Do you want to know ITR filing last date? Then this blog is for you. Get to know about the ITR filing Last date, consequences and the penalties involved.

ITR Filing Date Latest Update

It is crucial to know about the Last ITR Filing Date. This will help to prevent penalties. In general, Income tax is one of the significant sources of a country’s tax revenue which contributes to the government executing welfare works for its citizens. It is also called direct tax because people who earn a taxable income pay their taxes directly to the government of the State. The government imposes income tax, making it your legal obligation to pay your income tax return on time.

Income tax can be levied on individuals, companies, firms, local authorities, Hindu Undivided Families, and LLP. Every year during the launch of the new budget, some rules and slabs related to income tax get released. These rules are released in the financial year and applied in the subsequent assessment year. Every taxpayer must follow these rules before filing their income tax returns (ITRs). Mark your calendars and ensure you’ve taken note of the ITR filing last date for AY 2023-24.

ITR Filing Date Deadline

From April 1, the new assessment year will begin, and taxpayers can begin filing their Income Tax Returns (ITR) for the financial year 2023–24 on that date. The ITR filing deadline is July 31, 2023. If an ITR is submitted after that date, penalties or other fees may apply, and the taxpayer will be required to pay them.

Income Tax Return (ITR): An Overview

The income tax return is a form that contains data about the income of a person and whether they are taxable or exempted from paying tax. The amount of tax a person will pay is based on the slabs released in the financial year. The Income-tax rates are released annually, but the income tax is paid on a monthly basis.

If a person miscalculates the taxable income amount and pays excess tax to the Income Tax Department during a year, he will get a refund of the extra payment from the income tax department. Income tax transactions are made under provisions of income tax law that are prevalent in India. The Income-tax return has to be done every year by the individuals or corporations. If the tax is not paid within a specific time period, liabilities and penalties can be attracted. to avoid them it’s crucial to pay income tax soon.

Are you Eligible to File an ITR? Let’s Find Out

According to the new income tax slabs and rates, every person who is a citizen of India can file an income tax return irrespective of their age.

- So, all citizens are entitled to file an Income tax return according to their annual income

- An NRI can also file ITR if his annual income is more than ₹2.5 lakhs

- An NRI having Less than ₹2.5 lakhs yearly income is exempted from taxation liabilities

- All registered companies are liable for paying income tax returns irrespective of whether they have gained any profit or not

- Foreign companies established inside India are liable for paying income tax returns

- If a person owns any tangible or intangible assets outside the country, they are liable to pay taxes.

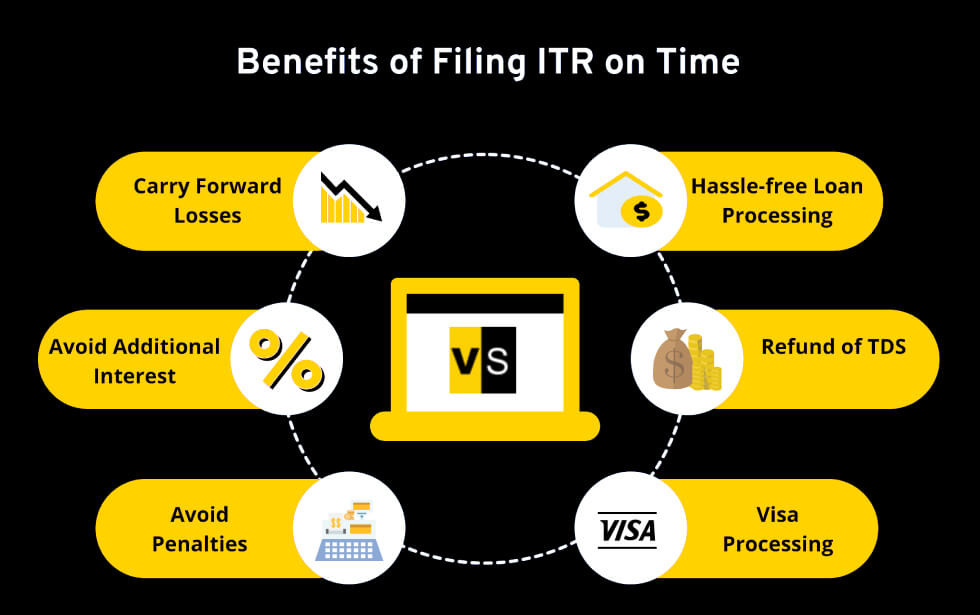

Benefits of Filing ITR on Time FY 2023-24 (AY 2024-25):

ITR Filing Date for FY 2023-24 (AY 2024-25)

Paying Income tax is a legal obligation that must be completed by all citizens who come under the ambit of taxable income according to the income tax slabs. If income tax is not paid within a certain period, default penalties can arise. So to ensure filing of income tax does not attract any penalty, income tax should be filed within the due dates. Mark your calendars and ensure you’ve taken note of the ITR filing date Deadline for AY 2023-24.

Section 234 A and 234 F of the Income Tax Act deal with penalty provisions. Income tax return filing is done after the financial year and within the assessment year. The central government has the discretion to extend the due dates.

| Category of Taxpayer | Due Date for Tax Filing- FY 2023-24 *(unless extended) |

| Individual / HUF/ AOP/ BOI (books of accounts not required to be audited) |

31st July 2023 |

| Businesses (Requiring Audit) | 31st October 2023 |

| Businesses requiring transfer pricing reports (in case of international/specified domestic transactions) |

30th November 2023 |

| Revised Return | 31st December 2023 |

| Belated/late Return | 31st December 2023 |

ITR Due Date for Paying Advance Tax

Income tax must be paid within a specific date. If the tax is not paid beforehand, it can put you in a situation where you have to face unnecessary liabilities and penalties. So it’s better to spend your tax before the end of the financial year. To ensure smooth processing, the government advises filing well before the ITR filing date deadline for AY 2023-24

Paying taxes in advance means paying taxes on the year’s income in which the payment has been made. Individuals must calculate their estimated income and taxable price and deliver it within the four installments provided during the financial year.

Maximize your tax benefits with our intuitive Income Tax Calculator – start planning smartly.

Taxpayers must pay their annual tax by estimating the income and delivering it in installments. These installments are 15%, 45%, 75%, and 100%. The payment must be made on or before 15 June, 15 September, 15 December, and 15 March. By this, a study flow can be maintained of the income tax because of the tax payments made at the same time as income. So the recent ITR filing date of 2023 is 15 June 2023.

ITR Filing Date Deadline for Paying Advance Tax Installments for FY 2023-24 (AY 2024-25)

| Due date | Nature of compliance | Tax to be paid |

|---|---|---|

| 15th June 2023 | First Installment | 15% of tax liability |

| 15th September 2023 | Second Installment | 45% of tax liability |

| 15th December 2023 | Third Installment | 75% of tax liability |

| 15th March 2024 | Fourth Installment | 100% of tax liability |

| 31st March 2024 | Presumptive scheme | 100% of tax liability |

Important ITR Filing Date Deadlines for FY 2023-24:

|

Due Date |

Nature of Compliance | Compliance Particulars |

Documents |

| 15 June 2023 | Advance Tax | First Installment for the financial year 2023-24 | Challan No./ ITNS 280 |

| 31 July 2023 | ITR filing | ITR Filing for FY 2023-24 | ITR Application Form |

| 15 September 2023 | Advance Tax | Second Instalment for FY 2023-24 | Challan No./ITNS 280 |

| 30 September 2023 | Tax audit report | Tax audit report for FY 2023-24 | Form 3CA/3CB/3CD |

| 31 October 2023 | Transfer Pricing Report | Submission of reports for FY 2023-24 | Form 3CEB |

| 31 October 2023 | ITR filing (audit cases without transfer pricing) | ITR Filing for FY 2023-24 | Applicable ITR Form |

| 30 November 2023 | ITR filing for transfer pricing cases | ITR filing for FY 2023-24 (specified domestic or international transactions) | Applicable ITR Form |

| 15 December 2023 | Advance tax | Third Instalment for FY 2023-24 | Challan No. or ITNS 280 |

| 31 December 2023 | Revised return or belated return filing | Revised return or belated return for FY 2023-24 | Revised or belated return |

| 15 March 2024 | Advance tax | Fourth Instalment for FY 2023-24, Single and final installment for taxpayers opting for presumptive taxation scheme | Challan No./ITNS 280 |

ITR Filing Date Deadline for TDS Return

TDS or Tax Deducted at Source is a type of income tax collected for a purpose that when a person is liable to make a payment to another person, he shall deduct tax at source. The central government shall be remitted about it.

The ITR Filing Date Deadline for filing TDS for the financial year 2023-2024 are:

| Quarter ending | Month of deduction | Due dates for depositing TDS (FY 2023-24)* |

TDS Return Due Date (FY 2023-24) |

|---|---|---|---|

| 30th June 2023 | April 2023 | 7th May 2023 | 31st July 2023 |

| May 2023 | 7th June 2023 | ||

| June 2023 | 7th July 2023 | ||

| 30th September 2023 | July 2023 | 7th August 2023 | 31st October 2023 |

| August 2023 | 7th September 2023 | ||

| September 2023 | 7th October 2023 | ||

| 31st December 2023 | October 2023 | 7th November 2023 | 31st January 2024 |

| November 2023 | 7th December 2023 | ||

| December 2023 | 7th January 2023 | ||

| 31st March 2024 | January 2024 | 7th February 2024 | 31st May 2024 |

Consequences for Delay Filing of Income Tax Return (ITR)

If, for any reason, you have not filed income tax returns within the due dates and that are not pre-specified can attract penalties. The penalty for not filing income tax within the due date is discussed under Section 234A of the Income-tax Act. If a person does not file ITR in time, he would be liable for paying the amount at the rate of 1% interest for every month. Remember, timely filing by the ITR filing last date for AY 2023-24 is not just a responsibility, but also saves you from unwanted fines.

Interest and Penalty for Last Date for ITR Filing:

If a person who is liable to pay TDS does not pay it within the due dates will be fined ₹200 for each day unless he files the scheduled payment.

ITR Filing Date Deadline FAQs

How to file an Tax Return before ITR filing last date?

Only when you file your income tax return can you claim a refund. If you still need to complete your ITR, you can file a belated return by 31st December of the assessment year. A penalty of ₹5,000 is charged for late filing. Nonetheless, if a person's total income is less than five lakh, a fee of one thousand rupees is charged.

How to pay income tax after the due date

If you fail to pay taxes and file your tax return by the due date, you will be charged a late filing penalty and interest. Delayed returns are subject to a penalty of Rs 5,000. A fee of ₹1,000 is payable if the person's total income is less than₹5 lakh.

Under which section income tax return is filed after the due date?

Under section 139(4), a belated return can be filed after the due date. For late filing of returns, a penalty of ₹5,000 is charged. If the person's total income is less than ₹ 5 lakh, the fee is Rs 1,000

What is the due date for filing Income tax return?

Generally, individuals and non-audit cases must file their income tax returns by 31 July and audit cases by 31 October. Your income tax return can be e-filed in under seven minutes using Vakilsearch.

How to revise Income Tax Returns before the Due Date?

Under Section 139 (5), the taxpayer can revise the original return if some amendments have been made. The revised return can be filed in the same manner as the original return. Under Section 139(5), the taxpayer must submit an ITR. When revising the return, the entire e-verification process must be completed.

What is the Due Date of return filing for Companies?

31 July is the due date for filing the return.

Can I file ITR for AY 2023 24 now?

At this time, only utilities for ITR 1 and ITR 4 Sugam for filing income tax returns for AY 2022 24 are available.

How do I file my ITR 2023 24?

For the year 2023 24, e-filing of Income Tax Returns (ITRs) is now available on the Vakilsearch portal. For more information, contact us.

What is the penalty for not filing ITR?

According to section 234A of the Income Tax Act, if a person fails to file his or her ITR by the due date and owes an outstanding tax, interest is charged on that amount at 1% per month.

Can we file ITR 3 without CA?

Yes, you can file ITR 3 without an audit. For intraday transactions, turnover is the sum of profits and losses. ITR-3 can be filed without audit if you pay tax on 6% of turnover.

Is ITR Due Date Extension Possible?

Yes, an ITR Filling last date extension is possible.

The Takeaway

Income tax is one of the significant sources of tax revenue for a country so contribute to the positive growth of the nation by paying your taxes as a responsible citizen.