Are you looking to make a PF withdrawal from your PF amount? EPF members can now submit their PF withdrawal/settlement/transfer claims online. Here is a compilation of all the information you will need to go make a successful claim.

What is PF Withdrawal Online?

PF Withdrawal is a process that allows individuals to withdraw funds from their Employee Provident Fund (EPF) account. PF Withdrawal process is initiated when an individual is no longer employed or needs to use the funds for a specific purpose. To withdraw funds from the EPF, individuals must meet specific criteria and follow an online process. In 2023, the EPF Withdrawal online process is expected to be more streamlined, with more options available and an easier process overall. Withdrawing funds from your EPF account can be a great way to provide financial stability, so it’s important to understand the process and be prepared when it comes. In this article, we learn PF Withdrawal online Process, customer support, and more.

New EPF Withdrawal Rules 2023

Under the new rules, PF account holders can withdraw money equivalent to three months’ basic salary plus a dearness allowance. This amount equals 75% of their net balance in their PF or EPF account, whichever is lower. The deposit will not be refunded. You can file PF Withdrawal Online.

PF Withdrawal Online – EPFO gives subscribers of the Employee Provident Fund (EPF) an interest rate of 8.1% for 2022-23. The interest rate was the lowest since 1977-78 when the EPF interest rate was 8%.

6 Reasons for PF Withdrawal Online

While you are still working, these are the conditions under which you can withdraw your EPF money

-

- Medical Treatment

- Marriage for Purposes

- Construction of a House or Purchase of Property

- Repaying the existing Home Loan

- Education Purposes

- Alterations or repairs to your House

3 Different Types of EPF Withdrawals

EPFO’s member portal allows subscribers to withdraw 3 types of PF Withdrawal Online. The following are among them:

-

- PF Final Settlement

- PF Partial Withdrawal

- Pension Withdrawal Benefit

With the employer’s attestation, EPFO members can withdraw their savings from the member portal using their Aadhaar card details.

Documents Required for PF Withdrawal

The following documents are required for PF Withdrawal online Process:

-

- Universal Account Number (UAN).

- You must provide accurate bank account information.

- Money cannot be transferred to a third party until the PF holder dies, so the bank account must be in the PF holder’s name.

- The EPFO must be notified of the employee’s details, and the employee’s exit from the company must be registered. Correctly state the joining and leaving dates.

- The date of birth and father’s name should match the proof of identity.

Brief Guide: PF Withdrawal Online Process

-

EPFO Withdrawal via New Form

- Step 1: Use UAN to update your Aadhaar number

- Step 2: Link your UAN to your AADHAAR

- Step 3: Use the EPF member portal to withdraw

- Step 4: Submit the form to receive your withdrawal

-

EPFO Withdrawal via Old Form

- Step 1: You must first contact the previous employer’s HR team to get Form 19 for EPF withdrawal.

- Step 2: The form is available to download from EPFO’s website

- Step 3: Fill in details like occupation details, PF account number, IFSC code, and bank details.

- Step 4: You will have to submit the cancelled cheque leaf

- Step 5: Raise the form to your employer

- Step 6: The employer will attest to the form.

Steps to Apply for PF Withdrawal Online Process on UAN Portal

Below given are the steps for PF Withdrawal Process:

-

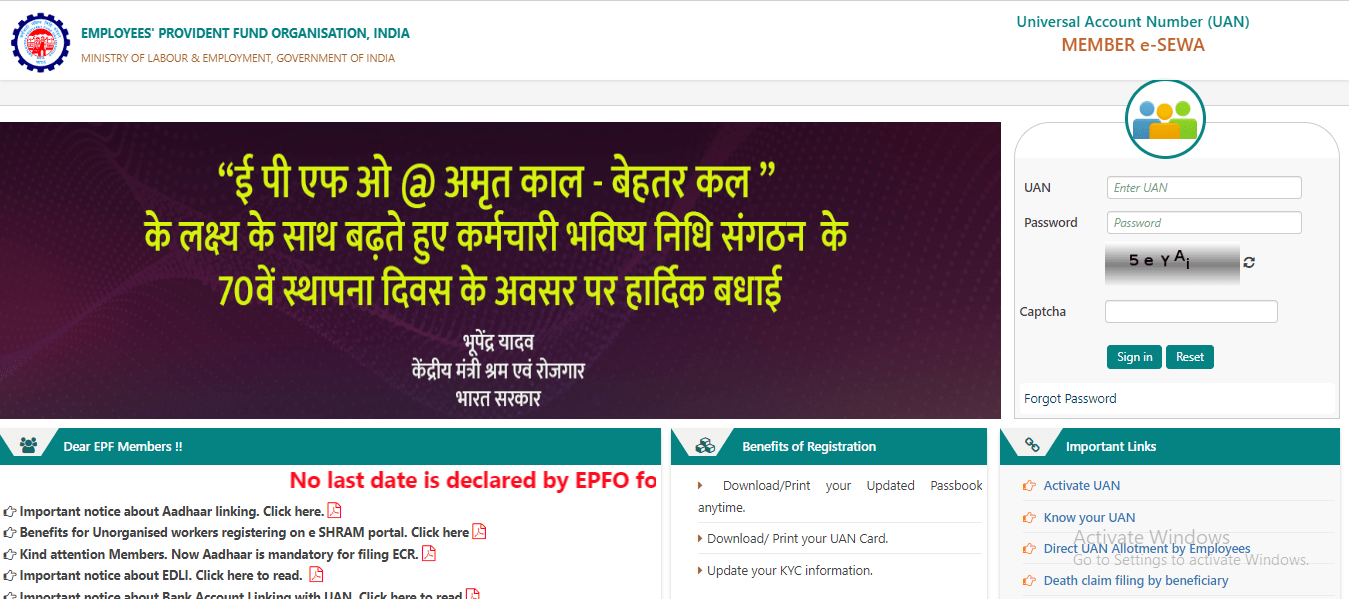

- Step 1: The first step for PF Withdrawal online Process is to visit the UAN portal.

- Step 2: Fill in the captcha with your UAN and password.

-

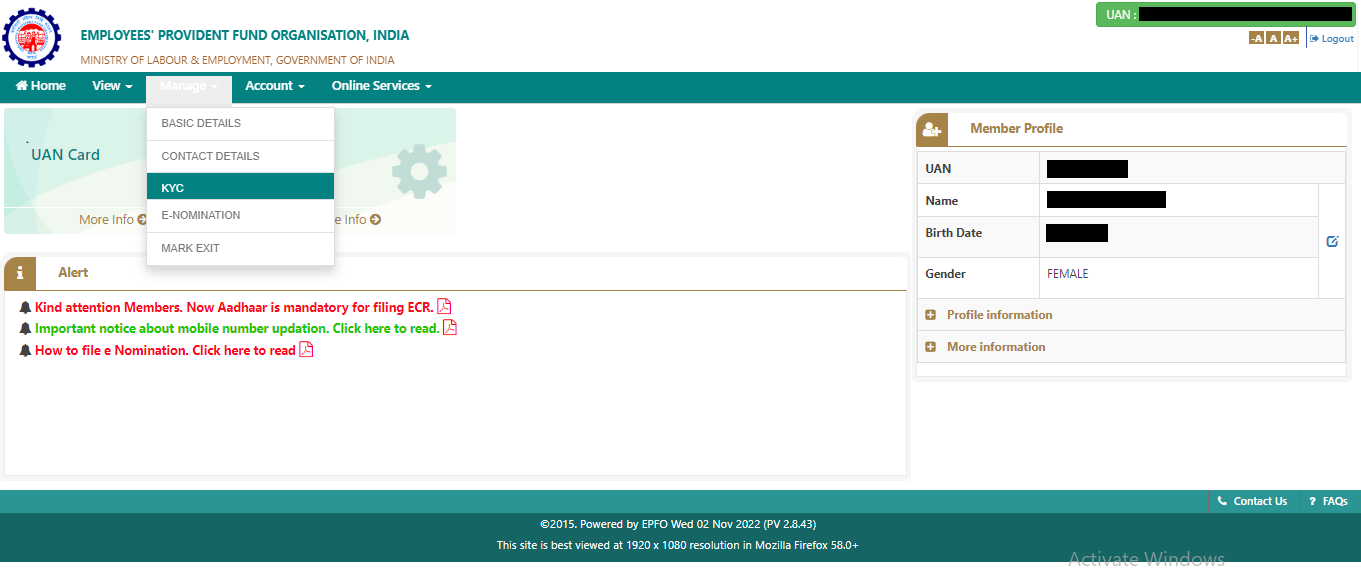

- Step 3: Check your KYC details, such as Aadhaar, PAN, and bank details, on the Manage page.

-

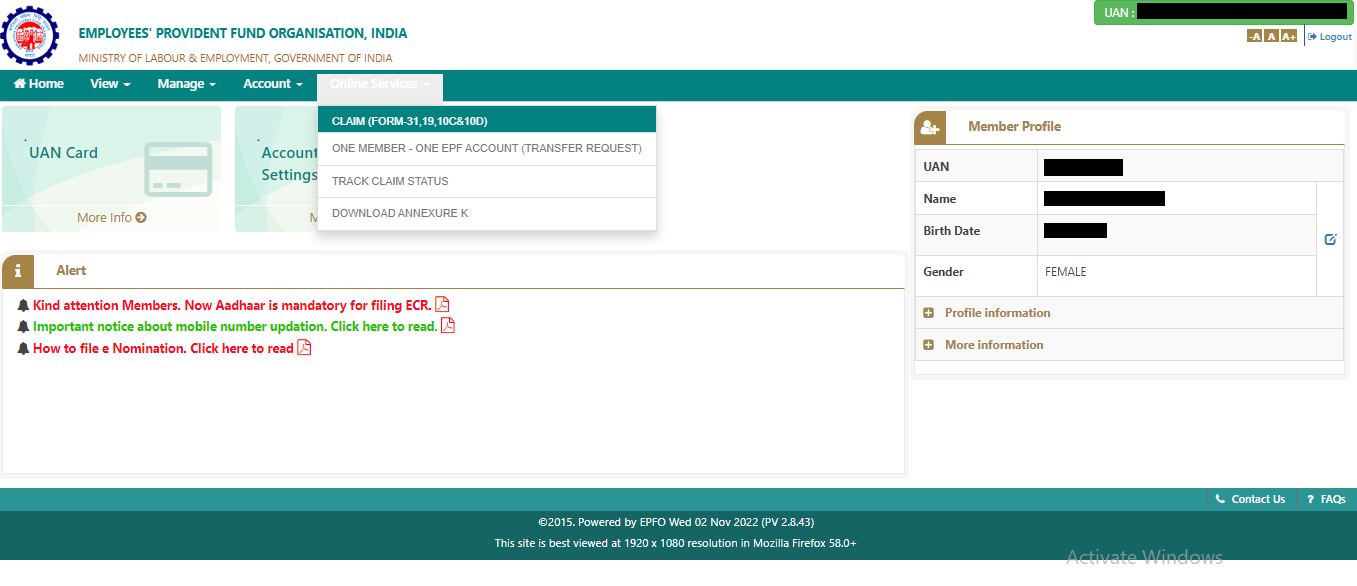

step 3 of pf withdrawal - Step 4: Select Claim (Form-31, 19 & 10C)’ from the drop-down menu once KYC information has been verified.

-

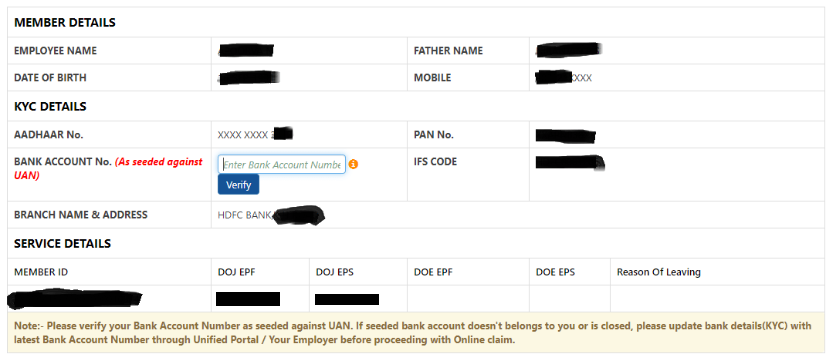

step 4 of pf withdrawal - Step 5: Enter your bank account number and press the Verify button to reveal the member’s information, KYC information, and other service information.

-

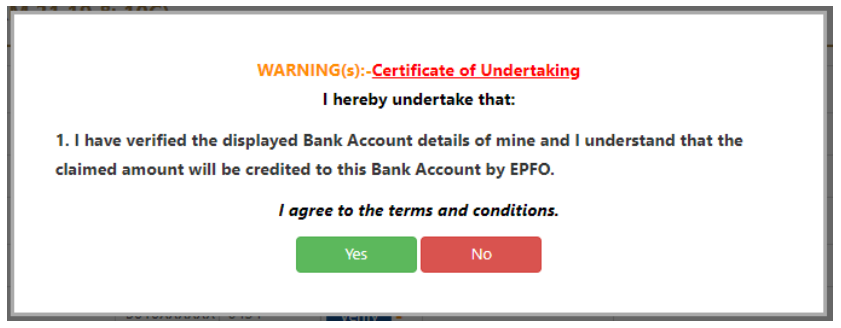

step 5 of pf withdrawal - Step 6: Sign the undertaking certificate by clicking ‘Yes’.

-

step 6 of pf withdrawal - Step 7: Click ‘Proceed for Online Claim’.

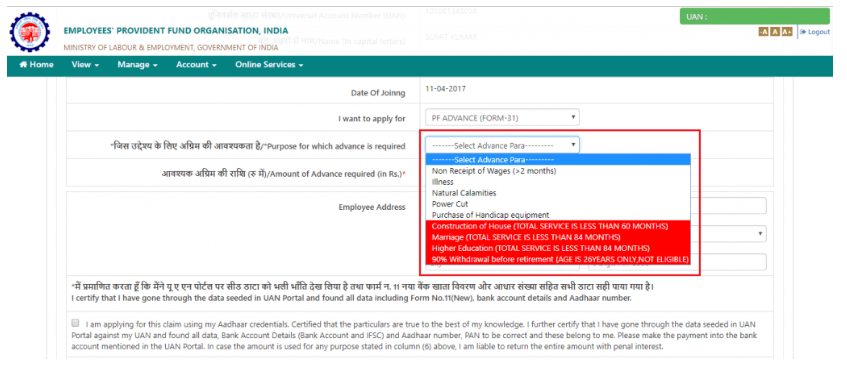

- Step 8: You can choose to apply for a full EPF settlement, a partial withdrawal (loan/advance), or a pension withdrawal from the claim form under the heading ‘I Want To Apply For’. The drop-down menu won’t display the services a member is ineligible for due to service criteria, such as online PF withdrawals or pension withdrawals.

- Step 7: Click ‘Proceed for Online Claim’.

-

-

-

- Step 9: Select ‘PF Advance’ and enter the employee’s purpose, amount, and address to withdraw funds.

- Step 10: Click on the certificate to submit your application. Your employer must approve a withdrawal request for the money to be credited to your bank account. The funds typically arrive in your bank account within 15-20 days. Your Withdrawal PF online Process is done here.

-

-

Steps to Apply your PF Withdrawal without having UAN

-

- No UAN? Please fill out a PF Withdrawal Online form and submit it to your local PF office.

- Aadhaar-based Composite Claim Forms or Non-Aadhaar Composite Claim Forms will be available online.

- It can be time-consuming to withdraw from PF without a UAN.

- PF account withdrawals can be partial or full, depending on your needs.

- An employee can withdraw his full EPF after retirement or if he remains unemployed for more than two months.

- Unemployed employees can withdraw 75% of their PF if they remain unemployed for a month.

PF Withdrawal Online

Complete Withdrawal

To withdraw your EPF balance completely, you must complete five years of service or be 58. If you withdraw your EPF balance before five years of service, your withdrawal will be taxable.

To withdraw your EPF balance completely, you can follow these steps:

- Log in to your EPFO account.

- Click on the “Online Services” tab.

- Click on the “Claim (Form-19)” link.

- Select the “Complete Withdrawal” option.

- Enter the required details, such as your bank account number and the amount you want to withdraw.

- Click on the “Submit” button.

Partial Withdrawal

You can also withdraw a portion of your EPF balance. To do this, you must have completed two years of service.

To withdraw a portion of your EPF balance, you can follow these steps:

- Log in to your EPFO account.

- Click on the “Online Services” tab.

- Click on the “Claim (Form-19)” link.

- Select the “Partial Withdrawal” option.

- Enter the required details, such as your bank account number and the amount you want to withdraw.

- Click on the “Submit” button.

EPF Withdrawal Taxability

EPF withdrawal taxability depends on the following factors:

- Whether you have completed five years of service

- Whether you are withdrawing your EPF balance completely or partially

If you have completed five years of service and are withdrawing your EPF balance completely, your withdrawal is tax-free. However, if you partially withdraw your EPF balance, the interest on your employee’s contribution will be taxable.

If you have not completed five years of service, your EPF withdrawal online will be taxable. The employee’s contribution will be taxed as salary income, and the interest on the employee’s and employer’s contributions will be taxed as income from other sources.

Process to Enter Exit Date for Withdrawal PF Online

To enter your exit date for PF withdrawal process, you can follow these steps:

- Log in to your EPFO account.

- Click on the “Online PF Withdrawal” tab.

- Click on the “Member UAN/Online Service (OCS/OTCP)” link.

- Enter your UAN and password.

- Click on the “Manage” tab.

- Click on the “Service History” link.

- Click on the “Add Service History” button.

- Enter the required details, such as your exit date.

- Click on the “Submit” button.

Which are the forms used for EPF withdrawal?

The forms used for EPF withdrawal are:

- Form 19: This form is used to withdraw your EPF balance completely or partially.

- Form 10C: This form is used to withdraw your EPF balance if you are leaving your job and have not completed five years of service.

- Form 10D: This form is used to withdraw your EPF balance if you are retiring.

How to Apply for a Home Loan Based on EPF Accumulation?

To apply for a home loan based on your EPF accumulation, you can follow these steps:

- Contact a bank or financial institution that offers home loans.

- Submit your application form and the required documents, such as your EPF statement.

- The bank or financial institution will assess your application and determine whether you are eligible for a home loan.

- If you are eligible for a home loan, the bank or financial institution will offer you a loan agreement.

- Once you have signed the loan agreement, you will receive the loan amount.

EPFO Customer Care Support:

If you are an Employee: employeefeedback@epfindia.gov.in

If you are an Employer: employerfeedback@epfindia.gov.in.

Toll-free Number: 1800118005

FAQs Related to Online PF Withdrawal Process:

Can I withdraw the full PF Amount?

According to the new EPFO rule, 75% of the EPF corpus can be withdrawn after one month of unemployment, with the remaining 25% being transferred to a new EPF account after finding new employment. Under the old rule, 100% of the EPF corpus could be withdrawn after two months.

Can I withdraw my PF early?

In certain conditions, we can withdraw our pf early.

How many days will PF withdrawal take?

PF amount is deposited into the bank account within 5-30 days after an employee applies for EPF online.

Which reason is best for PF Withdrawal?

In an emergency, such as a medical emergency, a house purchase or construction, or higher education, a partial withdrawal from an EPF account is permitted. Partial withdrawals are limited so that account holder can request them online.

Is it compulsory to furnish PAN by Employees for EPF Withdrawal?

EPF withdrawal/settlement requires PAN to prevent the excess tax from being deducted. If you do not submit PAN, tax deducted at source (TDS) can be as high as 34.6%. Are EPF withdrawals taxable? Employee Provident Fund withdrawals are taxable if you withdraw them before five years of service are complete.

Are EPFO contributions eligible for Tax Deductions(TDS)?

Yes, EPF contributions are eligible for tax deductions.

Can I increase my PF Contributions?

Yes, one can increase EPFO contributions.

Will the employer also contribute higher when I do?

Employees can contribute 100% if they have a salary hike. The employer, however, is not obligated to match your contributions. The employee will continue contributing 12% of your basic pay to your EPF account.

Do I need the employer's permission to withdraw the amount from EPF?

Due to EPFO changes, subscribers to the Employees' Provident Fund Organisation (EPFO) don't need their employer's permission to PF withdrawal partial or entire funds. Subscribers need to ensure their UAN is seeded with their Aadhaar card information.

Is it compulsory to furnish PAN by employees for EPF withdrawal?

No, it is not compulsory to furnish a PAN by employees for EPF withdrawal. However, if you do not furnish your PAN, TDS will be deducted at a higher rate.

Are EPF contributions eligible for tax deductions?

Yes, EPF contributions are eligible for tax deductions under Section 80C of the Income Tax Act 1961.

Can I increase my EPF contributions?

Yes, you can increase your EPF contributions up to 100% of your basic salary. However, you need to get your employer's consent to do so.

Will the employer also contribute more when I do?

No, the employer's contribution to EPF is limited to 12% of your basic salary.

Do I need the employer’s permission to withdraw the amount from EPF?

No, you do not need the employer's permission to withdraw the amount from EPF. However, you need to submit your EPF withdrawal claim form to your employer for processing.

Can I make premature withdrawals?

Yes, you can make premature withdrawals from EPF under certain conditions, such as unemployment, medical emergency, or home purchase.

How long will it take for the EPF claim to be settled?

The EPF claim settlement time depends on various factors, such as the type of claim, the completeness of the documentation, and the workload of the EPFO. However, the EPFO aims to settle all claims within 30 days.