In this article you will explore down to learn all about parivahan sewa and much more in India.

Overview:

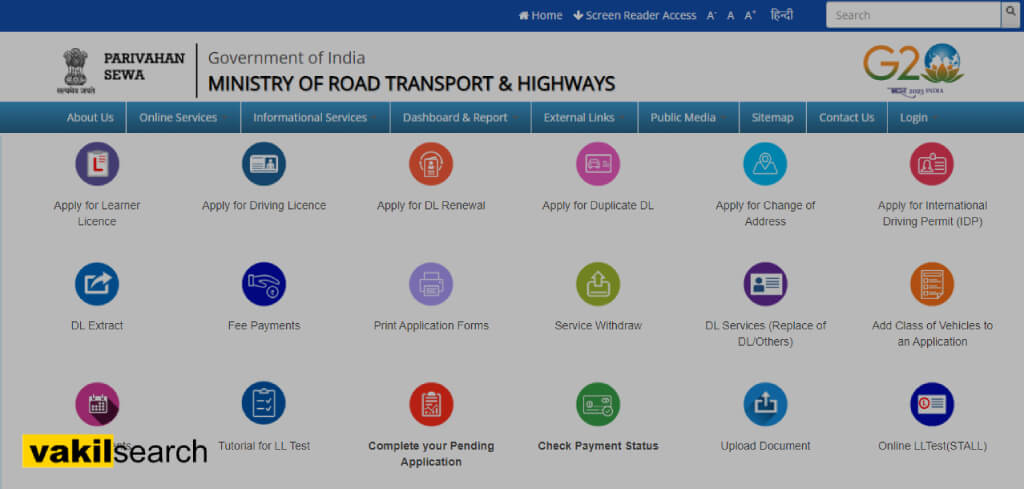

The certification and processes for automobile and licence-related services may now be completed digitally thanks to the Sarathi Parivahan Sewa Portal. Anyone in India who is interested in learning more about their Driving Licence (DL), Vehicle Registration Certificate (RC), E-challan, and other services may do so by visiting the Parivahan Sewa Portal.

The website for Sarathi Parivahan provides access to a comprehensive selection of different online services

The Vahan Parivahan Sewa website provides services about automobiles, such as the renewal of registration and the issue of duplicate driving licences and registration certificates.

On Sarathi Parivahan.gov.in, applicants may submit new licence requests, renew existing licences, or receive duplicate charges.

- Checkpost tax for vehicle tax collection at check post

- Fancy number booking

- National register or NR services

- Homologation

- National permit authorisation

- Trade certificate

- Vahan Green Sewa

On its website, Parivahan.gov.in provides users with access to various information services, such as those that allow them to look up information regarding their driver’s licence, car registration, and permits, as well as regulations and policy notifications and forms, and other relevant information. Additionally, clients may easily download many fillable forms readily available for them to use.

Payment of Road Taxes made by Parivahan Sewa

parivahan sarathi Portal – Road tax is something that all vehicle owners must pay, regardless of whether or not they utilise their vehicle for personal or professional use. The funds that are obtained from various taxes are used by the government for road maintenance. In India, commercial vehicle drivers must pay extra state vehicle taxes at checkpoints along the route before they are allowed to travel into another state. Check Post Tax may now be born online using the website at parivahan.gov.in/parivahan/. The following information is provided for your reference:

To begin the registration procedure, you must first go to the official website, which can be found at parivahan.gov.in. On the main page, under the heading “Online Services,” choose the option “Check Post Tax.”

- Login and online services for autos and the components that go into them are available via the Parivahan Sewa Portal.

- Start a new tab or window in your browser. Now, choose the “Tax Payment” option from the drop-down menu.

- Login and other online automobile services are available via the Parivahan Sewa Portal.

- From the ” service name selection,” choose the name of the state you will be travelling to. To get started, you need to hit the “Go” button.

- Login and online services for autos and the components that go into them are available via the Parivahan Sewa Portal.

- At this moment, the application for the payment of border taxes will appear on the computer screen. Go to the “Get Details” tab and input the vehicle identification number (VIN) to get further details on your car. You will have some of the fields pre-filled for you.

- Login and other online automobile services are available via the Parivahan Sewa Portal.

- The last step is to fill in the remaining specifications with the appropriate information. After that, you may pay the amount calculated by clicking on either the ‘Calculate Tax’ or the ‘Pay Tax’ button.

After completing your tax payment, you will be sent to the page labelled ‘Checkpost.’ You will be given a receipt that you are free to retain for your records and that you can print off and keep with you at all times.

Challan Payment For Parivahan Sarathi Sewa may be made online

People can make online payments for fines and challans issued to them using the official website for the Parivahan Sewa. If you need any further information, please go to the website of the E challan Parivahan and go to the “Check Online Services” section. Once there, click on the link “Check Challan Status.”

To give the required information, one of the following may be used: a Challan Number, a Vehicle Number, or a Driver’s Licence Number. After inputting the captcha code, click the “Get Detail” button for the next step.

The challan status row will provide the current status of your electronic challan. To make a payment, choose “Pay Now” from the drop-down menu in the Payment column. After you have decided on the payment option to use, proceed with making the payment. A transaction ID will be sent to your account’s registered cellphone number and a confirmation message.

The Required Materials for Submitting an Online Application for a Driver’s Licence

Sarathi Parivahan Sewa Portal – The Union Ministry of Roads and Motorways is responsible for developing the curriculum to teach people how to drive. The curriculum consists of two parts: the theoretical and the practical. The training for light motor vehicles (LMV) will take a total of 29 hours, equivalent to four weeks. The remaining time will be dedicated to training on various theoretical topics. To apply for a driver’s licence, you will be required to provide the following documentation:

- Complete the application form to the best of your ability.

- Age may be verified using a birth certificate, Aadhaar card, passport, or PAN card. All of these are valid means of identification.

- You will need documentation such as your driver’s licence or passport to demonstrate who you are and offer proof that your address is correct to show that you are a state resident.

- Size comparable to that of a passport photo

- Both form 1 and form 1A are for medical certification.

- To get a commercial driver’s licence, you must provide documentation that you have completed driving training.

- The fee that must be paid to submit an application

Recent Announcements from Sarathi Parivahan Sewa

Beginning in July of 2022, new requirements will be in place for driver’s licence.

The requirements for obtaining a driver’s licence in India have recently been updated to simplify the process of applying for new grants or renewing existing ones. Beginning on July 1, 2022, commercial and private motorists will be held accountable for adhering to the new standards.

Citizens would no longer be required to take a driving test for a 2-wheel drive or 4-wheel drive vehicle at their local RTO, which stands for Regional Transport Office, under the new guidelines for driver’s licences issued by the Union Ministry of Road Transport and Highways. These guidelines were issued by the Union Ministry of Road Transport and Highways.

Conclusion

Sarathi Parivahan – Vakilsearch is a website that allows users to do RTO-related tasks online, such as submitting an application for a driver’s licence, renewing an existing appointment, and many other similar jobs.

Helpful Links: