In this article, you will get to know the important facts about DSC, different types of DSC, and steps to follow to register the DSC on the new Income tax portal.

Register DSC in Income Tax Portal

DSC or Digital Signature Certificate is a computerised impression that acts like an online verification tool for an individual. A DSC is essential for you to file GST returns. Further, the domestic and foreign companies should e-sign the DSC form. Thus, by using DSC, one can easily avail of all an individual’s data. The Digital Signature Certificate is used in India and around the globe. And it is essential to register DSC on the New Income Tax Portal. But before we learn about the same, let us know what is accepted and what’s not.

What are the Different Types of Accepted DSCs and What are Not?

There are different types or classes of DSCs available. And you have to apply for the same based on your need. There are class 1 certificates that are issued to those individuals to confirm the user’s name and email contact details. Then there are class 2 certificates that are mandatory for those individuals who have to sign documents to file for ROC returns.

Finally, there are Class 3 Certificates used for online bidding/ online tenders anywhere in India. But make sure you are DSC is validated with the portal. And ensure that there are no multiple users. Finally, do not forget to re-register and update if you are an old user.

Prerequisites Before Registering on the Income Tax Portal Online

There are certain prerequisites one need to know before they register dsc on income tax portal. They are as follows:

- Try to keep the emSigner installed beforehand in your windows. By installing the app, you can ensure no last-minute rush

- Go through the terms and conditions of the application before you plan to register

- Keep your credentials like PAN number, User Id etc., ready to avoid last-minute mistakes

- Makes sure to plug in the DSC Token in the right USB port of your computer

- Most importantly, the DSC Token should be active until its expiry

- Ensure that the token is a class 3 or 2 certificates

Prerequisites During Enrollment of DSC Online

Now that we have seen the essential requisites before DSC registration in income tax portal. Let us learn about the things we need to do during enrollment. They are:

- While registering for DSC, do a thorough check of your PAN Card number to ensure that you have provided the right number

- Make sure to go through the windows extraction file of the app to verify and upload the documents faster

- Keep your certificate file ready beforehand to avoid any mistakes

- Look for the original app instead of falling prey to the fake apps

- Stay alert while providing your security detail to ensure privacy

Use the Income tax calculator on Vakilsearch to quickly calculate your taxes and submit your ITR.

Prerequisites After the Process Completion

Once you register for the DSC in the new sources of Income Tax you can go through the application and verify the same. And in case of changes, you can click on the right side of the screen and select the option “change”. This will further open the application, and you can make the changes ITR 4 Sugam

Steps to Register DSC on the New Income Tax Portal

You need to follow various steps for DSC Registration on Income Tax portal. And here are the same in detail:

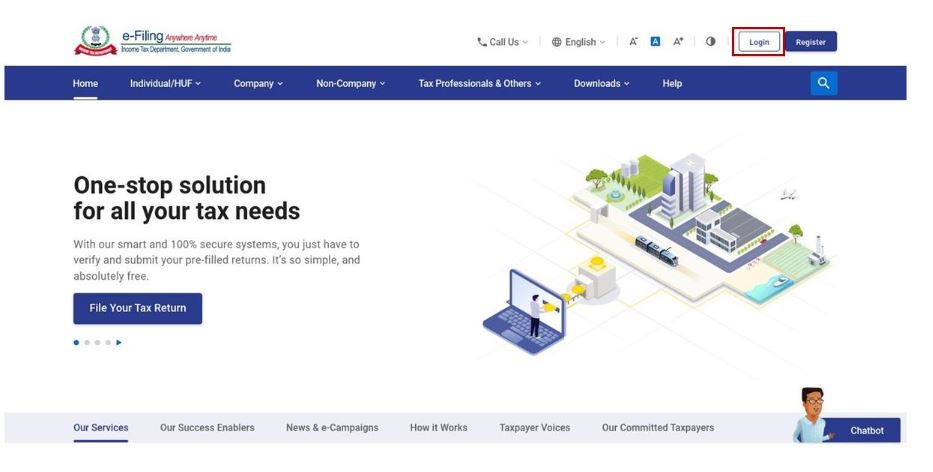

- Firstly, visit the https://eportal.incometax.gov.in/iec/foservices/#/login. Further, click on the login and enter your username and password. Ensure you enter the right username and password and log in within the first attempt to avoid the online rush.

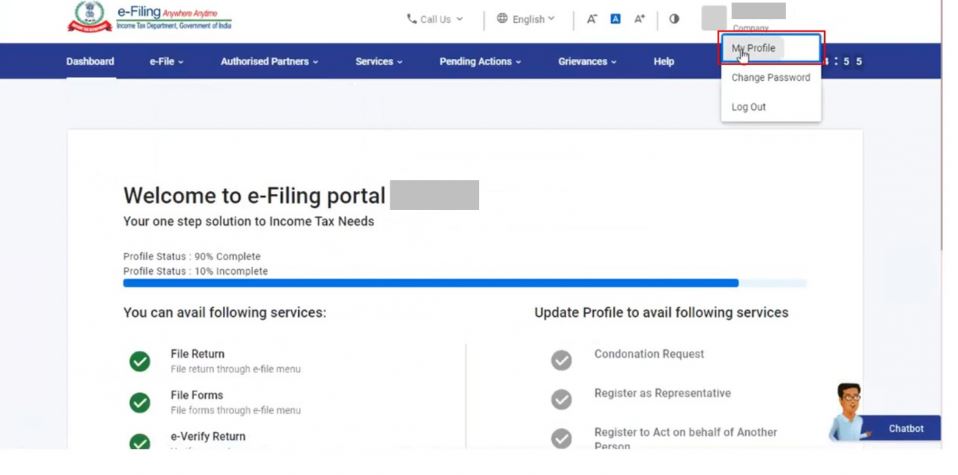

- Next, after you log in, a tab openly displays your dashboard. Here you have to select your profile and ensure that the information provided is complete. Make the profile completion percentage to 90% and be active in the same.

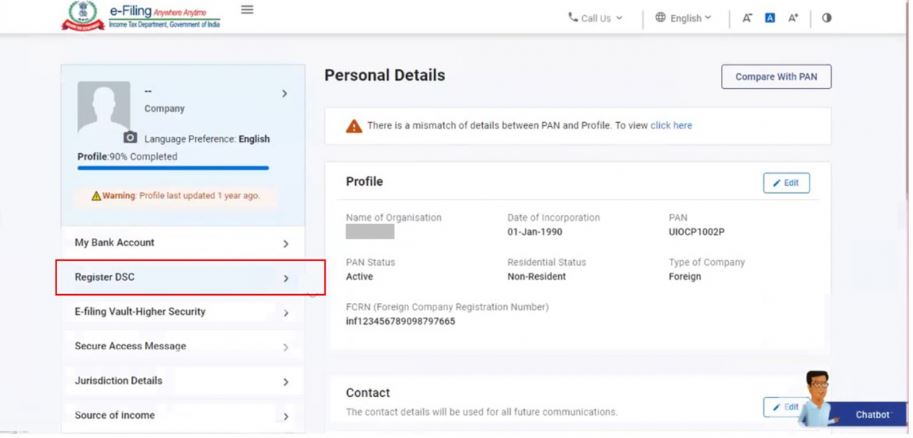

- Under your profile, the options for DSC web registration “Register DSC” are given right after the “My bank account” option. Click on the option. Make sure to install the emSigner utility beforehand from the Government of India’s official website to avoid the last-minute rush.

- When you click on the option, another tab opens that says you should enter your email ID linked with the DSC token. Make sure to enter a valid email ID. You will find a dialogue below the email id box “I have downloaded and installed the emSigner utility. And select the box with a tick mark. This will declare that you have already downloaded the emSigner.

- Select the “continue” option. And a dialogue box will display boxes where you have to fill in your token, certificate and password. Remember to fill in the right token, certificate and password. It will allow you to make the enrollment in a single attempt. And click on the “generate” option.

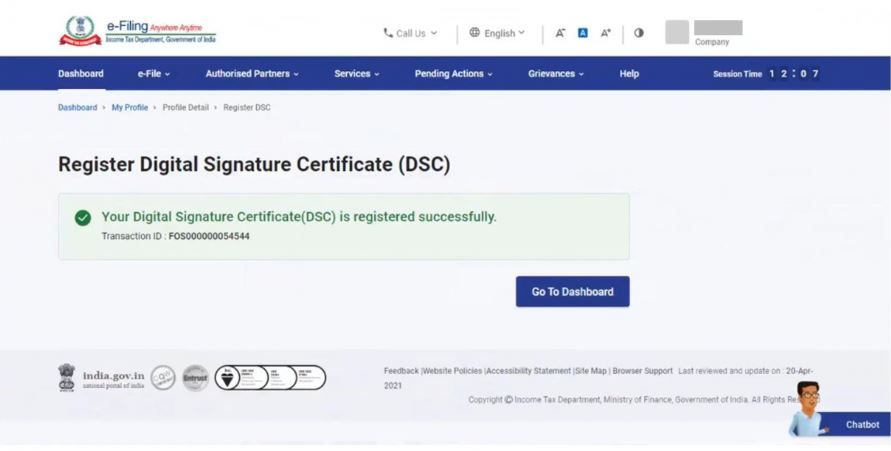

- Finally, when your enrollment is successful, a message box will be displayed saying, you have successfully generated your DSC. And thus, the process is complete. Further, it will display a transaction ID that you must keep in mind, ITR 1 form

- Thus, these are the steps you should follow to register your DSC on the new Income tax portal. Strictly follow the enrollment steps to ensure that you successfully generate your DSC.

Conclusion

Overall, registering DSC on the new Income tax portal: https://eportal.incometax.gov.in/iec/foservices/ is essential for you to prove your identity and validate that only you are operating the same. To register for the DSC, you have first to visit the official income tax portal and log in with the respective username and password. Further, click on the register DSC option and generate your digital signature certificate. This will serve as proof of your identity for online purposes.

But make sure you have installed the emSigner app before beginning the enrollment process. Finally, ensure that you follow all the prerequisites before, during, and after the enrollment. All the best!

Also, Read:

- Certificate-Based Digital Signatures

- Complete defention of ECS full form

- How Do I Create A Digital Signature Free?

- ITR Offline Utility