Resignation of a director from a firm is a big process. The director has to file a form DIR-11 notice to the registrar. learn more about it

A Director may quit from his office by providing a notice to the organisation and a document of his resignation letter along with comprehensive justifications for the resignation to the registrar within thirty days of resignation by filing an e Form DIR-11. The resignation of a director shall be acknowledged from the date on which the notice is procured by the company or the date, if any, prescribed by the director in the notice, whichever is later.

What Is Form DIR-11

As previously mentioned it is a form used by the director during the resignation process. A director resigns from his office by intimating the company through writing and he is also assigned to send a copy of his resignation along with all the explanations for the resignation to the registrar within thirty days of resignation in e Form DIR-11.

Rules Supporting the Form DIR-11

Article 168 of the Act contains provisions regarding the resignation of a director from the company. Article 168 (1) provides that a director may retire by notifying the company in writing. The management committee will note this notice upon receipt. The resignation of a director will be effective from the date on which the company receives the notice or the date specified by the Director in the notice, whichever is later.

eForm DIR-11 is needed to be documented according to Section 168 (1) of the Companies Act, 2013 and Rule 16 of Companies (Appointment and Qualification of Directors) Rules, 2014 which are simulated for your source. In case the director quits from his office, he should file the DIR-11 along with the fee as given in the Companies (Registration Offices and Fees) Rules, 2014.

The filing should be completed within a duration of thirty days from the date of resignation. The file has to be sent to the register along with the reasons for resignation. Delivered within case a company has already documented Form DIR-12 with the registrar under rule 15, a foreign director of such company resigning from his office may authorize in writing a practicing chartered accountant or cost accountant in the exercise of company secretary in practice or any other resident director of the company to approve form DIR-11 and document the same on his behalf inferring the explanations for the resignation.

Information to be filed in DIR-11

The director of a company must file a DIR-11 within 30 days of accepting the notice of resignation in order to provide the following information to the RoC

- Corporate Identification number (CIN)

- The firm’s name, address, and email address will be automatically populated based on the CIN

- Director Identification Number (DIN) of the director leaving the firm

- The director’s name and nationality will be automatically procured based on the DIN

- The date of the director’s appointment

- The director’s position

- The category of director (promoter, professional, or independent)

- The date of the company’s appointment

- The notice of resignation

- The reason for resignation

- Whether confirmation has been received from the firm (yes/no)

Notification to Registrar of Companies (ROC)

A director may inform the RoC about his resignation in two ways:

-

Intimation by Company

The Company shall notify the RoC about the resignation of a director within 30 days of receiving the notice in form DIR-12. The Company shall also post the information about the resignation on its website. (Section 168(1) of the Act, with Rule 15 of Companies (Appointment and Qualification of Directors) Rules, 2014.) The Company shall also make note of the resignation in the director’s report to be submitted to the next general meeting.

-

Resignation Notice (Section 168 with Rule 15)

A director may also notify the RoC of his resignation by sending a copy of the DIR-11 form to the registrar within 30 days of resignation. Until 6 May 2018, the phrase ‘shall’ appeared in Section 168(1) and Rule 16 instead of ‘may’. thereby removing the mandatory filing requirement of DIR-11. Accordingly, filing of DIR-11 is at the discretion of the director.

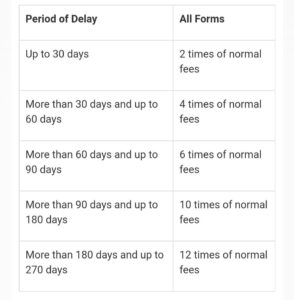

Applicable Fees

When a director documents e Form DIR-11 for conveying his resignation before the corporation documents e Form DIR-12, an email will be mailed to the firm for documenting the e Form DIR-12 and the level of the director in the company will be altered to ‘resigned’ against the selected designation. Once the company documents the related e Form DIR-12, the status shall be altered as per the subsisting system.

In the case of a company having share capital the applicable fees is

In case the company does not have share capital the applicable fee is ₹200.

Applicable fees.

How Vakilsearch Can Help in the Removal of a Director

As you can see, removing a director is a complicated process. It involves a lot of legalities, this is where experts at Vakilsearch can help you. Our experts handle more than 1000 companies every month and can make the removal of director process very easy. Reach out to our experts and they will address all the queries regarding the process and prepare the required documents for the removal. Our team provides a holistic approach to the entire process.

Read More: