The Uttar Pradesh government created the UP Kisan Karj Rahat programme to help farmers who are unable to pay back their agricultural debts.

UP Kisan Karj Rahat – Overview

The Uttar Pradesh government created the UP Kisan Karj Rahat programme to help farmers who are unable to pay back their agricultural debts. Eligible farmers can apply under this programme to have their outstanding loans forgiven or to get financial aid to pay off their debt.

Since the program’s April 2017 debut, thousands of farmers throughout the state have benefited. Being an Uttar Pradesh resident, holding a loan from a scheduled bank or cooperative society, and having an outstanding loan balance of up to Rs. 1 lakh are requirements for enrollment in the programme.

Farmers can submit their loan documentation and other pertinent information to the regional agriculture department or the district magistrate’s office in order to petition for assistance under the programme. After reviewing the applications, the government awards aid to qualified farmers based on the amount of outstanding loans.

The UP Kisan Karj Rahat programme aims to give farmers who are having a difficult time repaying their debts owing to a variety of factors, such as crop loss, natural catastrophes, or financial troubles, much-needed help. The government wants to lessen the burden on farmers and help them improve their financial circumstances by offering financial aid.

UP Kisan Karj Rahat List

You can take the following actions to check the UP Kisan Karj Rahat List:

- Visit the UP Kisan Karj Rahat scheme’s official website at https://upkisankarjrahat.upsdc.gov.in/.

- On the home page, select the “List of Beneficiaries” link.

- From the drop-down menu, choose your district.

- Choose the beneficiary category (loan waiver or financial assistance).

- Click the “Search” button after entering the verification code.

- The recipients listed under the category you chose will be shown on the screen.

- You can use the list’s search function to look up your name or the name of the person you’re looking for.

Uttar Pradesh Farmers Debt Relief Scheme 2023

A government programme called the Farmers Debt Relief Plan seeks to help farmers who are struggling with debt. The programme offers financial support to farmers who are unable to pay back their agricultural loans for a variety of reasons, including crop failure, calamities, or financial issues.

Eligible farmers can request for financial assistance to repay their debts under the programme or have their existing loans waived. Depending on the state or country, the program’s eligibility requirements may change, but in general, farmers who have taken out loans from approved banks, cooperative societies, or other financial organisations are able to apply.

In order to lessen the financial strain on farmers, the Farmers Debt Relief Program may be implemented in a variety of methods, including direct financial aid, loan waivers, and loan restructuring. The programme aims to improve farmers’ economic circumstances and lower the frequency of farmer suicides caused by debt-related problems.

The Farmers Debt Relief Plan has been adopted by a number of nations and governments to help their farmers. For instance, India has launched a number of debt relief programmes for farmers, including the Kisan Credit Card Program and the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) programme. Similar programmes to reduce farmer debt exist in nations including Canada, Australia, and the United States.

33000 farmers of 19 districts will get the benefit of loan waiver

These programmes often aim to lessen farmers’ debt loads and enhance their financial circumstances.

Depending on the programme and the area where it is implemented, the number of farmers who benefit from a loan waiver plan and the particular districts that are covered may change. The loan waiver may occasionally apply to all qualified farmers in a given state or district, but it may also only apply to a select group of farmers who meet certain requirements.

It is crucial to remember that loan waiver programmes are only one option to aid farmers who are drowning in debt; longer-term solutions include expanding access to finance, getting farmers’ access to crop insurance, and raising agricultural productivity.

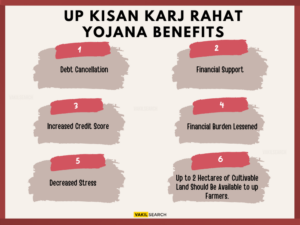

Benefits of Uttar Pradesh Kisan Karj Rahat Yojana

For farmers that qualify, the programme provides a number of advantages, including:

- Debt cancellation: The programme gives loan cancellations for unpaid agricultural loans up to a maximum of Rs. 1 lakh, which can be a big help to farmers who are drowning in debt.

- Financial support: The programme offers financial support to farmers who have loans that are more than Rs. 1 lakh in arrears to assist them in repaying their debt.

- Increased credit score: Farmers who have their loans forgiven or redeemed might raise their credit score and qualify for loans in the future with better terms.

- Financial burden lessened: With their loans waived or paid off, farmers’ financial burden is lessened, allowing them to concentrate on raising agricultural productivity and income.

- Up to 2 hectares of cultivable land should be available to UP farmers.

- Decreased stress: The programme can aid in lowering the stress and mental health problems that farmers may have as a result of the strain of debt.

UP Panchamrut Yojana

The Indian state of Uttar Pradesh started the UP Panchamrut Yojana programme. It tries to encourage the growth and consumption of five different fruit varieties known collectively as Panchamrut: banana, papaya, guava, mango, and citrus fruits.

Through this programme, farmers in Uttar Pradesh are urged to grow these five fruits on their properties, and the government supports their efforts with financial and technical help. The programme also seeks to expand the availability of these fruits in neighbourhood markets and to encourage Uttar Pradesh residents to eat them.

The Indian state of Uttar Pradesh has introduced two distinct programmes, UP Panchamrut Yojana and UP Kisan Karj Rahat Yojana. Despite the fact that both programmes serve farmers in the state, their goals and support areas are distinct.

Although both programmes are meant to aid farmers in Uttar Pradesh, their goals and areas of focus are distinct. While the UP Panchamrut Yojana concentrates on developing sustainable agricultural methods and increasing the availability and consumption of Panchamrut fruits, the UP Kisan Karj Rahat Yojana is more concerned with debt alleviation.

The following are some of the UP Panchamrut Yojana’s essential components:

- Financial Support: The government offers financial support to farmers so they can grow Panchamrut fruits on their properties. Subsidies for seeds, fertiliser, insecticides, and other inputs are included in this.

- Technical Assistance: In order to help farmers increase the quality and yield of their crops, the government also offers technical aid to them. This includes training courses, seminars, and exhibits on good agricultural practises.

- Market Linkages: In order to guarantee that the food is sold at reasonable prices, the government assists in establishing market links between the farmers and the neighbourhood markets.

- Campaigns for Public Awareness: The government runs programmes to encourage people in Uttar Pradesh to eat Panchamrut fruits.

Documents of Kisan Debt Redemption Scheme

Depending on the particular system and the state or nation where it is administered, the documentation needed for the Kisan Debt Redemption Scheme may change. Nonetheless, the following common documents may be needed for the scheme:

- Loan contracts, repayment plans, and other loan-related paperwork are included in the category of agricultural loans.

- Land ownership paperwork: If appropriate, this also contains land lease agreements.

- A government-issued identity document, such as an Aadhaar card, passport, voter ID card, or driver’s licence, qualifies as identification.

- Utility bills, bank statements, and other documents that provide the farmer’s address are acceptable forms of address proof.

- Income evidence is any document that demonstrates the farmer’s income, including bank statements, income tax returns, and other similar records.

- Details on the sort of crop being grown, the crop output, and the area that is being cultivated are included here.

- Other pertinent documents: Other documents, such as a caste certificate, a disability certificate, or any other pertinent document, may be required depending on the individual plan.

How to see UP Kisan Karj Rahat List

Visit the Uttar Pradesh government’s official website to view the Uttar Pradesh Kisan Karj Rahat List. In order to promote accessibility and transparency, the list is typically posted online on a website or portal run by the government. To check the UP Kisan Karj Rahat List, follow these steps:

- Visit the Uttar Pradesh government’s official website.

- On the website’s home page, look for the “Kisan Karj Rahat” or “Farmer Loan Waiver” area.

- To access the Kisan Karj Rahat List, click the link.

- Once you have access to the list, you can check to see if your name, the name of your village, or the name of your district is on it by performing a search.

- You can get further information by contacting the relevant authorities if you can’t find your name on the list.

How to file complaint in Kisan Debt Redemption Scheme ?

You can take the following actions if you need to lodge a complaint regarding the Kisan Debt Redemption Scheme:

- The first step is to get in touch with the official body in charge of putting the Kisan Debt Redemption Plan into effect in your region. On the official scheme website or by contacting the district administration office, you can obtain the relevant authority’s contact information.

- Describe the complaint in detail: After determining the appropriate authorities, describe your complaint to them in writing. Details such as your name, address, loan account number, the nature of the complaint, and any supporting documentation may be included in this.

- After submitting your complaint, check in with the appropriate authority to see if it has been received and is being handled. To follow the progress of your complaint, you can request a reference number or complaint ID.

- If necessary, escalate the issue to a higher authority or submit a grievance with the State Government’s Grievance Redressal Cell if you are dissatisfied with the response or action taken by the appropriate authority.

- You can take the following actions if you need to lodge an online complaint regarding the Kisan Debt Redemption Scheme:

- Visit the Kisan Debt Redemption Scheme webpage here: The first step is to go to the program’s official website, which can be run by the state or federal government.

- On the website, look for the “Complaint” or “Grievance Redressal” section: Search for the portion of the website that deals with complaints or grievance redressal once you’ve gained access to it.

- Fill out the complaint form: If there is a complaint form available on the website, you must fill it out with information about your name, address, loan account number, and the specifics of your concern.

- Submit supporting papers: You might be asked to upload proof of your address, identity, or loan documents as support for your complaint.

- Complaint submission: After you’ve completed the complaint form and submitted any necessary supporting materials, submit the complaint using the website.

- Follow the complaint’s progress: After submitting your complaint, you can check on its progress online or by getting in touch with the relevant authority.

Know the status of the complaint ?

You can take the following actions to find out the status of your complaint regarding the Kisan Debt Redemption Scheme:

- The first step is to get in touch with the official body in charge of handling complaints regarding the Kisan Debt Redemption Plan in your region. On the official scheme website or by contacting the district administration office, you can obtain the relevant authority’s contact information.

- Provide reference or complaint ID: When you get in touch with the appropriate authority, give them the reference or complaint ID you were given when you filed the complaint. This will make it easier for the authority to find your complaint and give you a status update.

- Follow up with the authority: If the complaint is still being looked into, get in touch with them to find out how things stand. You can also request an estimated turnaround time for a response.

- If necessary, escalate the issue to a higher authority or submit a grievance with the State Government’s Grievance Redressal Cell if you are dissatisfied with the response or action taken by the appropriate authority.

Process Of Viewing The State

You can take these methods to check the status of your loan account or application in the UP Kisan Karj Rahat List:

- Visiting the official website is the first step. The state government may be hosting the website for the UP Kisan Karj Rahat Program.

- Locate the section titled “Beneficiary List”: On the website, look for the “Beneficiary List” area. Details about the farmers who have been chosen for loan waivers under the programme will be provided in this section.

- Enter your information Enter your information, including your name, district, tehsil, and village, to view the status of your application or loan account.

- Click on “Search” to examine the status of your application or loan account in the UP Kisan Karj Rahat List after entering your information.

- Contact the appropriate authorities: You can contact the appropriate authority in charge of carrying out the UP Kisan Karj Rahat Scheme in your area if you have any questions or concerns regarding the status of your application or loan account.

Procedure to download offline format for registering complaint

Depending on the individual Kisan Debt Redemption Plan and the state or country where it is administered, there may be variations in the process for downloading the offline format for filing a complaint. To download the offline complaint registration form, you can, nevertheless, follow these general instructions:

- Visit the Kisan Debt Redemption Scheme website: The first step is to go to the Kisan Debt Redemption Scheme website, which may be maintained by the state or the federal government.

- On the website, look for the “Complaint” or “Grievance Redressal” section: Search for the portion of the website that deals with complaints or grievance redressal once you’ve gained access to it.

- Verify if an offline format is offered: See if the website offers a download link for an offline complaint form. If it’s available, you could find it under the website’s “Downloads” or “Forms” area.

- Get the form here: Click the link to download it in PDF or Word format if the offline version is available for download.

- Complete the form: After downloading the form, complete it with the required information, including your name, address, loan account number, and the specifics of the complaint.

- Fill complete the form, then send it to the official organisation in charge of handling complaints regarding the Kisan Debt Redemption Plan in your region.

Login Process

Depending on the exact website or portal used to access the programme, the UP Kisan Karj Rahat Yojana login method may change. However, you can adhere to the general steps listed below:

- Visit the UP Kisan Karj Rahat Yojana website here: The first step is to go to the program’s official website, which can be run by the state government.

- The “Login” or “Sign In” button should be visible: Once you have reached the website, search for the “Login” or “Sign In” button or link. It might be in the website’s upper right corner.

- Put in your login information: When prompted, enter your login information, including your username and password, by clicking the “Login” or “Sign In” button. You might have received these login credentials when you registered.

- Click “Submit” or “Login”: To access your account after providing your login information, click the “Submit” or “Login” button.

- Access your account: After successfully logging in, you should have the ability to visit your account and see information on your loan status, application status, and any other pertinent details regarding the UP. KIRJ RAHAT YOJANA

Contact Details

The department or organisation in charge of administering the UP Kisan Karj Rahat Yojana may have different contact information. To contact the appropriate authorities, however, you can use the following general contact information:

- Helpline Number: You can call the UP Kisan Karj Rahat Yojana’s designated hotline number to learn more about the programme or to file a complaint. The helpline number can be found on the scheme’s official website or by getting in touch with the local authorities in your region.

- Dial 0522-2235892 or 0522-2235855 to reach us.

- Email: To obtain more information or to file a complaint, you can also send an email to the authorities in charge of carrying out the UP Kisan Karj Rahat Yojana. The email address might be visible on the scheme’s official website.

- Postal Address: The department or organisation in charge of carrying out the UP Kisan Karj Rahat Yojana is located at the above postal address. On the scheme’s official website, you might find the address.

- Local Authorities: To learn more about the UP Kisan Karj Rahat Yojana or to file a complaint over it, you can also get in touch with the local authorities in your community, such as the district collector or the tehsildar.

Conclusion

The UP Kisan Karj Rahat scheme is a much-needed initiative by the Uttar Pradesh government to provide debt relief to the farmers of the state. The scheme has been implemented in a phased manner, covering loans taken by farmers from different types of banks. The scheme has been widely welcomed by the farmers of the state, and it is expected to have a positive impact on the agricultural sector in the state.

Must Read Topics: