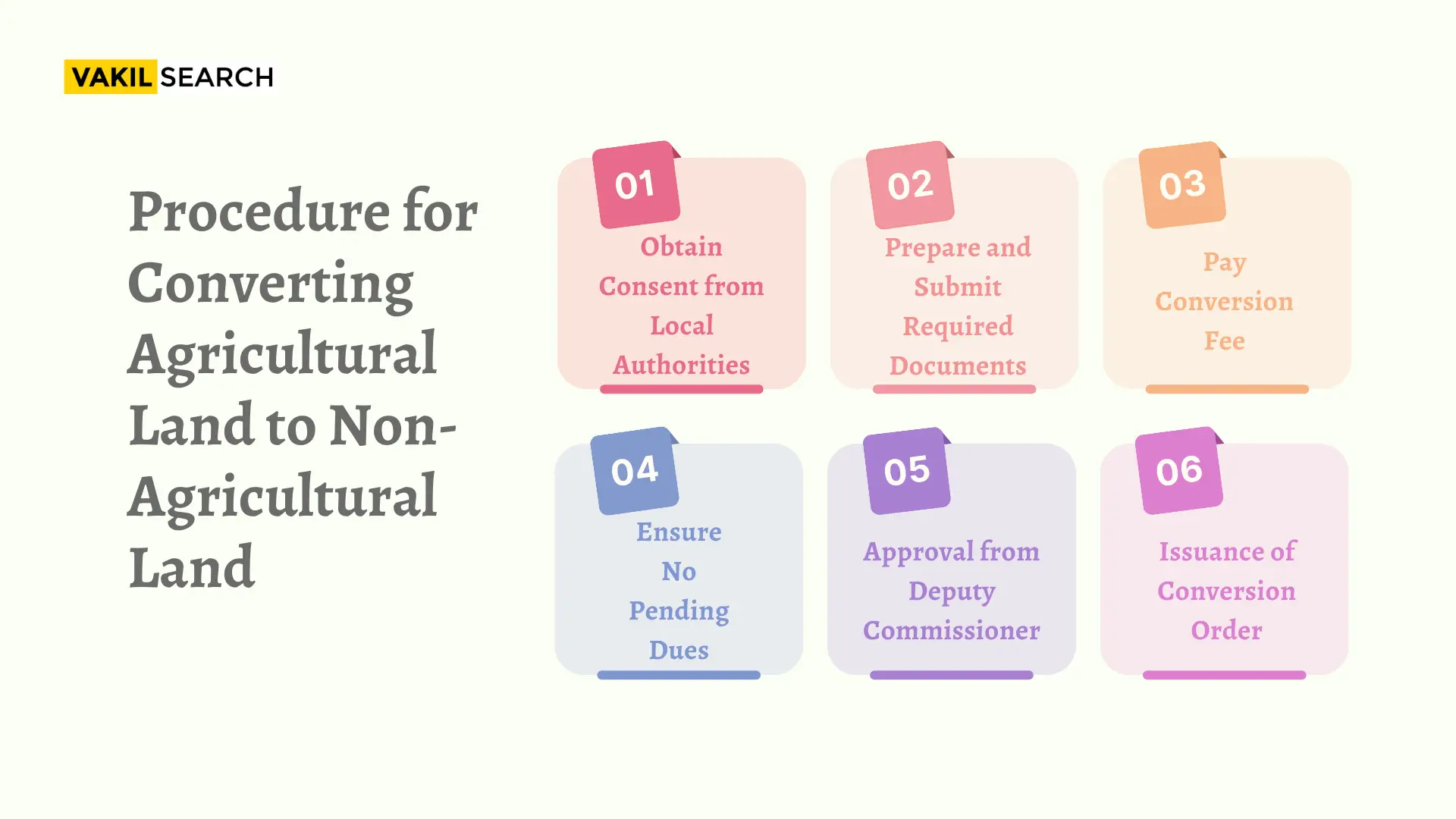

Procedure for Converting Agricultural Land To Non-Agricultural Land

- It is compulsory for one to obtain consent which is absolutely necessary from the local authorities to effect a ‘change of land use.’ An application form has to be sent to the Commissioner of the Land Revenue Department clarifying the reason behind seeking conversion of land.

- The following documents should be attached with the application letter seeking a change of land use:

- Original Sale deed (or gift/partition deed)

- Mutation Letter

- RTC (record of rights, tenancy and crops)

- Certified survey map

- Latest receipt of tax paid

- ID proof

- Fee Payment: When agricultural land is converted to non-agricultural land a mandatory fee is necessary to be paid depending on the kind of the property and its locality.

- Details such as the extent of land, mortgages, kind of crops and soil grown there, the names of the previous and present owners, etc. need to be mentioned in the application. You can also make property registration with few Experts.

- Certified copies of the documents as mentioned earlier can be acquired from the Tahasildar or Revenue Office. All the unpaid dues should be paid, and copies of payment proof need to be added.

- It is the Deputy Commissioner or Collector who is authorized to permit the conversion of agricultural land to non-agricultural land. The Deputy Commissioner or Collector will permit conversion only if they’re convinced that all the necessary pre-conditions to change of land usage have been met and there are no pending dues or litigation on the land.

- The conversion ought to be permissible as per the master plan of the land. A conversion order permitting the change in land from agricultural to non-agricultural will then be issued if all criteria for conversion are satisfied.

- Once a conversion certificate is granted, the farmland is officially converted to non-agricultural land.

Documents to Converting Agricultural Land to Residential

Having the proper documentation to Converting Agricultural Land to residential use is crucial, even if the rules are different for each state. After applying, the owner must submit the following documents for making a relevant application:

-

Identity Proof of the Owner:

Aadhar card, passport, voter ID, or any government-issued identity document.

-

Record of Rights, Tenancy, and Crops:

Document providing details about the land’s record of rights, cultivation, and any tenancy agreements.

-

Sale Deed and Mutation Deed:

Legal documents proving the sale of the land and its mutation in the revenue records.

-

Gift Partition Deed (in Case of inheritance of Land):

In case the land is inherited, the gift partition deed establishes the transfer of ownership.

-

Nil-encumbrance Certificate (NEC):

Certificate confirming that the property is free from any legal dues or mortgages.

-

No-objection Certificate from the Municipal Council or Gram Panchayat:

Consent from the local governing body for the conversion of land use.

-

7/12 Extract Establishing Land Ownership:

Official extract from the land revenue department confirming ownership.

-

Survey Maps:

Maps outlining the geographical details of the land.

-

Land Utilization Plan:

A plan specifying how the land will be utilized for residential purposes.

-

Receipt of Payment for Land Revenue:

Proof of payment of land revenue or tax.

-

Project Report (for Housing Projects):

Detailed report outlining the proposed residential project.

-

Receipt of Payment of Land Revenue (tax):

Proof of payment of land revenue or tax.

-

Portability of Water Certificate:

Certification ensuring access to water resources for the residential land.

Most of these land documents can be obtained from the Department of Revenue. It is also obligatory to pay a one-time conversion charge which varies from state to state.

Tamil Nadu Change of Land Use Rules

The Tamil Nadu Change of Land Use (From Agriculture to Non-agricultural Purposes in Non-planning Areas) Rules, 2017 regulates the conversion of agricultural land to non-agricultural purposes in Tamil Nadu. The conversion process is completed upon payment of a premium, and if verification confirms that the landowner meets all the conditions, a conversion order will be granted to the landholder.

Exempted Lands for Tamil Nadu Land Conversion

- Public water bodies such as channels, tanks, canals, lakes, and rivers

- Government Pocomoke land, temple lands, wakf properties, and other lands belonging to religious or charitable institutions

- Vacant lands with encroachments on streets, public roads, or any land over which the owner lacks ownership rights

- Properties located beneath high tension and extra high voltage electric lines, including tower lines

- Land suitable for cultivation

Applicable Fee for Tamil Nadu Land Conversion

Tamil Nadu land use conversion charge at the rate of 3% of the market value fixed under the Indian Stamp Act, 1899 needs to be paid to the local authority, and the concerned body will deposit the amount in Government head of account and grant permission for carrying out the development works.

Note: This information is subject to change and may not reflect the most current legal developments. We recommend consulting with our professional for the most accurate and up-to-date information.

Applying for Tamil Nadu Land Conversion

- Step 1: Submit the application form and supporting documents for Tamil Nadu land conversion to the local authority where the agricultural land is located.

- Step 2: The local authority acknowledges receipt of the application within seven days and seeks prior concurrence from the Director before proceeding with development permissions.

- Step 3: The Director reviews the application and obtains approval from the Collector for wetlands and a report from the Joint Director of Agriculture for drylands.

- Step 4: The Collector verifies that the proposed development site complies with Tamil Nadu land use change rules and conducts a site inspection with relevant officials.

- Step 5: Ensure the proposed development does not obstruct irrigation canals, distribution channels, or affect groundwater levels or nearby areas.

- Step 6: The Director of Agriculture confirms the proposed development does not infringe on public water bodies, government lands, religious/charitable institution properties, or high tension electric lines, ensuring proper drainage.

- Step 7: Based on the Collector’s concurrence and the Agriculture Director’s report, the Director grants prior consent for land conversion, following necessary inspections or reports as required.

What Are the Land Conversion Charges?

Land conversion charges in India vary from state to state, district to district, and area to area. The charges depend on the nature of the property, its location, and the area. In general, land conversions involve a one-time fee, which is mandatory to pay.

To know more, reach out to the experts at Vakilsearch right away!

Can I Apply for Land-Use Conversion Online?

In many Indian states, the process of converting agricultural land to residential can be initiated online through the respective official websites. Here’s a general guide, but it’s crucial to check the specific process in your state:

1. West Bengal:

- Website: [banglarbhumi.gov.in]

- Visit the official website and look for the option related to land conversion.

- Follow the specified steps to fill out the online application form.

2. Karnataka:

- Website: [landrecords.karnataka.gov.in] or [Bhoomi portal]

- Access the designated portal and navigate to the land conversion section.

- Complete the online application form as per the instructions provided.

3. Andhra Pradesh:

- Website: [Dharani portal]

- Log in to the Dharani portal and locate the section for land conversion.

- Submit the necessary details and documents through the online application process.

Please note that the steps and websites mentioned are general examples, and the actual process may vary. Ensure that you check the specific guidelines and procedures outlined by the land revenue department of your state. Additionally, the online application may require you to create an account or log in with existing credentials. Always refer to the official government portals for accurate and up-to-date information.

The Bottom Line:- Converting Agricultural Land

According to law, if any violation is found with respect to the procedure to be followed when applying for and executing a conversion, there will be severe penalties.

For example, if any converting agricultural land in Telangana or Bihar is converted to non-agricultural use without first obtaining permission from the Revenue Officer, the land will be deemed to be converted. In the event of a deemed conversion, the Revenue officer will levy a fine of 50% of the conversion fee for that land. And this penalty must be paid by the landowner. If a penalty remains unpaid after the penalty payment deadline, the land will be recoverable under the provisions of the Revenue Recovery Act.

FAQs on Converting Agricultural Land

Can agricultural land be converted to residential?

Yes, converting agricultural land can be converted to residential land. In India, agricultural land cannot be used for residential or commercial purposes without undergoing a land conversion process to avoid penalties imposed by the government.

What is the cost of converting agricultural land to non-agricultural land in Karnataka?

The cost of converting agricultural land to non-agricultural land in Karnataka depends on the specific area of land and the percentage of the collector rate in the state.

How much does it cost to converting agricultural land to non-agricultural land in Maharashtra?

In Maharashtra, you may need to pay close to 50% of the total price of the land, which is calculated through the ready reckoner rates (RR rates).

How Can I build a house on agricultural land in Maharashtra?

To build a house on agricultural land in Maharashtra, you need to convert the land to non-agricultural land. The process involves applying to the collector for permission to convert the use of agricultural land into non-agricultural purposes. You must then submit the necessary documents, such as identity proof of the owner, record of rights, tenancy, and crops, sale deed and mutation deed, gift partition deed (in case of inheritance of land), nil-encumbrance certificate (NEC) and no-objection certificate from the municipal council or gram panchayat.

Can you convert agricultural land to residential in India?

Converting agricultural land to residential in India involves applying to local authorities for land use change. It requires approvals based on zoning laws and land use policies specific to each state. Constructing a house on agricultural land usually mandates prior conversion to residential use to comply with legal requirements and avoid penalties.

Can I construct a house on agricultural land?

Constructing a house on agricultural land in India requires converting the land to residential use through local authorities. Without proper conversion, building on agricultural land is prohibited and may lead to legal repercussions, including fines and demolition of unauthorised structures. It's essential to obtain necessary permissions and adhere to zoning laws.

How much does it cost to convert agricultural land to residential in Tamil Nadu?

The cost of converting agricultural land to residential in Tamil Nadu varies. Additional expenses may include administrative fees, legal charges, and infrastructure development costs, depending on the location and size of the land.

How much does it cost to convert agricultural land to residential in UP?

In Uttar Pradesh, converting agricultural land to residential use generally differs per acre. Costs can increase based on administrative charges, legal expenses, and compliance with local regulations, varying with the land's specifics and location.

Don’t Go! Get a Free Consultation with our Expert to assist with Property Registration!

Don’t Go! Get a Free Consultation with our Expert to assist with Property Registration!