Tamil Nadu Registration Department - In order to prevent the registration of lands with fake documents, the Tamil Nadu government has recently initiated the pre-mutation scrutiny of land records prior to the registration of landed properties that do not have 'online pattas'. In accordance with the new system, landowners who have not obtained online pattas must obtain a pre-mutation sketch before registering their property.

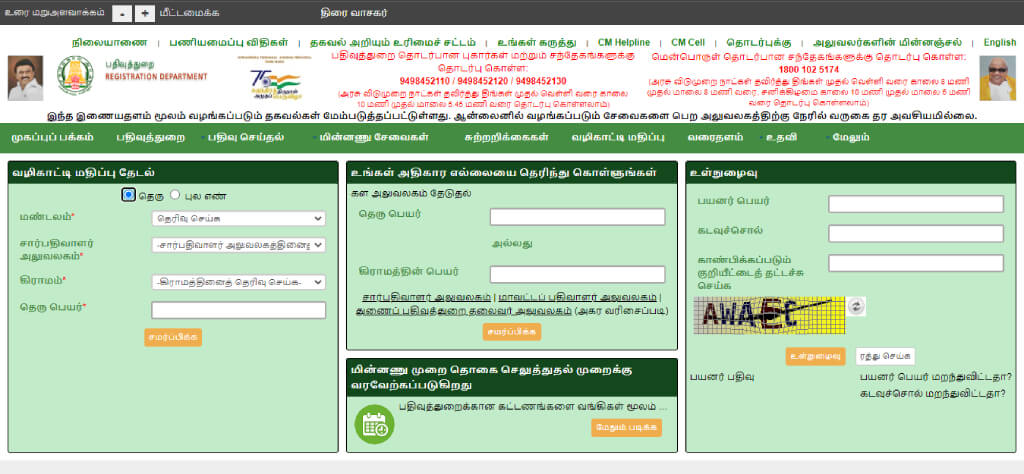

The Tamil Nadu Revenue Department authorizes TNREGINET as its official website, offering diverse property-related services. Citizens can conveniently access a wide range of information and carry out tasks such as user registration, checking property guideline values, searching for encumbrance certificates, and determining building values through this online platform. To make the most of the TNREGINET portal, follow the steps below.

The state government’s revenue department manages the TNREGINET portal, which allows citizens in Tamil Nadu to conveniently access various services and solutions related to property certificates, registration, and transfers. The primary goal of this official website is to simplify the process for people by removing the requirement to visit the sub-registrar office (SRO). By utilizing TNREGINET, individuals can save time and expedite the registration and transfer of their properties.

TNREGINET Highlights |

|

| Name Of Portal | TNREGINET IGRS (Inspector General Of Registration) |

| Portal For | TNREGINET Portal For Land, Marriage Registration |

| Launched By | Department Of Registration |

| Beneficiaries | Residents Of Tamil Nadu |

| Major Benefit | Various Online Services |

| Portal Objective | Providing Online Services |

| Portal Under | State Government |

| Name Of State | Tamil Nadu |

| Post Category | Portal / Yojana / Yojana |

| Official Website | https://tnreginet.gov.in |

What is TNREGINET?

The revenue department of the Tamil Nadu Government, also known as IGRS Tamil Nadu, manages TNREGINET, an online platform that offers a range of services to citizens. Tata Consultancy Services (TCS) monitors and maintains this portal.

TNREGINET: Key Takeaways

- TN’s land and property registration portal is TNREGINET

- TN launched the portal to streamline property registration

- Register and create an account with a valid mobile number and email address to access the portal

- E-Encumbrance certificates, certified copies of registered documents, and online stamp duty and registration fees are all available on the portal

- The portal lets users search for registered documents, track their applications, and apply for mutations and subdivisions

- There’s also information on property taxes, guidelines for property registration, and FAQs about land and property registration

- You can also download TNREGINET’s mobile app from the Google Play Store or the Apple App Store

- Tamil Nadu’s new property registration portal has made the process more transparent and efficient, and it’s helped reduce time and effort

- As a result of TNREGINET, corruption, and fraud in property registration have been reduced

- Tamil Nadu’s users have given the portal positive feedback and it’s been widely adopted.

Services Offered by TNREGINET Portal 2023

There are many services available on the TNREGINET portal. These include:

- Access to (villangam)

- Stamp duty valuation

- Application tracking status

- Landowner details

- Jurisdiction information

- Guideline Value

- Tamil Nadu e-Distinct Services

- Social Document Application

- Application for Online Certified Documents

- Application for Online Encumbrance Certificate (EC)

- TNREGINET Guideline Value View

- Removal of Guideline Value Online

- Birth Certificate

- Marriage Certificate

- Death Certificate

- Land Registration

- Check Property Ownership Details in India

- Business Registration

- Checking TNREGINET EC Registration

How to Register at TNREGINET Portal?

To register as a user on TNREGINET, follow these steps:

-

- Visit the official website TNREGINET.gov.in.

- Click on ‘Registration’, and then select ‘User Registration’.

- Fill in the required details, such as your username, account type, and password. Verify the password and select a security question.

- Enter your name, gender, identification number/type, date of birth, email address, and mobile number.

- Provide your address and fill in the captcha code to receive an OTP (One-Time Password) on your mobile number.

- Enter the OTP and click on ‘Complete Registration’.

What Are the Steps Involved in the TNREGINET User Registration?

- Step 1: Visit the Official Home page of TNREGINET.

- Step 2: From the Homepage, you need to “Select the User Registration Option” from the Registration tab to proceed further with registering a User.

- Step 3: From the “Drop-down Menu” select the Citizen Option.

- Step 4: Then you will be redirected to a page where you will be required to type the User name of your choice in the User Name text box. You can “choose a Unique Username” for yourself which can consist of words, numbers, and symbols. It will appear as provided in the screenshot below.

- Step 5: First, make a password for yourself of a minimum of 10 characters and a maximum of 20 characters, using a lowercase, having one number, and one special character you need to enter the password with respective password rules as displayed on the right side of the screen in the highlighted box.

- Step 6: In the Next Step, you have to “choose a Security Question” from the Drop-down List and provide the answer to the selected question. Remember the question and answer as it will be asked in case you forget your password.

- Step 7: Now, the user has to enter the Personal Details in the respective fields such as:

- In the Salutation Drop Down Box, choose the appropriate option “Miss, Mrs, Mr“.

- Type the First Name, Middle Name, and Last Name in the respective fields.

- Select Gender from the drop-down box.

- Choose the identification document for verifying your personal details.

- Enter the Email address and confirm the email address by retyping the same.

- Select the appropriate date of birth from the drop-down box.

- Provide mobile and fixed-line phone numbers.

- Type the Identification No as given in the Identification document selected by you.

- Provide the address as given in the identification document selected by you.

TNREGINET Encumbrance Certificate (EC)

What is an Encumbrance Certificate(EC)?

An encumbrance certificate proves that the property has no monetary or legal liabilities. Any transaction involving the property is included in this TN REGINET EC certificate. The report identifies any unpaid mortgages or loans against the property.

The certificate demonstrates that the property is free from all legal dues, providing a buyer with peace of mind that the property is free of legal encumbrances.

How to Apply for EC Online in Tamil Nadu?

Here is a step-by-step guide on how to apply:

- Step 1: Visit the official portal: TNREGINET.gov.in.

- Step 2: Login by entering your username and password. Fill in the captcha code and click on ‘Submit’.

- Step 3: Select ‘Encumbrance Certificate’ and then choose ‘Apply Online’.

- Step 4: Fill in the required form and upload the necessary certificates/documents. Once done, click ‘Submit’.

- Step 5: Take a printout of the application form for future reference.

Why TNREGINET EC is Necessary?

-

- When applying for a home loan or loan against property, it is extremely imperative to obtain an EC since banks and financial institutions generally require 10-15 years of encumbrance. Consequently, homebuyers must obtain an EC not only to secure their legal title to the property but also to confirm their eligibility for financing.

- In all real estate transactions, it validates free title/ownership and is a requirement for sellers and buyers.

- This ensures that the property you purchase is free of legal dues and has a marketable title.

How to View EC (Encumbrance Certificate) Online?

Previously, users could find encumbrance certificates or Villangam certificates under the ‘eServices’ section on tnreginet.gov.in. However, now it requires users to log in to access this option.

To search for an encumbrance certificate (EC), you have two options: using the document number or house number. Make sure to have the zone details and district handles ready before searching for the EC document on TN REGINET.

Follow these Steps:

- Visit TNREGINET.gov.in and log in using your credentials.

- Click on ‘EC Search’. There are two options available: ‘Document-wise’ and ‘EC’.

- If you choose the ‘EC’ option, provide the necessary information, such as district, zone, EC start date, sub-registrar office (SRO), village, EC end date, subdivision number, and survey number.

- If you choose the ‘Document-wise’ option, fill in the information like the document number, SRO, code, and year.

- Click on ‘EC Search’, and you will be able to view EC.

TNREGINET EC Search Fees

| Type of Search | Fees |

| E.C. Application Fee | Re.1/- |

| EC Search Fee for the one year | Rs.30/- |

| EC Search fee for every additional year | Rs. 10/- |

| Additional fees for the computerised period (from 1987) | Rs.100/- |

Property Registration on TNREGINET 2023

How to Get Documents Ready for Deed Registration on the TNREGINET Portal?

- Stamp Valuation: You can determine the stamp duty and registration charges valuation online through the portal. Simply enter the necessary information regarding the property in question, and the valuation will be shown on the screen.

- Building Value Calculation: When you provide details such as the type of building, region, calculation period, insertion unit, building age, floor number and name, area, and amenities offered, you can calculate the value of a building.

- Encumbrance Certificate: You can create this certificate by applying online. Visit the official website and choose the relevant option. Enter information regarding the zone, district, sub-registrar office, EC start and end date, as well as other survey details.

- Create an Application: To access this option, you need to register in this domain and use your login ID and password. Once logged in, you can create various documents, such as a draft deed abstract, an encumbrance certificate, and certified copies of title deeds. These services greatly facilitate the process of obtaining property registration-related documents efficiently.

Documents needed for Property Registration in Tamil Nadu

Before applying for property registration in Tamil Nadu, make sure to gather the following documents:

-

-

- Encumbrance Certificate (EC)

- Original Documents with signatures of all parties involved in the property transaction

- Demand draft or challan of the registration fee and stamp duty charges based on the guideline value or property valuation

- Property Card

- Identification proof of the buyer, seller, and witnesses involved in the property transaction

- Power of attorney, if applicable

- PAN Card

- Aadhaar Card

- Proof of Address and identification to present at the registrar’s office.

-

How to Register a Property on TNREGINET?

To register a property on TNREGINET, follow these steps:

-

- Authenticate the ownership of the property by generating the encumbrance certificate online at TNREGINET.GOV.IN, the Government of Tamil Nadu’s official website.

- Calculate the stamp duty and registration charges. Obtain the required stamp duty papers based on the registration charges generated on the official website. Follow the land guidelines and calculate the value based on mandatory parameters.

- Prepare the draft and sale deeds for registration in the presence of an advocate, buyer, seller, and witnesses.

- Book a slot to visit the Sub-Registrar Office (SRO).

- All parties involved in the property transaction (buyer, seller, and witnesses) should visit the SRO at the scheduled slot with their identity and address proofs, along with other required documents for authentication.

- After authentication, the registration charges must be paid in Tamil Nadu, and all parties will need to sign the respective documents to complete the registration process.

Property buyers should be aware that the office may refuse to register the document. In such cases, a check slip will be generated, and the user will receive an SMS notification. If the document is refused, the e-payment number can be used for normal registration or against the same online document. The document can be resubmitted within ten days of check slip generation. The user can modify all the details except the party details.

Tamil Nadu Guideline Value 2024

The Tamil Nadu state government lists the guideline value, which represents the minimum value of a property in a specific area. Knowing the guideline value is crucial for property owners in Tamil Nadu to calculate the applicable fees and duties. It is the minimum value at which a property can be registered, as determined by the state government. The guideline value is derived from the estimated market value of the land according to government records, specifically the Tamil Nadu Registration Department. It is intended to reflect the actual market value of the property.

In cases where a property is sold at a value higher than the guideline value, the registration will be based on the higher value. Conversely, if the property is sold below the guideline value, the buyer must pay registration charges and stamp duty based on the minimum value.

The guideline value is set by the Tamil Nadu government for each area in the state. In well-developed residential areas, the guideline values are based on streets. For lands or properties that haven’t been formed into streets, the guideline value is determined based on the survey number of the property.

Importance of Guideline Value

The guideline value serves multiple purposes:

- It assists in evaluating the advantages and disadvantages of purchasing a house.

- It plays a crucial role in determining the registration and stamp duty charges. It also aids registration authorities and buyers in identifying instances of undervaluation in property transactions.

- It helps prevent fraud by enabling the tracking of individuals who try to evade registration charges, thereby reducing scams and corruption related to land transactions.

- It serves as a useful indicator for buyers to understand the value of land, allowing them to price their properties competitively.

How to Check the Guideline Value of TN on TNREGINET?

Here is a step-by-step guide on how to check the guideline value on TN REGINET:

- Step 1: Visit the official portal at TNREGINET.gov.in.

- Step 2: Choose ‘TNREGINET Guidance Value – Guide for TNREGINET Registration’.

- Step 3: Enter all the required details and the captcha code.

- Step 4: Click on ‘Search’, and the information will be displayed on your computer screen.

How to Check Jurisdiction for Guideline Value?

Here is a step-by-step guide on how to check the jurisdiction for guideline value on REGINET:

- Step 1: Visit the official TNREGINET portal.

- Step 2: On the homepage, click the ‘Help’ tab, and then select ‘Web Home Application Services’.

- Step 3: Choose the ‘Know Your Jurisdiction’ option.

- Step 4: Enter the ‘Street Name’ or ‘Village Name’ in the field office search, and click ‘Search’. Step 5: The details related to the jurisdiction will be displayed, including the district name, zone, name and address of the Sub Registrar’s Office (SRO), and the Sub Registrar’s email address.

How to Calculate Building Value on TNREGINET?

One of the services provided on the portal is building value calculation, which allows users to calculate the value of a building for property tax assessment.

The building value calculation on TNREG is based on the property’s guideline value, which the Tamil Nadu government determines. The guideline value is determined by taking into account factors such as the property’s location, the building’s age, and the building’s size.

To calculate the building value on TNREG, follow these steps:

- Visit the official portal: TNREGINET.gov.in.

- Click on ‘Building Value Calculation’.

- Fill in the required information in the form.

- Submit the form to calculate the building value.

It is important to note that the building value calculation on TNREG is only an estimate, and the actual market value of the building may be higher or lower than the guideline value.

TNREGINET Patta / Chitta 2024

In the Tnreginet Registration system, Patta is a land record document. Tamil Nadu’s REGINET Patta Chitta is a land record. The TNREG Patta Chiita provides information on a property, such as the size of the land and the surrounding area, as well as proof of ownership. Owner’s name, address, and date of ownership.

Patta: Pattas contain information about land ownership, acreage, location, and survey information. Before acquiring a property from the owner, Patta documentation must be verified. The seller must have a legal Patta for the land to have a clear title to the property. For a clear title, the buyer must transfer the Patta to his name at the Taluka office after acquiring the land.

Chitta: According to Chitta, land ownership, size, and area are all pertinent details. The appropriate Village Administration Officer (VAO) and Taluka office issue an immovable property tax document. There are two types of land: Nanjai (wetland) and Punjai (dry land). Nanjai refers to land or regions with water bodies such as canals, rivers, ponds, etc. “Punjai” describes the relationship between smaller water bodies and the land.

How to Get Patta/Chitta Online on TNREGINET?

You cannot find Patta Chitta online on REGINET. This portal specifically offers services related to searching guideline values, calculating stamp duty, and other property registration-related tasks.

TNREGINET: Jurisdiction Check Process

REGINET (Tamil Nadu Real Estate Regulatory Authority Information Network) is an online portal that provides various real estate services in Tamil Nadu, India. One of the services provided on the portal is the jurisdiction check process, which allows users to check the jurisdiction of a specific property.

What Is the Process of Checking the TN REGINET Jurisdiction?

Here is a step-by-step guide on how to check the TN REGINET jurisdiction:

-

Method 1:

- Step 1: Log in to TNREGINET.gov.in

- Step 2: Choose ‘More’, then select ‘Portal Utility Services

- Step 3: Select ‘Know Your Jurisdiction’ and enter your street or village name

- Step 4: Click on ‘Submit’, and the complete details will be displayed on the screen

-

Method 2:

-

- Step 1: On the home page, locate ‘Know Your Jurisdiction

- Step 2: Enter your village or street name

- Step 3: Click on ‘Submit’ on the online registration portal.

It is important to check the jurisdiction of a property before buying, selling, or renting it, as the jurisdiction determines the office where the property registration needs to be done.

Tamil Nadu Stamp Duty and Registration Charge

In Tamil Nadu, stamp duty and TN registration charges are levied on the sale or transfer of immovable property. These charges must be paid to the government as part of the TN registration process.

|

TN REGINET: Stamp Duty and TN Registration Charges |

||

| Document Classification | Stamp Duty Charges | Registration fee |

|

Sales Document / Purchase Document ( Sales / Purchase ) |

7% of market value

|

4% of market value |

|

Donation document |

7% of market value |

4% of market value |

|

Transaction |

7% of maximum property value |

4% of maximum property value |

|

Compensation mortgage |

1% (for loan amount) Maximum ₹40,000 / – |

1% (for loan amount) Maximum ₹10,000 / – |

|

Mortgage (Independent) |

4% (for loan amount) |

1% (for loan amount) up to a maximum of ₹2,00,000 / – |

| Selling agreement | ₹20 | 1% (upfront) 1% of the transaction amount if the sale agreement is independent |

| Building contract agreement | 1% for the contract amount or for the amount specified in the document | 1% for the contract amount or for the amount specified in the document |

| Cancellation document | ₹50 | ₹50 |

|

Partition Documents i) Between family members |

1% of market value for each component (maximum ₹ 25,000 / -) | 1% of market value per component (maximum ₹ 4,000 / -) |

|

ii) Among non- family members |

4% of the market value of the split component |

1% of the market value of the split component |

|

Document of public authority. i) Sale of public power |

₹ 100 |

₹10,000 |

| ii) For sale of public power (per family member) | ₹ 100 | ₹1,000 |

| iii) For purposes other than the sale of public power | ₹ 100 | ₹50 |

| iv) Public Authority (with transfer amount) | 4% per transaction | 1% of the transfer amount or ₹10,000 / – whichever is higher will be charged. |

| Handing over of title documents | Maximum ₹ 30,000 / – for 0.5% loan amount | Maximum ₹ 6,000 / – for 1% loan amount |

| Release Deed i) Between family members | 1% of market value (maximum ₹ 25,000 / -) | 1% of market value (maximum ₹ 4,000 / -) |

| Nature of Document | Stamp Solution | Registration fee. |

| ii) Among family non-persons | 7% of market value | 1% of market value |

|

Leasing Within 30 years |

1% for an additional lease amount | Maximum ₹20000 / – for 1% lease amount |

| Within 99 years | 4% for an additional lease amount | Maximum ₹20000 / – for 1% lease amount |

| Over 99 years | 7% for an additional lease amount | Maximum ₹20000 / – for 1% lease amount |

| Document of trust (in the absence of immovable property) | ₹180 |

1% Corpus Fund |

Process: Search Birth and Death of the Person in Tamil Nadu

- Visit to TN REGINET

- Click on More

- Navigate your search to drop-down menu

- Choose Birth/death

- Select your search type

- Fill in the certificate number, Child Name, Gender, Date of Birth, Father’s Name, Mother’s Name, and captcha code

- Hit the search button.

TN REGINET FAQs

What is TNREGINET?

TNREGINET is the Tamil Nadu Government's online registration portal. TN REGINET allows citizens to access government records without visiting a Sub-Registrar office.

What is the Process to Check the TN REGINET Document Status?

Organisation Name: Revenue Administration. Category: Government To Citizen. Service Title: View A - Register Copy. Description: A provision to view the A - Register copy online (Land records) Url: http://eservices.tn.gov.in/eservicesnew/land/areg.html? lan=en

How can I give feedback on the TNREG Portal?

Register your feedback at helpdesk@tnreginet.net.

How can I Check my Villangam in Tamil Nadu

You can view your EC Tamilnadu online at Tami Nadu Registration Department. You can view or download the encumbrance certificate by clicking on the encumbrance certificate option. Download your Villangam certificate.

Where can I view the Transaction Status for my e-Payment?

To check the status of your transaction, go to E-services-> E-Payment-> Payment-> Payment status.

Is TNREGINET 2.0 available for all types of property registration?

Yes, TNREGINET 2.0 can be used for registering all types of properties, including land, apartment, and house.

What documents are required for property registration on TNREGINET 2.0?

The necessary documents for property registration on TNREGINET 2.0 include proof of identity and address, property documents, and payment receipts.

What is the payment process for property registration on TNREGINET 2.0?

The payment process on TNREGINET 2.0 is entirely online, and individuals can use various payment options like net banking, credit card, and debit card.

How do I check my guideline value in Tnreginet?

To check your guideline value in Tnreginet, follow these steps:

● Go to the Registration Department's official website i.e. https://tnreginet.gov.in/portal/.

● Click on the guideline value tab.

● Fill in the required details such as street number or survey number.

What is the guideline value in Tamil Nadu 2024?

If the property is sold at a value higher than the guideline value, the registration of the property will be based on the higher value. However, if the property is sold below the guideline value, the registration of the property will be based on the guideline value. In the case of the property being bought at a higher value than the guidance value, it is registered in terms of the market value.

Is registration on guidance value or market value?

If the property is sold at a value higher than the guideline value, the registration of the property will be based on the higher value. However, if the property is sold below the guideline value, the registration of the property will be based on the guideline value. In the case of the property being bought at a higher value than the guidance value, it is registered in terms of the market value.

How to find guidance value of property in Chennai?

To find the guidance value of property in Chennai, follow these steps:

● Go to the Registration Department's official website i.e. https://tnreginet.gov.in/portal/.

● Click on the guideline value tab.

● Fill in the required details auch as street number or survey number.

How guideline value is fixed in Tamil Nadu?

The Tamil Nadu government fixes the guideline value for each area in the state. The guideline values are based on the streets for well-developed residential areas. The guideline value is fixed based on the survey number of the property for lands/properties that have not been formed into streets.

What is guideline value Tamil Nadu?

The guideline value in Tamil Nadu is the minimum value of a property in a particular area, as listed by the Tamil Nadu state government. It is essential to know the guideline value to calculate the fees and duties payable in Tamil Nadu.

What is the difference between market value and guideline value in TN?

The guideline value is the minimum value of a property in a particular area, as listed by the Tamil Nadu state government. The market value is the actual value of the property in the market.

If the property is sold at a value higher than the guideline value, the registration of the property will be based on the higher value. However, if the property is sold below the guideline value, the registration of the property will be based on the guideline value.

What is the market value rule?

The market value rule is the actual value of the property in the market.

What is the use of guideline value?

The guideline value is used to calculate the fees and duties payable in Tamil Nadu. It is also the minimum value of a property in a particular area, as listed by the Tamil Nadu state government.

Is market value fair value?

The market value is the actual value of the property in the market. Whether it is fair or not depends on various factors such as demand and supply, location, condition of the property, etc.

How can I check my EC online in Tamil Nadu?

To check your Encumbrance Certificate (EC) online in Tamil Nadu, follow these steps:

● Go to the Registration Department's official website i.e. https://tnreginet.gov.in/portal/.

● Click on the EC tab.

● Fill in the required details which are district, sub registrar office, EC start date, and EC end date.

To download Form 15 EC online, follow these steps:

● Go to the Registration Department's official website i.e. https://tnreginet.gov.in/portal/.

● Click on the Public Utility Forms tab.

● Select Appln. for Encumbrance Certificate (EC) / Certified Copy(CC), and download it.

What is EC in house registration?

EC stands for Encumbrance Certificate. It is a certificate that shows the history of the property, including all the transactions that have taken place on it. It is required during house registration.

How do I file an EC?

To file an EC, you need to apply for it online on the Tamil Nadu Registration Department's official website i.e. https://tnreginet.gov.in/portal/.

How can I check my land documents online in Tamil Nadu?

You can access some land documents online on the TNREgistration website, others at Land Records department.

Can we get EC online?

Yes, we can get EC online through the TNREgistration website or Sub-Registrar office.

How many types of EC are there?

There are mainly two types of Encumbrance Certificates (EC) - Form 15 and Form 16.

What is EC verification?

EC verification is the process of verifying the Encumbrance Certificate (EC) to ensure that the property is free from any legal or financial liabilities.

How many days it will take to get EC online?

It usually takes around 2-3 days to get an Encumbrance Certificate (EC) online.

What is CC in property?

CC stands for Commencement Certificate. It is a certificate that is issued by the local authorities to allow the builder to start construction of the property.

What is the reason for EC?

The reason for an Encumbrance Certificate (EC) is to show the history of the property, including all the transactions that have taken place on it. It is required during property registration to ensure that the property is free from any legal or financial liabilities.

Conclusion

The main purpose of Vakilsearch is to assist in the verification of the property and also to ensure that the documents provided by others as well as you are accurate and genuine.