Discover the process of registering a Proprietorship firm without GST in India, its benefits, required documents, steps, and compliance requirements. Essential guide for small businesses and startups.

Overview

If you are planning to start a business in India, register a Proprietorship firm is one of the most common and simplest forms of business registration. A Proprietorship firm is a type of business structure where a single individual, known as the proprietor, owns and manages the business.

It is not a separate legal entity from the proprietor, and the registration process for a Proprietorship firm is relatively straightforward compared to other types of business structures. In this article, we will explore how you can register a Proprietorship firm without GST in India.

Understand Proprietorship Firm Registration

Before we dive into the registration process, it is crucial to clearly understand what a Proprietorship firm is and how it operates. A Proprietorship firm is a business structure owned and managed by a single individual, known as the proprietor.

It does not have a separate legal entity, which means that the proprietor is personally liable for all the debts and liabilities of the business. However, it also means that the proprietor has complete control and decision-making authority over the business.

Advantages of Registering a Proprietorship Firm

There are several advantages to registering a Proprietorship firm, which makes it a popular choice for small businesses in India. Some of the advantages include:

- Ease of Registration: Registering a Proprietorship firm is relatively simple and does not require extensive documentation or complex legal formalities. It can be registered with minimal paperwork and at a low cost compared to other business structures.

- Complete Control: As the proprietor of the firm, you have complete control over all aspects of the business, including decision-making, operations, and finances. You can run the business as per your vision and preferences without the need for any external approvals.

- Fewer Compliance Requirements: Proprietorship firms have fewer compliance requirements compared to other business structures. For example, Proprietorship firms with a turnover of less than Rs. 20 lakhs (as of the financial year 2021-22) are not required to register for GST, which can save time and effort in complying with complex GST regulations.

- Flexibility: Proprietorship firms offer flexibility in terms of operations and can be easily modified or dissolved as per the proprietor’s requirements. There are no legal formalities involved in transferring or closing a Proprietorship firm, which makes it a convenient choice for small businesses.

Documents Required to Register a Proprietorship Firm

To register a Proprietorship firm in India without GST, you must gather and submit certain documents. The exact documents may vary depending on the state or city where you are registering your firm, but generally, the following documents are required for Sole Proprietorship registration:

- PAN (Permanent Account Number) card

- Aadhaar card

- Bank account proof

- Business name proof

- Declaration (You would need to provide a declaration stating that you are the sole proprietor of the business, and that the business is not registered under any other legal entity).

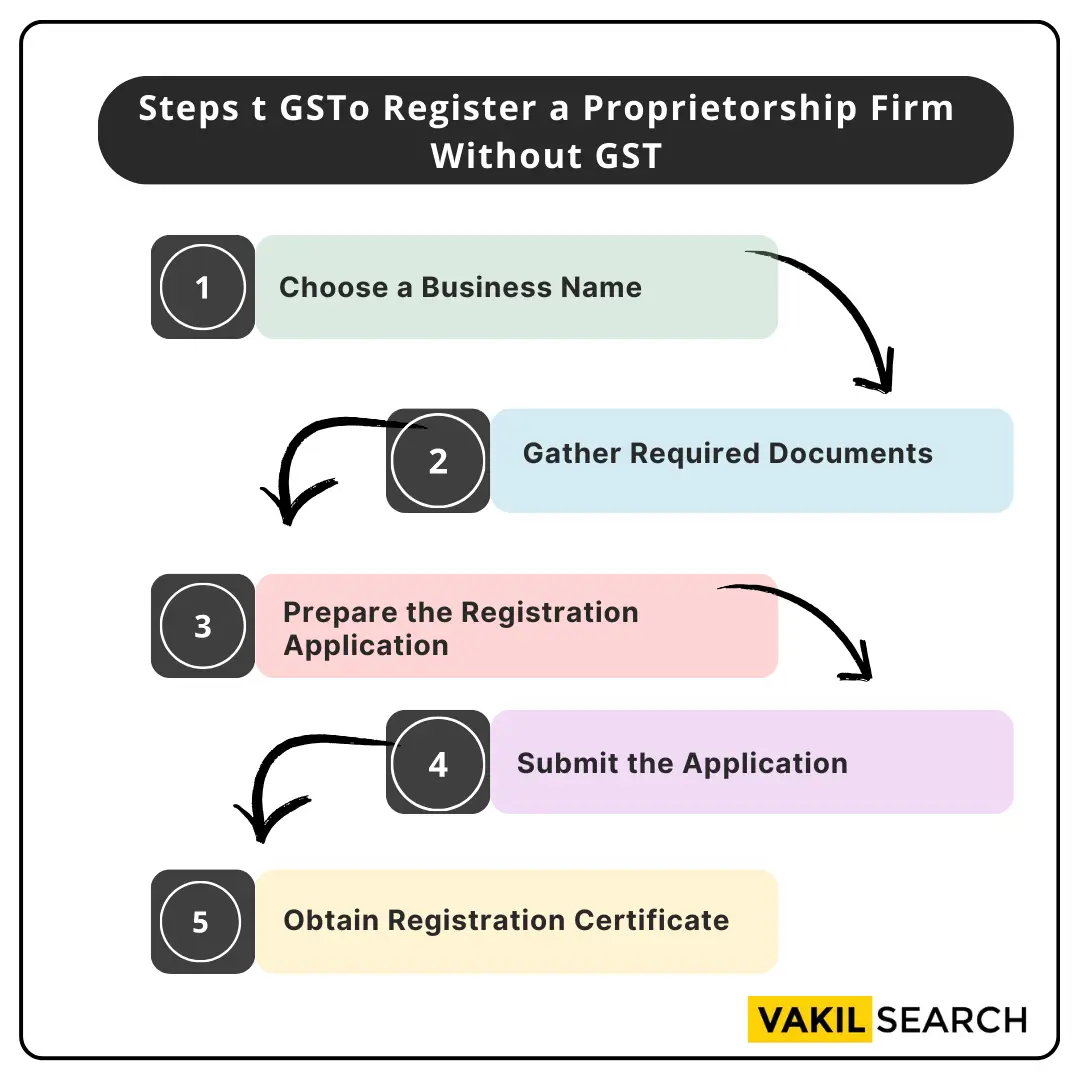

Steps to Register a Proprietorship Firm Without GST

The process of registering a Proprietorship firm without GST in India involves the following steps:

Step 1: Choose a Business Name – Select a unique name for your Proprietorship firm that is not already registered by another business. You can choose any name as long as it is not infringing on any trademarks or copyrights.

Step 2: Gather Required Documents – Collect all the necessary documents, as mentioned above, including PAN card, Aadhaar card, bank account proof, and business name proof.

Step 3: Prepare the Registration Application – Prepare the registration application for your Proprietorship firm, including the business name, proprietor’s details, business address, and other required information. You may need to use the prescribed format or form as per the rules of your state or city.

Step 4: Submit the Application – Submit the completed registration application along with the required documents to the relevant authority. This may be the local Municipal Corporation, Gram Panchayat, or other designated authority, depending on the location of your business.

Step 5: Obtain Registration Certificate – Once your application is processed and approved, you will receive a registration certificate for your Proprietorship firm. This certificate serves as proof of registration and can be used for various business purposes.

Compliance Requirements for Proprietorship Firm

Even though Proprietorship firms have relatively fewer compliance requirements than other business structures, some important compliance requirements still need to be fulfilled. These include:

- PAN and Aadhaar Linkage: As a Proprietorship firm, linking your PAN and Aadhaar cards is mandatory. This can be done online through the Income Tax Department’s website or through authorised facilitation centers.

- Income Tax Filings: The proprietor of the firm is responsible for filing the business’s income tax returns along with their personal income tax returns. This includes filing of the annual income tax return (ITR) and quarterly advance tax payments, if applicable.

- Business Licenses and Permits: Depending on the nature of your business, you may require specific licenses or permits from the relevant authorities. For example, if you are running a food-related business, you may need to obtain a food license from the Food Safety and Standards Authority of India (FSSAI).

- Bookkeeping and Accounting: Maintaining proper books of accounts and financial records for your Proprietorship firm is essential. This includes maintaining records of all business transactions, expenses, and income, and preparing financial statements such as profit and loss statement and balance sheet.

- Goods and Services Tax (GST): While Proprietorship firms with a turnover of less than ₹20 lakhs (as of the financial year 2021-22) are not required to register for GST, if your turnover exceeds this threshold, you would need to register for GST and comply with the applicable GST laws, including filing regular GST returns and maintaining proper records.

- Compliance With Other Applicable Laws: Apart from the above, you may also need to comply with other applicable laws depending on the nature of your business, such as the Shops and Establishments Act, labor laws, environmental laws, etc. It is important to stay updated with the relevant laws and regulations and ensure timely compliance to avoid any legal liabilities.

Conclusion

Registering a Proprietorship firm without GST in India can be suitable for small businesses and startups looking for a simple and cost-effective business structure. It offers several advantages, such as an easy registration process, sole ownership and control, flexibility in operations, minimal compliance requirements, tax benefits, and confidentiality.

However, it is essential to ensure timely compliance with applicable laws and regulations, maintain proper financial records, and fulfil other legal obligations to operate the business smoothly and avoid any legal liabilities.

Vakilsearch, a leading online legal service provider in India, can assist you with registering a Proprietorship firm without GST. Our expert team of legal professionals can guide you through the company registration process, help you understand the necessary documents, and ensure compliance with applicable laws.

Frequently Asked Questions

Is it mandatory to register a proprietorship firm without GST, and when is GST registration not required for a proprietorship?

GST registration for a proprietorship is mandatory if turnover exceeds the prescribed threshold. It's not required if turnover remains below the threshold or if the business deals exclusively with exempted goods or services.

Are there specific eligibility criteria or conditions for a proprietorship to operate without GST registration?

Yes, a proprietorship can operate without GST registration if its aggregate turnover remains below the specified threshold, which varies for different states.

Can a proprietorship firm choose to register for GST at a later stage, and how is this transition managed?

Yes, a proprietorship can voluntarily register for GST later. The transition involves applying for registration, obtaining a GSTIN, and complying with related requirements.

What are the advantages of not registering a proprietorship firm under GST?

Not registering under GST can simplify compliance for small businesses, reduce paperwork, and eliminate the need for filing regular GST returns.

What are the disadvantages of not registering a proprietorship firm under GST?

The disadvantages include the inability to collect GST from customers, claim input tax credit, or participate in inter-state transactions, limiting business growth opportunities.

Does the decision to not register under GST impact the ability of the proprietorship to engage in certain business transactions or access benefits?

Yes, it restricts engagement in inter-state transactions and hinders access to input tax credit, potentially limiting competitiveness and benefits under various government schemes.

Are there specific types of businesses or activities that are exempt from GST, allowing the proprietorship to operate without registration?

Yes, certain businesses dealing with exempted goods or services are not required to register under GST, provided their turnover remains below the threshold.

How does the absence of GST registration affect the proprietorship firm's tax liabilities and compliance requirements?

Without GST registration, the proprietorship is not liable to collect or pay GST. Compliance requirements are minimal, sparing the business from regular return filings.

Is there a distinction in the registration process for proprietorship firms that deal exclusively with goods or services?

No, the registration process is similar for businesses dealing with goods or services. It involves applying for GST registration, obtaining a GSTIN, and adhering to compliance requirements.

What resources or government agencies should individuals consult for accurate and updated information on registering a proprietorship firm without GST?

Individuals should consult the official GST portal, seek guidance from tax professionals, or refer to the GST laws and notifications for accurate and updated information on proprietorship registration without GST.