Need to update GST registration details? Learn how to change business name, address & contact info in the GST portal with this easy step-by-step guide.

Keeping GST registration details accurate and up to date is crucial for maintaining GST compliance. Businesses may need to update their registration due to changes in business address, contact details, ownership, or business structure. The GST amendments process ensures that all official records are accurate, preventing compliance issues and penalties.

Common scenarios requiring updates include shifting to a new location (how to change address in GST portal), updating contact details (how to change mobile no in GST portal), modifying business names, or adding/removing business activities. These changes must be promptly recorded in the GST portal to avoid discrepancies in tax filings and invoices.

The process of updating GST registration details is straightforward and must be done through the GST portal by submitting a modification request under the appropriate section. Certain amendments, such as changes in core details like the business address or legal name, require verification and approval from tax authorities, while non-core details, such as email or mobile number, can be updated instantly.

Understanding how to update GST registration details ensures smooth business operations, avoids tax disputes, and maintains compliance with GST regulations. This guide will walk you through the step-by-step process of making GST amendments, ensuring your business information remains accurate and compliant.

Types of GST Registration Amendments

When making changes to GST registration details, businesses must understand the distinction between core fields and non-core fields. The GST amendment scope categorizes these fields based on the level of approval required for modifications.

Core Fields

Core fields are critical details that affect a business’s legal identity or tax jurisdiction. Any changes to these fields require approval from tax authorities and may need supporting documentation. Examples of core fields include:

- Business name (if there is no change in legal entity)

- Principal place of business or additional place of business

- Changes in partners, directors, or authorized signatories (not involving PAN changes)

Since these changes impact tax records, updates in core fields must be verified by the GST officer before approval.

Non-Core Fields

Non-core fields are less critical details that do not affect the fundamental identity of the business. These changes do not require approval and can be updated directly through the GST portal.

The key difference is that core field amendments require tax authority approval, while non-core field changes are processed automatically. Understanding this distinction ensures businesses can efficiently manage GST compliance and keep their registration details updated without unnecessary delays.

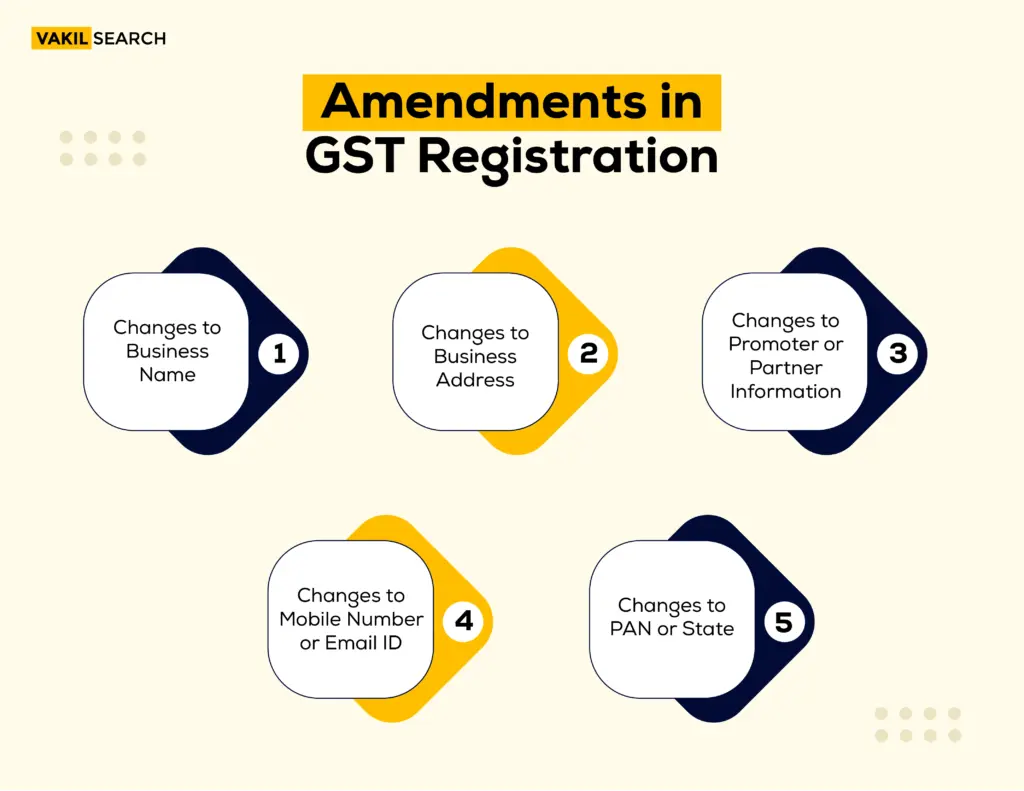

Amendments in GST Registration

Businesses may need to update their GST registration details due to operational changes. GST amendments ensure compliance and prevent tax-related complications. Below are key types of GST registration amendments and their procedures.

Changes to Business Name

A business name update can be made for changes in the legal name or trade name of the business. However, the PAN must remain the same; otherwise, a new GST registration is required. To update the name:

- Log in to the GST portal and navigate to Amendment of Registration (Core Fields).

- Update the legal name and upload supporting documents, such as a name change certificate from the Ministry of Corporate Affairs (MCA) or partnership deed (for partnerships).

- Submit the request for approval.

Changes to Business Address

Updating the principal place of business or additional place of business requires submitting address proof. Steps to change the address in the GST portal:

- Select Amendment of Registration (Core Fields) and update the new address.

- Upload address proof, such as a rent agreement, electricity bill, or property tax receipt.

- Ensure correct jurisdiction details to avoid processing delays.

Changes to Promoter or Partner Information

Businesses can update promoters, partners, or directors’ details, including contact information or resignation. Steps include:

- Update promoter details in Amendment of Registration (Core Fields).

- Upload supporting documents, such as PAN or Aadhaar, for identity verification.

Changes to Mobile Number or Email ID

To update contact details, businesses must use the GST portal:

- Navigate to Non-Core Field Amendments and update the mobile number or email ID.

- Complete OTP verification for validation.

Changes to PAN or State

- PAN changes are not allowed—a business must apply for new GST registration.

- If relocating to another state, state migration is required by registering under the new state’s GST jurisdiction.

Accurate amendments ensure smooth compliance, correct invoicing, and seamless tax credit claims.

Step-by-Step Guide to Updating GST Registration Details

Updating GST registration details ensures compliance with tax regulations and helps businesses maintain accurate records. The amendment process differs for Core Fields and Non-Core Fields. Below is a step-by-step guide for both types of amendments, along with instructions for tracking amendment status.

-

Core Field Amendments (Requires Approval)

Core fields include business name, principal place of business, additional place of business, promoter/partner details, and authorized signatory changes. These amendments require approval from tax authorities.

Steps to Amend Core Fields:

- Log in to the GST Portal: Visit www.gst.gov.in and sign in with your credentials.

- Navigate to Amendment Section: Go to Services → Registration → Amendment of Registration (Core Fields).

- Select the Field to Update: Modify details such as the business name, address, or promoter details.

- Upload Supporting Documents:

-

- Business Name Change: Upload a name change certificate from MCA or a partnership deed.

- Address Change: Provide proof such as a rent agreement, electricity bill, or property tax receipt.

- Promoter/Partner Updates: Submit the updated PAN, Aadhaar, or other identity documents.

-

- Submit REG-14 Application: Click Submit and verify via Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).Approval Process: The GST officer reviews the request. Upon approval, an updated GSTIN update is issued.

-

Non-Core Field Amendments (No Approval Required)

Non-core fields include mobile number, email ID, bank details, and business descriptions. These changes do not require approval.

Steps to Amend Non-Core Fields:

- Log in to the GST Portal.

- Go to Amendment of Registration (Non-Core Fields) under the Services tab.

- Select the Fields to Modify (e.g., bank details, contact number, business activities).

- Enter the Updated Information and save changes.

- Submit the Amendment. Since no approval is required, the updates reflect in real-time.

Tracking GST Amendment Status

After submitting an amendment request, businesses can track their Amendment Status using the GST portal.

Steps to Track GST Amendment Status:

- Log in to the GST Portal.

- Go to Services → Registration → Track Application Status.

- Enter the ARN (Application Reference Number) received after submitting REG-14.

- Check Status Updates:

- Pending for Approval: Application is under review.

- Approved: Amendment accepted, and REG-15 approval order is issued.

- Rejected: If rejected, the rejection reason is displayed.

By following these steps, businesses can efficiently update GST registration details, ensuring smooth compliance and uninterrupted business operations.

Limitations in GST Registration Amendments

While businesses can update many GST registration details through GST registration amendment, certain key restrictions apply. Understanding these limitations helps businesses avoid compliance issues and determine when a new GST registration is required instead of an amendment.

1. Restrictions on PAN Updates

- The Permanent Account Number (PAN) is a unique identifier for GST registration.

- Businesses cannot update or change the PAN in an existing GST registration.

- If the business undergoes a legal restructuring (e.g., proprietorship to a company), a new GST registration is required.

2. State Amendments Are Not Allowed

- GST is state-specific, meaning businesses must register separately for each state where they operate.

- State amendments cannot be made in an existing registration.

- If a business expands to a new state, it must apply for a fresh GST registration in that state.

3. Other Key Limitations in GST Amendments

- Changes in Business Constitution (e.g., partnership to LLP) require a new GST registration.

- Time Limit for Amendments: Businesses must submit any amendments requiring approval within 15 days of the change.

- Pending Applications Delay Processing: If an amendment request is already under review, additional changes cannot be made until the previous request is processed.

Businesses should carefully evaluate their changes and compliance issues to determine whether a GST registration amendment is sufficient or a new GST registration is required.

Conclusion

Keeping your GST registration details up to date is essential for ensuring smooth GST compliance and avoiding legal complications. Any outdated or incorrect information in your registration can lead to processing delays, rejection of returns, or penalties. The GST amendment process allows businesses to modify important details, such as their business name, address, contact details, and partner or director information.

To ensure hassle-free amendments, businesses should follow the correct steps, submit accurate supporting documents, and track their application status through the GST portal. While non-core field amendments can be updated instantly without approval, core field amendments require verification and approval from GST authorities, which may take up to 15 days.

For complex amendments, such as business name changes, principal address updates, or promoter modifications, consulting a tax professional can help avoid errors and ensure compliance. Additionally, certain changes, like PAN or state modifications, require a new GST registration, and businesses must be aware of these limitations before initiating amendments.

By keeping an updated GST registration, businesses can maintain transparency, avoid compliance issues, and continue benefiting from input tax credit (ITC) claims and seamless invoicing. Staying informed about GST amendment rules and seeking professional guidance when needed will help businesses remain compliant and operational without unnecessary disruptions.

FAQs on Updating GST Registration Details

How can I change my business address in the GST portal?

To change your business address on the GST portal, log in and go to Services > Registration > Amendment of Registration (Non-Core Fields). Update the address, upload required documents, and submit via DSC/EVC. Track the status under Track Application Status; approval takes up to 15 days.

How can I change the registered mobile number or email ID on the GST portal?

To update your registered mobile number or email ID on the GST portal, log in and navigate to Services > Registration > Amendment of Registration (Non-Core Fields). Update details under Authorized Signatory, submit using DSC/EVC, and wait for GST officer verification.

Who can update GST registration details?

Authorized users who can update GST registration details include business owners, authorized signatories, and tax consultants with GST portal access. Only users with valid login credentials can amend details. Business owners can authorize chartered accountants or GST practitioners to file amendments, ensuring compliance with GST registration amendment rules.

What is the difference between core and non-core fields in GST registration?

Core fields in GST registration require approval and include changes to the business name, principal place of business, and promoter details. Non-core fields do not need approval and include updates like email, mobile number, and bank details. For example, changing the business address is a core field, while updating contact details is non-core.

Can the PAN number or state in GST registration be changed?

No, the PAN number in GST registration cannot be changed. If a business undergoes a PAN change, a new GST registration is required. Similarly, state changes require a new GST registration as GST is state-specific. Businesses expanding to a new state must register separately in that state.

How long does it take to process GST registration amendments?

Core field amendments in GST registration typically take 15 days for approval after submission through the GST portal using Form REG-14. The GST officer reviews the application, and if approved, an updated GST certificate is issued. If additional clarification is needed, a notice is sent before final approval.

What happens if GST registration details are not updated?

Failing to update GST registration details can lead to non-compliance, tax mismatches, and legal penalties. Incorrect details may cause delays in refunds, failed communication, and input tax credit (ITC) issues. Authorities may issue notices or suspend GSTIN for persistent discrepancies, impacting business operations and leading to penalties or registration cancellation.

Can address changes in GST registration be made multiple times?

Yes, address changes in GST registration can be made multiple times, but each amendment requires approval. Businesses must submit valid address proof through the GST portal. However, frequent changes may trigger verification by tax authorities. Amendments should align with business operations to avoid compliance issues or rejection.

What to do if a GST amendment application is rejected?

If a GST amendment application is rejected, review the rejection reason in the GST portal. Correct errors, ensure accurate documents, and reapply using Form REG-14. If needed, respond to notices promptly. Seek professional help for compliance. Persistent issues can be escalated to the jurisdictional GST officer.