Becoming a tax lawyer in India is a challenging yet rewarding career choice. This comprehensive guide will take you through the intricate steps required to embark on this journey. We'll discuss educational qualifications, essential skills, internships, exams, and career prospects for aspiring tax lawyers.

Tax lawyers, or tax attorneys, specialize in taxation. They advise clients on tax matters, ensure compliance with laws, and represent clients in disputes with tax authorities. This guide outlines the steps to become a tax lawyer in India.

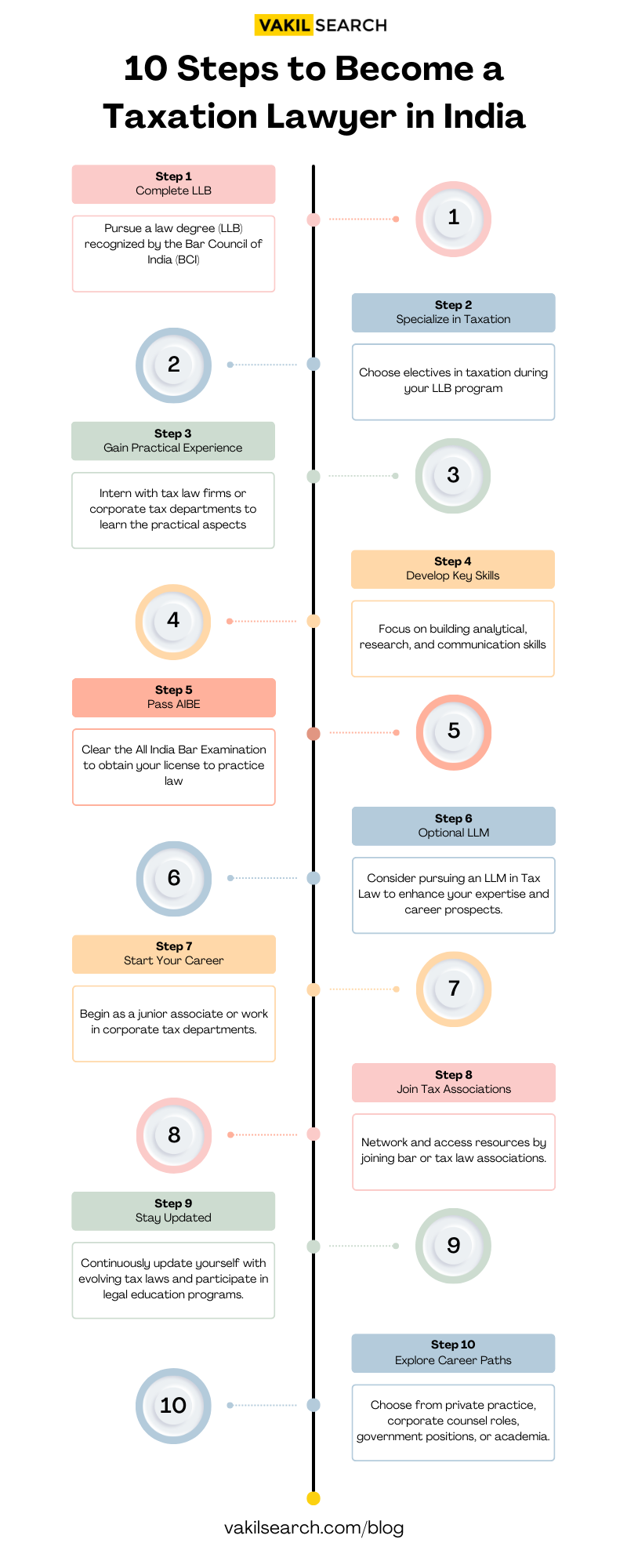

10 Steps to Become a Taxation Lawyer (In Short)

Steps to Become a Taxation Lawyer in India

-

Step 1: Educational Requirements

The journey to becoming a tax lawyer in India begins with a strong educational foundation. Here’s what you need to do:

-

-

Complete Your Bachelor’s Degree:

-

Pursue a Bachelor’s degree in law (LLB) after completing your undergraduate studies. Many prestigious law schools in India offer this program.

Ensure your LLB program is recognized by the Bar Council of India (BCI) to be eligible for legal practice.

-

-

Specialization in Taxation:

-

Opt for courses or electives in taxation during your LLB. Specializing in tax law early on can be beneficial.

-

Step 2: Gain Practical Experience

-

Internships:

-

Secure internships with law firms or legal departments that specialize in taxation.

During internships, focus on practical aspects of tax law, such as drafting legal documents, researching tax codes, and assisting senior lawyers.

-

-

Join a Tax Law Clinic:

-

Some law schools have tax law clinics where you can work on real cases under the guidance of experienced professionals.

-

Step 3: Build Essential Skills

To excel in the field of tax law, you must develop certain skills:

-

-

Analytical Skills:

-

Tax lawyer is intricate and subject to frequent changes. Strong analytical skills are essential for interpreting and applying tax codes.

-

-

Research Skills:

-

Tax lawyers need to conduct extensive legal research to support their cases and provide accurate advice to clients.

-

-

Communication Skills:

-

Effective communication is crucial, both in writing and orally, as you will need to explain complex tax issues to clients and argue cases in court.

-

Step 4: Clear the All India Bar Examination (AIBE)

Before you can practice law in India, you must clear the AIBE conducted by the Bar Council of India. Passing this exam is mandatory for obtaining a license to practice law.

-

Step 5: Pursue an LLM (Optional)

While not mandatory, pursuing a Master of Laws (LLM) with a specialization in tax law can enhance your knowledge and career prospects.

-

Step 6: Enroll as an Advocate

After completing your LLB and passing the AIBE, enroll with your state’s Bar Council as an advocate.

-

Step 7: Gain Experience

-

Junior Associate Positions:

-

Start your career as a junior associate in a law firm specializing in taxation.

Learn from experienced lawyers and gradually take on more responsibilities.

-

-

Taxation Departments:

-

Consider working in the taxation department of a corporation or for government agencies to gain diverse experience.

-

Step 8: Join a Bar Association

Membership in a bar association, such as the Tax Bar Association, can provide networking opportunities and access to resources in the field of tax law.

-

Step 9: Stay Updated

Tax laws are subject to frequent changes. Continuously update your knowledge to remain relevant and effective in your practice.

-

Step 10: Career Prospects

Tax lawyers in India can explore various career paths:

-

- Private Practice: Set up your own tax law practice or become a partner in an established firm.

- Corporate Counsel: Work as in-house counsel for corporations, advising on tax compliance and strategies.

- Government Positions: Join government agencies like the Income Tax Department as a legal officer.

- Academia: Teach tax law at law schools or universities.

-

Step 11: Networking and Continuing Education

- Networking: Building a strong professional network is crucial in the legal industry. Attend legal conferences, seminars, and workshops related to taxation to connect with fellow professionals and stay updated on industry trends.

- Continuing Legal Education (CLE): Participate in CLE programs to meet mandatory requirements and enhance your knowledge in tax law.

- Join Tax Law Associations: Consider becoming a member of tax law associations, such as the International Fiscal Association (IFA) or local tax bar associations. These organizations offer networking opportunities and access to the latest tax law developments.

-

Step 12: Specialize in a Niche Area

- International Taxation: Given the globalization of business, specializing in international taxation can open doors to exciting opportunities, especially if you have an interest in cross-border transactions and tax planning.

- Transfer Pricing: Becoming a transfer pricing expert can be highly rewarding, as multinational corporations need specialists to ensure compliance with transfer pricing regulations.

- GST (Goods and Services Tax): With the implementation of GST in India, specializing in GST law can be particularly valuable. GST experts are in high demand to help businesses navigate this complex tax regime.

-

Step 13: Professional Development

- Consider Certification: Pursue certifications such as the Chartered Accountancy (CA) or Certified Public Accountant (CPA) in addition to your legal qualifications to broaden your expertise and appeal to a wider range of clients.

- Publish Articles and Presentations: Sharing your knowledge through legal articles, blogs, or presentations can establish you as an authority in the field and attract clients seeking tax expertise.

- Mentorship: Seek mentorship from experienced tax lawyers who can guide you in your career and provide valuable insights.

-

Step 14: Ethics and Integrity

Tax lawyers are held to high ethical standards. Uphold the principles of integrity and confidentiality in all your dealings with clients and authorities. Ethical conduct is not only legally required but also essential for building a trustworthy reputation.

-

Step 15: Stay Resilient

A career in tax law can be demanding due to its complexity and the high stakes involved. Stay resilient, remain adaptable to changes in tax laws, and handle challenges with professionalism and composure.

Conclusion

Becoming a tax lawyer in India is a rigorous but rewarding journey. It demands dedication, continuous learning, and practical experience. With the right education, skills, and determination, you can excel in this dynamic field and provide valuable legal counsel in taxation matters. For those seeking specialized advice or career guidance, online lawyer consultation can be a valuable resource to connect with experienced professionals in the field.

This guide has outlined the steps from educational requirements to career prospects, giving you a comprehensive roadmap to follow. As you embark on this path, remember that the field of tax law is constantly evolving, so staying updated is essential for long-term success.