Even though the vast majority of these firms are found in the unorganised sector of the economy, micro, small, and medium-sized enterprises (MSMEs) make a considerable contribution to India's gross domestic product. Read to know more about ‘how do I get a loan for my business from MSME?

Overview:

In the recent few decades, this industry has experienced rapid growth, particularly following liberalisation in the 1990s. Nevertheless, other elements can support MSMEs in reaching their full potential. In India, MSME Loan for new Business are mainly unorganised. Many business owners have a tendency to spend their savings to launch operations, but they must reinvest in order to expand. This can be accomplished by contributing more personal or family savings, cash flow, or MSME loans.

MSME Loan – Highlights – 2023

- Revamped Credit Guarantee Scheme for MSMEs: The Indian government has revamped the scheme for MSMEs to provide easier access to credit for small businesses. The revamped scheme will provide collateral-free guaranteed credit of up to ₹2 lakh crore to MSMEs and reduce the cost of credit by about 1%.

- New MSME Categorisation and Definition: The Indian government has introduced a new categorisation and definition for MSMEs. Under the new categorisation, MSMEs are classified into three categories based on their annual turnover and investment:

- Micro enterprises: Annual turnover up to ₹50 lakh and investment up to ₹10 lakh

- Small enterprises: Annual turnover between ₹50 lakh and ₹250 crore and investment between ₹10 lakh and ₹50 crore

- Medium enterprises: Annual turnover between ₹250 crore and ₹1,000 crore and investment between ₹50 crore and ₹100 crore

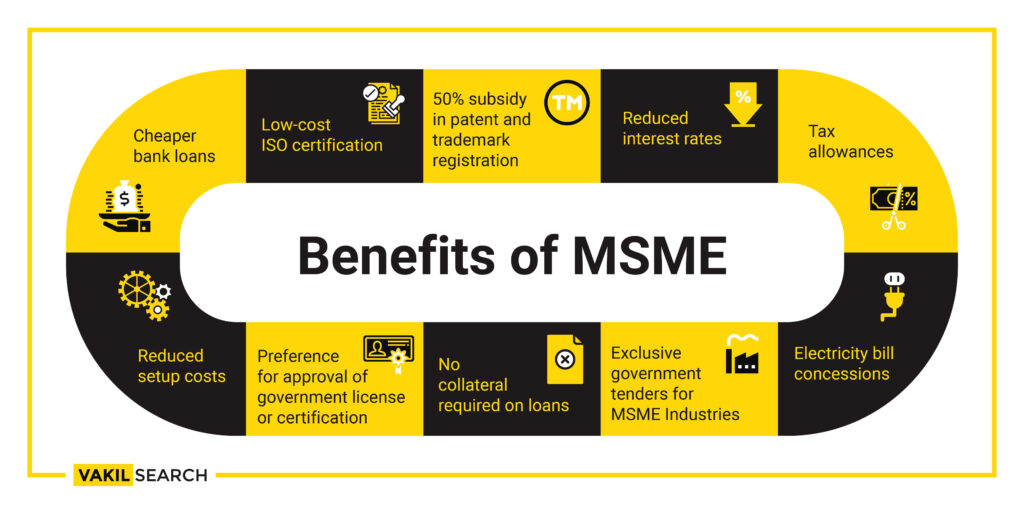

- MSME Registration: MSME registration is not mandatory, but it offers a number of benefits, including:

- Access to government schemes and subsidies

- Lower interest rates on loans

- Priority in government procurement

- Ease of doing business

- Collateral for MSME Loan: Banks typically require collateral for MSME loans. However, there are a number of government schemes that provide collateral-free loans to MSMEs.

Other Important Highlights:

- Interest Rates: The interest rates on MSME loans have been falling in recent years. This is due to a number of factors, including the government’s focus on MSME lending and the increased competition among banks.

- Online Lending: Online lending platforms have made it easier for MSMEs to access loans. These platforms typically offer faster and more hassle-free loan processing than traditional banks.

- Government Schemes: The Indian government offers a number of schemes to support MSMEs. These schemes provide MSMEs with access to credit, subsidies, and other forms of assistance.

If you are a small business owner, you should explore your options for MSME loans. MSME loans can help you start a new business, expand an existing one, or purchase machinery and equipment. MSME loans can also be used for working capital, research and development, and marketing and promotion.

What is an MSME Loan?

Any loan or credit facility offered by banks or non-banking financing organisations to micro, small, and medium-sized businesses to meet their financial needs is referred to as an MSME loan. Many lenders frequently provide Small-ticket MSME Loan for new Business without any type of security, but larger loans are typically subject to collateral requirements. A plot of land, a house, or a piece of business property might serve as collateral.

Small and medium-sized enterprises and startups typically lack the assets or property needed to satisfy the collateral requirements of many lending institutions. As a result, a sizable portion of MSME business loans is secured.

Purpose of MSME Loans

MSME loans can be used for a variety of purposes, including:

- Starting a new business

- Expanding an existing business

- Purchasing machinery and equipment

- Working capital

- Research and development

- Marketing and promotion

Using MSME Loan for New Business to Increase Revenue

- Expansion through cash flow financing is prone to be postponed because it takes time for a firm to earn enough surplus to be returned back into the business

- Additionally, the majority of MSME business owners lack the ability to continue investing their savings in their companies. Therefore, the best method to go huge is to get an MSME loan to expand

- MSME loans are a great way for borrowers to get the money they need to expand their businesses. These loans can be used for a variety of purposes, including business expansion

- MSMEs can utilise these loans to finance working capital requirements, purchase inventory or raw materials, buy fixed assets and equipment, upgrade infrastructure and technology, and marketing

However, there are a few significant requirements before a company organisation can apply for an MSME loan.

-

Credit Rating in MSME Loan for New Business

A default on a loan puts the lender in danger of losing money. Lenders analyse a borrower’s ability to repay loans on time by looking at their credit history and credit score. A borrower’s creditworthiness is revealed by their credit score. This is based on a person’s credit history, which takes into account things like timely repayments, how frequently one has borrowed money, how much, what kind of loans, etc.

An excellent credit score of 800 or higher not only makes it easier to establish a credit line but also makes it easier to negotiate a better interest rate and other terms.

-

GST, Statutory Registrations

It is crucial to register a firm with the Goods and Service Tax (GST) administration. A corporate entity is given a special number by tax authorities under the GST law, which enables them to collect tax on behalf of the government. Lenders prefer to grant MSME business loans to companies with the necessary legal registration.

-

Bank Statements and Financial Statements

Accounts make it easier to comprehend what is going on in a firm. An audited financial statement from a potential borrower is frequently requested by MSME loan providers as confirmation of an accurate business record. These documents aid lenders in determining how effectively the company has managed its finances. Lenders are impressed by a financial statement that shows strong profitability and a steady cash flow.

Bank statements provide lenders with a good sense of a company’s actual cash flow and financial stability. Bank statements assist lenders in determining the main inflows and outflows into the business that are used to determine loan eligibility.

-

Reliable Business Plan

The lenders can determine the borrower’s ability to repay the loan through cash flows with the support of a credible assessment of the future company plans. Consequently, a credible expansion plan must be given when asking for an MSME loan.

Qualifications for Business Loans for New Businesses and MSMEs

Different eligibility requirements are set forth for different MSMEs and startup business lending programmes. However, the following general requirements must be met in order to be eligible for business loans:

- The applicant’s age must be at least 21 years old and cannot be more than 65 years old

- The candidate must be an Indian national

- The candidate ought to submit a business plan

- MSMEs and startups should be set up as a limited liability partnership, sole proprietorship, partnership, or corporation (LLP)

- Startups and MSMEs need to have strong credit histories

Required Documents for MSME Business Loans

- Passports, Aadhar cards, driver’s licences, voter ID cards, PAN cards, and utility bills are examples of KYC papers

- an original business plan

- Bank statements from the preceding 12 months and ITRs from the prior year

- Certificate of business incorporation

- proof of a business address

- any additional paperwork that the lender requests.

Factors Affecting MSME Loan Interest Rates

The interest rate on an MSME loan is affected by a number of factors, including:

- The borrower’s credit score

- The loan amount

- The loan term

- The type of collateral offered

- The lender’s risk assessment

Bank Loan Programs for New Businesses and MSMEs

In addition to working capital and term loans, banks and financial institutions offer MSMEs and startups a variety of business loan programmes. These loans can be used for a variety of company requirements, including:

- inventory and equipment purchases

- operating money (working capital)

- Funding needed for growth, etc.

The terms and circumstances that apply to the loan programs provided by various banks or financial institutions vary, as do the interest rates. On the websites of the separate banks, the applicant can obtain information about the various business loan programs offered by those institutions to small firms. Some of the banks that provide small firms with business loans include:

- State Bank of India

- HDFC

- ICICI

- Axis Bank

- Non-Banking Financing Companies (NBFCs)

- Small Finance Banks (SFBs)

- Regional Rural Banks (RRBs)

New MSME Categorisation

The Indian government has recently introduced a new categorisation for MSMEs. Under the new categorisation, MSMEs are classified into three categories based on their annual turnover and investment:

- Micro enterprises: Annual turnover up to ₹50 lakh and investment up to ₹10 lakh

- Small enterprises: Annual turnover between ₹50 lakh and ₹250 crore and investment between ₹10 lakh and ₹50 crore

- Medium enterprises: Annual turnover between ₹250 crore and ₹1,000 crore and investment between ₹50 crore and ₹100 crore

The New Definition of MSME

The Indian government has also recently introduced a new definition of MSMEs. Under the new definition, MSMEs are enterprises with an annual turnover of up to ₹1,000 crore and investments up to ₹100 crore.

MSME Registration

MSME registration is not mandatory, but it offers a number of benefits, including:

- Access to government schemes and subsidies

- Lower interest rates on loans

- Priority in government procurement

- Ease of doing business

Registration For Entrepreneurs Already Having UAM

Entrepreneurs who already have a UAN (Universal Account Number) can register their MSME online through the Udyam Registration portal. The registration process is simple and straightforward.

Collateral for MSME Loan

Banks typically require collateral for MSME loans. However, there are a number of government schemes that provide collateral-free loans to MSMEs.

FAQs

Is Credit Score Important for MSMEs in getting MSME Loans?

Yes, a credit score is important for MSMEs in getting MSME loans. Lenders use credit scores to assess the borrower's creditworthiness and determine the risk of lending. A good credit score indicates that the borrower has a good track record of repaying loans on time. This makes the borrower more attractive to lenders and increases the chances of getting a loan.

Is MSME Registration Voluntary or Compulsory?

MSME registration is voluntary. However, it offers a number of benefits, including: Access to government schemes and subsidies Lower interest rates on loans Priority in government procurement Ease of doing business

How can I get Collateral-free MSME Loans?

There are a number of government schemes that provide collateral-free loans to MSMEs. Some of these schemes are: Pradhan Mantri Mudra Yojana (PMMY) Stand Up India Scheme Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) You can contact your bank or a financial institution to learn more about these schemes and how to apply for them.

Is there any Turnover Limit for MSME Schemes?

Yes, there is a turnover limit for MSME schemes. The turnover limit for MSMEs is ₹1,000 crore.

Is a Machinery Loan offered to MSMEs?

Yes, machinery loans are offered to MSMEs. Machinery loans can be used to purchase machinery and equipment for your business.

What is the MSME Registration Fee?

The MSME registration fee is ₹500. You can register your MSME online through the Udyam Registration portal.

Conclusion

MSME loans play a vital role in the Indian economy. The government has taken a number of steps to make MSME loans more accessible and affordable. If you are a small business owner, consider exploring your options for MSME loans.