We go over the pan card documentation that a corporation needs in this article (a partnership firm, in particular). We'll also talk about how to apply for a pan card online.

On 22 September 2020, the Indian parliament passed a bill to amend the Companies Act, 2013 and decriminalise various compoundable offences. This has been done to help small companies, partnership firms and LLPs by reducing the litigation burden on them. However, the honourable Finance Minister said that matters related to fraud, deceit and injuries to the public interest will continue to be dealt with firmly. Know how to apply for PAN Card for Partnership Firm in this blog.

What Is a Partnership Firm?

In India, a partnership firm can be formed by two or more individuals either through an oral or written agreement. These firms are governed as per the provisions mentioned in the Indian Partnership Act of 1932.

Section 4 of this Act defines a partnership firm as the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all. Through this relationship, they agree to share the profits of a business run by all or any of the partners.

Importance of PAN Card for Partnership Firm

A PAN (Permanent Account Number) card is an important document all taxpayers must possess. As mandated in the Income Tax Act of 1961, it is the tax identity for any individual/business that generates income. Therefore, a partnership agreement operating in India must have a business pan card, irrespective of whether it is incorporated in India or abroad.

The main objective of a PAN is to track and prevent tax evasion. Moreover, if you are without a pan card in the partnership’s name, you can’t enjoy the tax benefits offered by the Government. You will also be liable to pay taxes at the highest rate applicable.

Documentation Criteria for Application of a pan card for partnership firm

A few important documents are required for availing a pan card for a firm. For a partnership firm, the following documents are required to process a pan card application form –

- Partnership Deed* or Certificate of Registration from the Registrar of Firms

- Proof of address for the registered office of the firm

- A Demand Draft of the requisite fee ( if the payment is made offline)

*Please note

- The partnership deed should be duly attested

- It should define any one of the partners as the managing partner. He will be the signing authority on behalf of the other partners

- It should clearly mention the address of the firm and the date of the formation of the said partnership

- A rubber stamp bearing the firm name should be made. It should also mention the word ‘partner’ at the bottom. The managing partner can use this stamp while signing the pan card for partnership firm.

How to Apply for a PAN Card Online for your Partnership Firm

The following step-by-step procedure will help you understand how to apply for a pan card online –

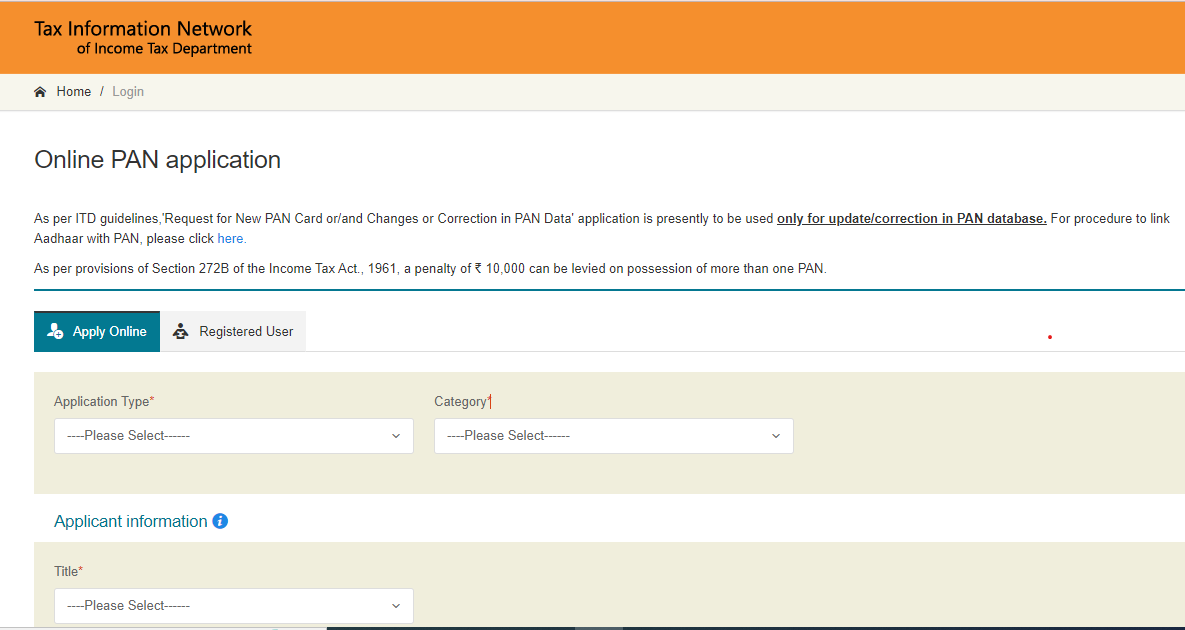

Step 1: Visit the paperless PAN application page on the NSDL website: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

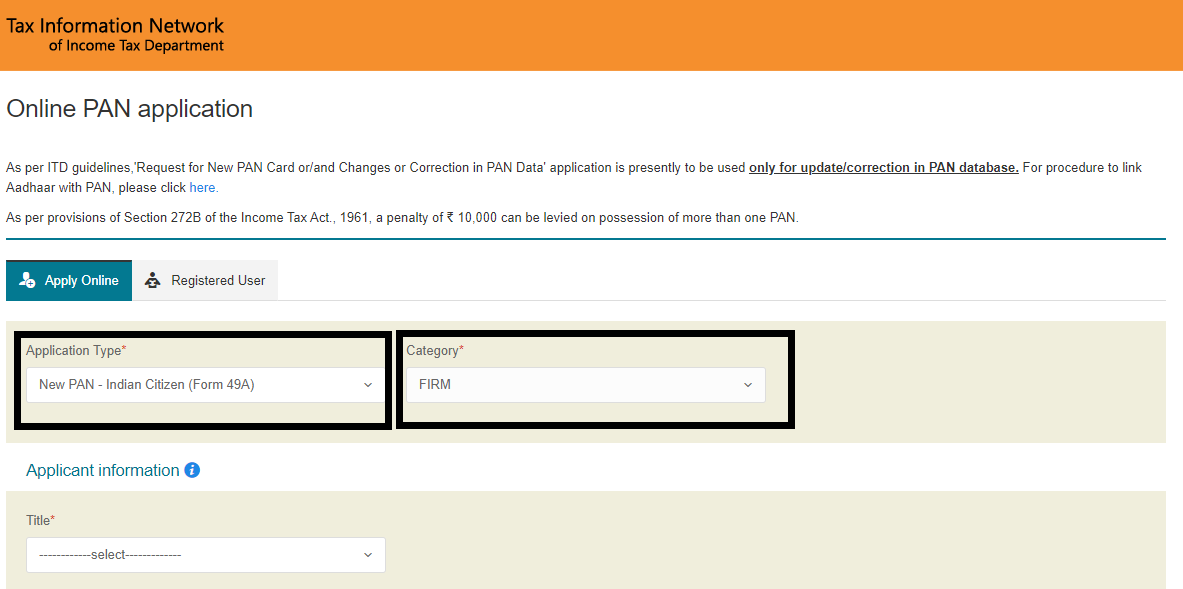

Step 2: From the ‘Application Type’ drop-down menu, select ‘FORM 49A’. Also, select ‘Firm’ from the ‘Category’ drop-down menu.

Step 3: Fill in your partnership firm details in appropriate boxes. After you fill-up, the details, enter the Captcha code and click ‘Proceed’. An auto-generation token number will be sent to your email address.

Step 4: On the next page, you need to specify the source of income of your firm. Select ‘Income from business/profession’. If you have income from any other sources, tick the appropriate buttons accordingly. Fill in your office address as well. This will remain as the official communication address of your firm on the PAN database.

Step 5: In this Step, you need to provide your AO (Accounting Officer) Code. This will depend on your jurisdiction area. Click on the ‘Indian Citizen’ button and select your City and the State.

You should also know how to register partnership firm?

Step 6: In this stage, you can upload the required pan card documents for the firm. To know more about the documentation criteria, refer to the previous section in this blog.

After you fill up the form, the same will be available for your review. After checking for any errors, you can click the ‘submit button.

Step 7: In this Step, you need to pay the required application fee. You can make the payment through debit/credit card, net banking, and demand draft.

Step 8: On successful submission of payment, an acknowledgement receipt, bearing an acknowledgement number, will be delivered to your email id. With this number, you can check your PAN card application status online at the NSDL website.

Step 9: You need to send the following via post to the NSDL office-

- Signed acknowledgement receipt

- Copy of company registration certificate or partnership deed

- Demand draft, if payment is offline

The address of the NSDL office is-

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411016

Please note that the hard copies should reach the NSDL office within 15 days from the date you have applied for a pan card for partnership firm. The department will then verify your application and accompanying documents. If everything is in order, you can expect to receive your PAN card for partnership firm within 15 business days.

Read more: