What is the concept of interest on capital payable to partners in partnership deeds? Does it include a facility to withdraw capital with interest? Here is the complete information.

Interest on Partner’s Capital: The partnership deed is a legal document containing all the terms and conditions governing the partnership’s formation. All of the partners have signed it. Some benefits are not accessible to partners if there is no partnership agreement.

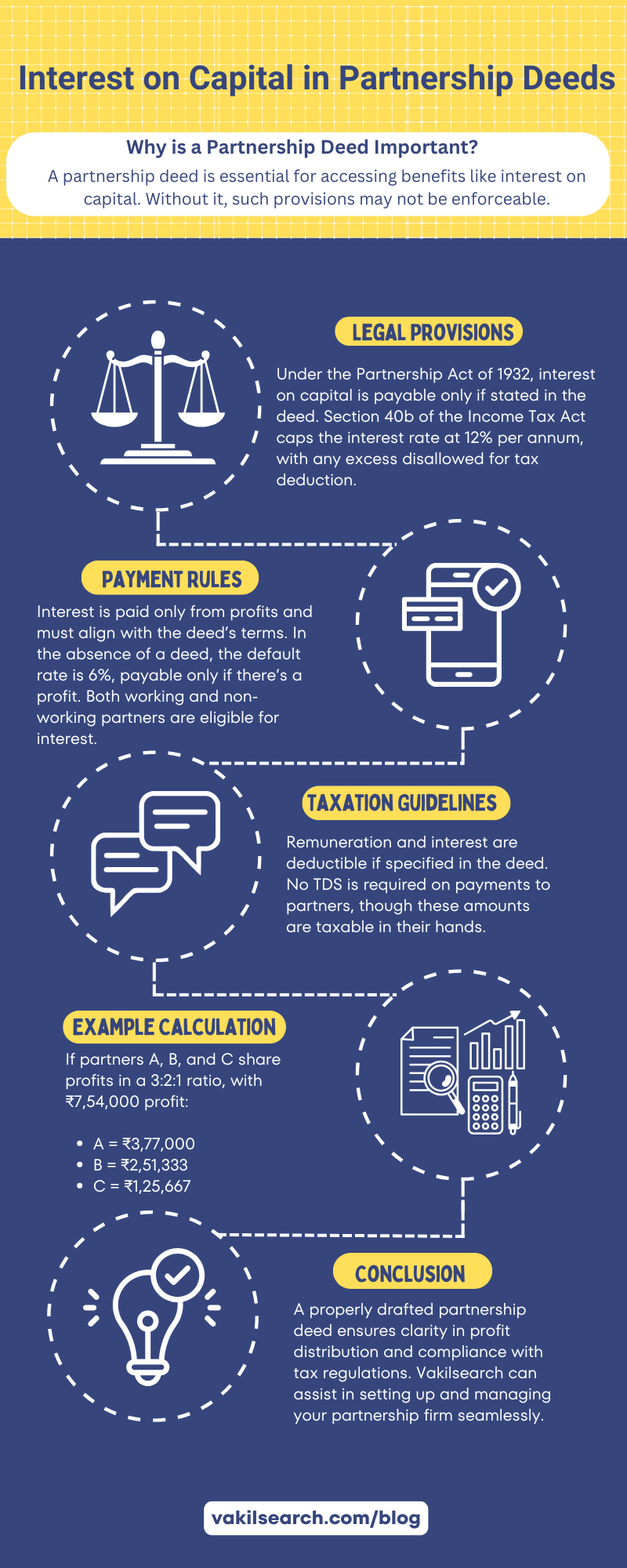

The Partnership Act of 1932 states that before a partnership firm interest on capital rate paid to partners out of earnings must be explicitly noted in the partnership agreement. Section 40b of the Income Tax Act: https://incometaxindia.gov.in/pages/acts/income-tax-act.aspx specifies the maximum salary and capital interest paid to a partner. A partnership business is not permitted to deduct any amounts that are over the limit allowed.

The partnership agreement may specify the interest rate on a partner’s capital investment as long as it is paid from earnings. Interest could be paid at any rate mentioned in the Partnership Deed or decided by the partners. Because interest is an expense rather than a charge, this is remunerated from earnings.

Interest Payments to Partners

The payment of compensation to a partner should be approved by and in conformance with the partnership deed. Besides, the amount could be asserted as a tax reduction only if the partnership agreement either specifies the amount of compensation payable to each partner or specifies the method of quantifying such compensation.

The payment of interest to a partner should not increase the total estimated at a simple interest rate of 12 % annum. Any amount over 12% will be rejected. Interest can be paid to either working or non-working partners.

- Only working partners are eligible for remuneration.

- Remuneration must be authorised by the partnership deed and following the terms of the partnership deed. The salary amount and method of calculation must also be specified in the deed. No deduction is permitted if there is no such provision in the deed. In most cases, the deed states that partners may be paid up to the maximum limit specified in this section. This clause satisfies the quantum of deduction requirement.

- It must be related to the duration of the partnership agreement. If another partnership deed exists for another period, the provisions of that deed will be considered for that period.

- It is not permitted if the tax is paid on a presumptive basis under sections 44AD or 44ADA.

- Remuneration should be limited to the amounts specified below. Please keep in mind that this limit applies to the total salary of all partners, not to each individual partner.

Partner’s Capital Interest

Interest on capital in partnership – The following conditions must be met to deduct Interest on Partner’s Capital calculation:

- Interest can be paid to either a working or a non-working partner.

- Payment of interest must be authorised by the partnership deed and must be related to the partnership deed’s term. If another partnership deed exists for another period, the provisions of that deed will be considered for that period.

- The rate of Interest on Partner’s Capital should not be higher than 12%. If the interest paid exceeds 12% of the capital, the excess is disallowed.

- It is not permissible if the tax is paid on a presumptive basis under sections 44AD or 44ADA.

- Suppose a person is a partner in a firm on behalf of or for the benefit of another person. In that case, any interest paid to that person in any other capacity shall not be taken into account for the purpose of the section.

- If a partner receives interest on behalf of or for the benefit of another person, that interest is not disallowed under this section.

- If the firm receives Interest on Partner’s Capital drawings, it is taxable in the firm’s hands.

- When it is stated that remuneration or interest is not permitted, it means that it is not permitted as a deduction when calculating net taxable profit. The partnership act does not preclude the firm from paying it to the partner in cash.

The amounts deductible as remuneration or interest in the firm under section 40b are taxable in the hands of the partners who receive such amounts under the heading Profit from the business.

A partnership firm is not required to deduct TDS on salary or interest paid or credited to a partner. TDS is not required to be deducted even if the salary or remuneration is taxable in the hands of the partner. More information can be found at TDS Return Filing on salary to partners.

When certain conditions are met, a partnership firm is assessed as a firm for income tax purposes – Section 184. A working partner is an individual actively involved in the management of the firm’s business or profession.

Thus, the Partnership Act of 1932 states that no interest on capital of partners should be paid if the partnership deed is not based on Interest on Partner’s Capital. Capital Interest, on the other hand, is only paid out of profits if all partners agree.

For Instance

If A and B are partners who split profits in a 3:2 ratio. C was approved for a 1/6th revenue share with a minimum amount of Rs. 10,000. The company made a profit of Rs. 7,54,00 at the end of its first fiscal year. Determine the profit share that A, B, and C will receive. Profit Calculation for a New Profit Share.

Let Total Share be 1.

1/6 share of incoming partner

1-1/6=5/6 is the remaining share.

5/6*3/5=15/30 is A’s new ratio.

5/6*2/5=10/30 is B’s new ratio.

C’s new proportion = 5/30

3:2:1 is the new ratio.

Thus, Profit-sharing calculation

A’s share amount = 7,54,000*3/6 =3,77,000

B’s share amount =7,54,000*2/6=2,51,333

C’s share amount = 7,54,000*1/6= 125667

Conclusion

Some benefits are unavailable to partners if there is no partnership agreement or the partnership agreement is silent on certain provisions. So, if the partnership agreement does not specify the rate of interest, there is a provision for capital interest payment; interest can be paid at 6% and is payable only if there is a profit.

Furthermore, Vakilsearch can facilitate you in starting a partnership firm from the ground up. We can suggest and serve you even as your business grows and expands. We believe that flexibility leads to greatness; we personalise our services to each client’s unique guidelines.