Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued by the Income Tax Department. It tracks all the day to day transactions and tax payments of the holder. Even an NGO is not exempted from the responsibility of having a valid PAN card.

Overview

One of the most important documents an NGO should have in India is the PAN card. It is crucial as it is necessary for all sorts of commercial transactions. So much so that NGO’s cannot even claim essential benefits, file taxes, or accept donations without it.

Like any individual, every organization, even non-profit ones are required to register for a PAN card. So, if you’re running an NGO, you need to have a Permanent Account Number. You should get one sooner rather than later. After all, you can’t even open a bank account nowadays without one.

In India, PAN cards are one of the most important documents when it comes to financial transactions. PANs are ten-character alphanumeric identifiers issued by the Income Tax Department on laminated cards. A number is issued to any “person” who applies for it or to whom the department allots it without an application. To pay taxes and claim benefits from them, individuals and companies alike need PAN Cards. How to get a PAN card for a Registered NGO will be discussed here.

Why Does an NGO need a PAN Card?

- It is important to have a PAN to open a bank account and make transactions.

- Moreover, a PAN card is mandatory for filing taxes. Moreover, it is also crucial for all monetary and related correspondences with the Income Tax Department and other government departments.

- The government of India has made PAN cards mandatory for receiving funds and donations.

- Additionally, NGOs should be registered under the NGO DARPAN website of Niti Ayog (Planning Commission) to be eligible for such funds. Further, this registration process requires NGO’s to furnish their PAN card as well.

- Moreover, NGOs also require a PAN card for preparing documents and challans for payment of tax, interest on tax or any other transactions applicable under the Income-tax Act.

- For getting Section 12A registration and obtaining certification under section 80g of the Income Tax Act.

PAN Card for a Registered NGO has Many Benefits.

Registered NGO’s benefit from having a PAN card include the following:

- NGOs are funded by the NITI Aayog from time to time, and to receive these funds from the government, they need a PAN card. This would ensure the authority and legitimacy of the bank transactions, and the government would have the appropriate details about the NGO’s finances.

- In addition to business transactions, NGOs buy and sell stocks, and purchase lands or other property. To keep track of all these transactions, a registered PAN card is necessary.

- The NGO, as we can see, is involved in many transactions, which makes it an assessee under the Income-tax Act, and therefore is required to pay taxes. It is essential to have a PAN card to successfully pay taxes.

Documents Required to Obtain a PAN Card

The list of documents that are acceptable as proof of identity and address for Indian-origin non-profit organizations is as below:

Type of Applicant |

Document to be submitted |

| Association of Persons (Trust) | Copy of trust deed or copy of the certificate of registration number issued by Charity Commissioner. |

| Association of Person, Body of Individuals, Local Authority, or Artificial Juridical Person | Copy of agreement or copy of the certificate of registration number issued by charity commissioner or registrar of cooperative society or any other competent authority or any other document originating from any central or state government department establishing identity and address of such person. |

Steps to Apply for Pan Using the Offline Method

There are a few important steps to apply for PAN using the offline method:

- To begin with, the authorised person, could include the signatory, President, Secretary or Treasurer or even the member of NGO registration should file the application form – Form 49A

- To be submitted alongside the application is the MoA or Trust deed or Samvidhan (Constitution)

- Note that the copy of the deed or Memorandum of NGO should be signed by the authorised signatory.

- Any authorised person of the NGO can submit the application

- You need to keep in mind that the PAN application should have the ID proof and address proof of the applicant.

- The income tax department will assign people to check and the PAN application is to be made to these assessing people of the authorised agency

- After all the assessing, the authorised people will provide the acknowledgement slip with a stamp seal and signature to receive application.

Get a PAN Card for a Registered NGO Online

A PAN card can be obtained either through offline or online modes. In the face of the current pandemic, it is preferable to go with the online application. Moreover, the online mode is more time-efficient and hassle-free.

PAN applications can be made online on the official website of NSDL. The online application process for obtaining a PAN card is described below.

Step 1: Log on to the website of NSDL e-Gov or Protean website: https://www.protean-tinpan.com/

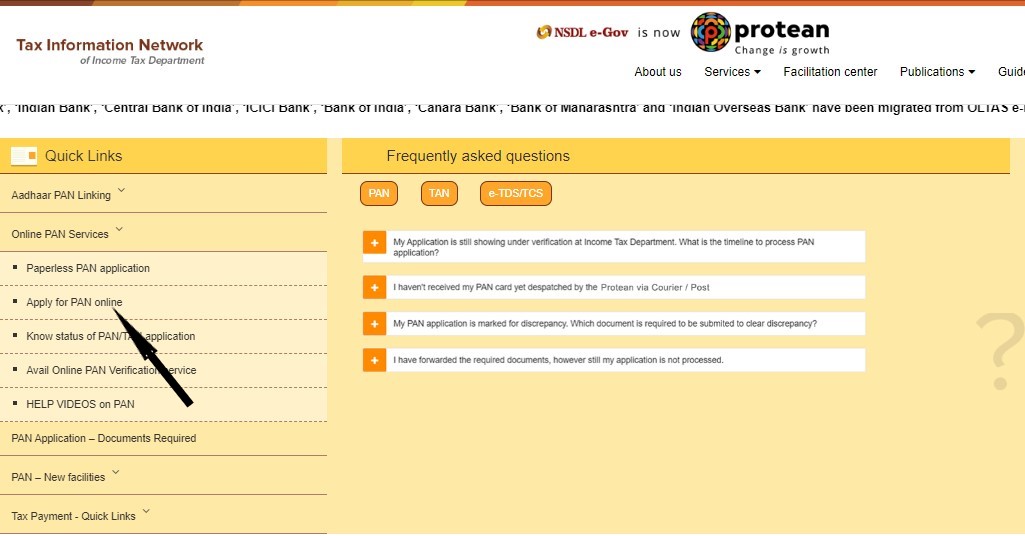

Step 2: Scroll Down to quick links and select Online PAN Services a dropdown will appear click on apply for PAN Online.

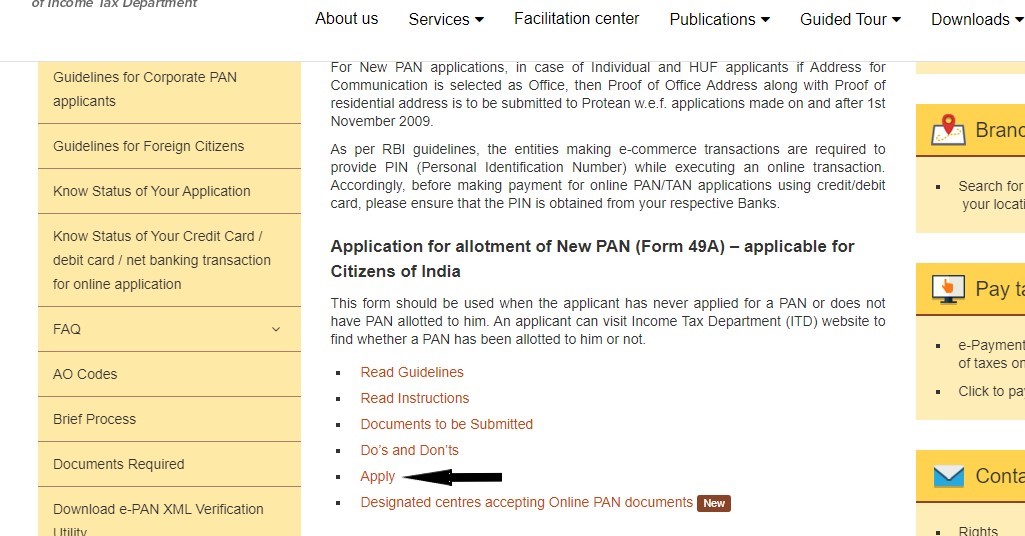

Step 3: In the Application for allotment of New PAN (Form 49A) – applicable for Citizens of India section read the instructions and Click on Apply.

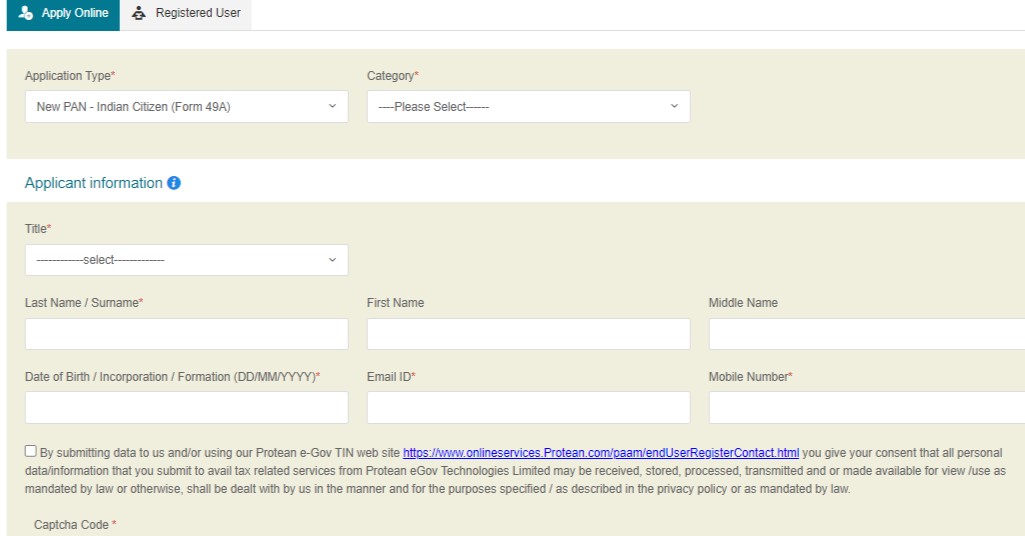

Step 4: Submit the PAN card application through Form 49A available on the portal. Fields marked by an asterisk (*) are mandatory and should be filled without fail.

Step 5: Make an online payment of the prescribed application fee of ₹93 (excluding GST) in case of an Indian communication address and ₹864 (excluding GST) in case of a foreign communication address.

Step 6: Under the successful submission of the online application, an acknowledgment receipt is generated. The acknowledgment receipt must be saved and printed.

Step 7: One must then forward the receipt to NSDL e-Gov along with supporting documents for further processing.

The status of the PAN application can then be tracked online. Typically, it takes three weeks for the PAN to arrive at the address provided.

Consequences of Not Having a Pan Card for a Registered NGO

If you see under Section 272B of the Income Tax Act, the penalty for not having a PAN card is to pay ₹10000. This penalty can be levied if the person did not apply for a PAN card intentionally, enter the incorrect PAN number or imitate the PAN number of a different person/institution.

FAQs

How do I get a PAN card for a charitable trust?

Charitable trusts have to apply online through any of the 2 sites named NSDL or UTIITSL portals, and submit the required documents like trust deed or registration certificate .

How can I get PAN card for association of persons?

Associations of Persons (AOP) must apply for PAN online at NSDL or UTIITSL by completing Form 49A/49AA and attaching supporting documentation proving the entity's address and identity.

Can a society have PAN card?

Societies can apply for a PAN card via the NSDL or UTIITSL websites and submit supporting documentation, including a society deed and registration certificate.

What is the category of PAN card for society?

The Bombardier Public Trusts Act and the Indian Trust Act permit the registration of societies established under the Societies Act of 1860. Your PAN will therefore fall under the Trust Category.

How can I apply for PAN card for a cooperative society?

The two approved organisations for PAN card services in India are NSDL and UTIITSL, where cooperative societies can apply online for a Permanent Account Number (PAN).