Read this blog to understand more about the checklist needed for EPF registration in India.

Every company that employs a sizable workforce eventually needs to register for EPF. Many working professionals are aware that a company with more than 20 workers must register for EPF. However, a small business with fewer employees has the option of voluntary registration. The list of documents required for EPF Registration will become clearer after reading this post.

Page Contents: Checklist of Documents Needed for EPF Registration for Proprietorship Firms, Partnership Firms, Limited Liability Partnerships/Companies, Societies, and Trusts, Step-by-Step Guide for EPF Registration and Conclusion

Checklist of Documents to Gather Before Registering for EPF

The federal government supports an online and offline platform for employer EPF registration. However, based on the entity classification, the employer must provide some mandatory paperwork before implementing these approaches. The above list will serve as a checklist for the paperwork needed to register an employer for EPF.

What are the Requirements for EPF Registration Eligibility?

- Establishments that meet the following requirements must register with the EPF:

- A factory with a workforce strength of 20 people or more is involved in a certain industry.

- Other businesses with 20 or more employees, or a group of businesses with similar characteristics that the central government specifies in a notification

- A penalty could result if an employer doesn’t register for EPF within a month of hiring twenty new employees. In addition, if a registered organization’s staff strength falls below the Act’s minimal criterion, it continues to fall outside of its permitted range.

- A company with a certain number of employees may be subject to certain regulations from the central government. of less than 20 employees following the delivery of a notice of two months regarding required registration.

- Some businesses with fewer than 20 employees would also need to register with the EPF, but this is a voluntary registration.

Private Companies

- Candidate’s name

- Information about the PAN card

- ID documents such as a passport, driver’s license, or voter ID.

- Evidence of the business’s address as well as household addresses

- the business’s phone number.

Society/Trust (Co-operatives)

- Certification relating to Trust/Society Registration.

- MOA(Memorandum of Association)

- PAN card information;

- key personnel who manage the company information; and

- a statement of the society’s or trust’s address.

Company Partnerships: –

- A statement of the partnership deed in writing

- identification documentation for each active partner, such as a voter ID card, driver’s license, and passport,

- Information on the current partners who are in charge of managing the business.

- Documents proving the active or existing partners’ identities and addresses Limited Liability Partnership (Company)

- A certificate confirming the company’s incorporation

- The Digital Signature Certificate (DSC) of the active director in charge of overseeing the company’s operations

- Data on every current director working for the company.

- Identification and address verification for the director.

- The Articles of Association and the Memorandum of Association (MoA) (AOA)

- bill for the initial sale

- A list of the equipment and raw materials that were bought for manufacturing.

- IFSC code, address, account number, and other fundamental bank information.

- Information on the organization’s workforce

- information on the pay and wages of the workers.

- A crossed-out check

Before interfering with the EPFO registration procedures, the entities must arrange all the paperwork needed for EPF registration.

Step-by-Step Guide for EPF Registration:-

We advise you to use the online process rather than the offline one to simplify the registration procedures because it is a more practical and practical choice. Following the preparation of the necessary paperwork for EPF registration, the registration process is as follows.

- Launch your browser and navigate to the EPFO website.

- After arriving at the homepage, choose “Establishment Registration.”

- By taking this action, you can reach the page where you can, on your computer, get the registration-based instructions.

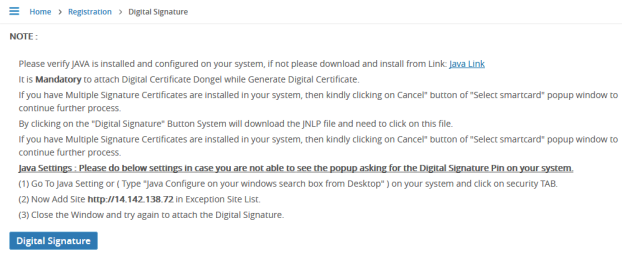

- To successfully submit an application, the applicant must first register with DSC. The manual itself has instructions on how to do this.

Use your login information, such as your UAN and password, on the signup screens to access the portal. If you don’t already have one, create one by following the on-screen instructions and entering the necessary information.

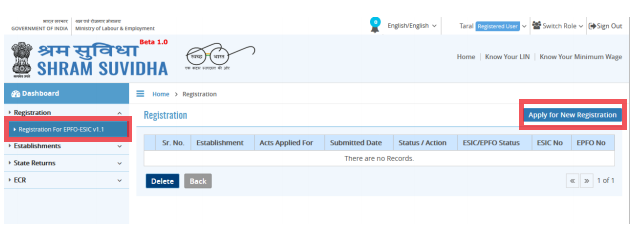

- After logging in, choose “Registration for EPFO-ESIC.”

- Select “Apply for New Registration” in the following box.

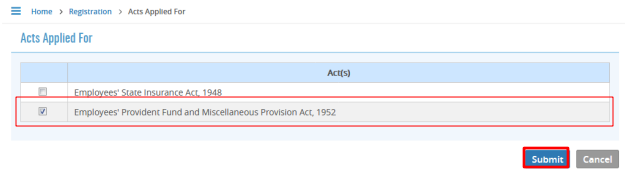

- The following two choices would now appear on your computer’s screen:

Employees’ State Insurance Act (Act No. 1)

Click here to more about: https://unifiedportal-mem.epfindia.gov.in/

2 “Miscellaneous Provision and Employees’ Provident Fund Act, 1956.”

- Choose the option that best fits your needs, then click Submit.

- You will find a few vacant fields next to the following options on the following page, which you must fill out.

- The company’s date of founding

- information about the current employer and employees in the business.

- The employee’s title and information about their work schedule

- Identity documents

- Use the choices available on the dashboard for rapid reference or an overview of the details presented.

- Finally, click “Submit” to complete the procedure.

In the event of a fresh application, the applicant must then complete the employer’s Digital Signature Certificate (DSC). Once the registration process is complete, a confirmation email will be sent to the email address you registered with the site.

Conclusion:-

The previously noted will enable you to avoid the employer’s EPF registration difficulty. Even a non-technical individual can easily engage with the online process because it is simple. Remember that the registration procedure is not difficult. The majority of the issues arose during the paperwork organization for the registration. Take care of your documents and make sure they are legitimate in every way if you want to finish the registration process on your first try.

If you want some professional advice on this process, feel free to speak with a specialist. We would be happy to give you comprehensive instructions on the paperwork needed for EPF registration or any related issues. In addition, we offer a variety of services to our prestigious clientele in the areas of taxation and finance. You will be given the authority by our professionals to deal authoritatively with Act compliance.

Read More: