The Harmonised System of Nomenclature (HSN) code is used to classify products subject to GST. There are several items and services available. A single tax rate does not apply to all of them. As a result, they are divided into smaller groups, each with its own GST rate. The Service Accounting Code is used to categorise services (SAC).

Overview

Checking the HSN code on the GST portal is a simple yet crucial process for businesses. The HSN code, a systematic classification for goods and services, is essential for accurate tax calculation and reporting. By entering a brief product description on the GST portal, businesses can promptly obtain the relevant HSN code, ensuring proper categorization of their transactions and compliance with taxation regulations.

Understanding how to navigate the GST portal for HSN code information is vital for businesses to maintain transparency and consistency in their tax reporting. This uncomplicated procedure is accessible to businesses of all sizes, contributing to the efficiency of the Goods and Services Tax (GST) framework. Mastery of this process ensures that businesses accurately classify their products and services, facilitating smooth compliance with regulatory requirements and fostering a streamlined approach to tax assessment.

On the GST Portal, a person can look up the tax rate associated with a given HSN/SAC code. There is no requirement for the individual to be a registered user of the GST Portal.

Understanding the HSN Code

To check the HSN code on the GST portal, businesses need to navigate to the relevant section and enter the description of their product or service. The portal will generate the corresponding HSN code, ensuring businesses use the correct code for their transactions. Understanding the HSN code is essential for businesses to streamline their tax reporting processes and comply with regulatory requirements.

HSN in India

The Harmonized System of Nomenclature (HSN) in India is a systematic classification of goods and services that simplifies the tax structure. It is a numerical code assigned to each product or service to facilitate uniformity in international trade and domestic taxation. The HSN code plays a pivotal role in the Goods and Services Tax (GST) framework, helping businesses classify their products for accurate tax assessment.

For an extended period, various nations have utilized HSN codes in international trade. Following the implementation of GST in our nation, HSN codes and globally accepted codes for imports and exports have been incorporated to align with global standards. Utilizing HSN codes not only reduces costs but also streamlines customs procedures.

HSN codes serve as a valuable tool for all taxpayers, providing insights into the applicable GST rates for specific products. It is obligatory to include HSN codes when completing GSTR forms, contributing to enhanced clarity and accuracy in the tax filing process.

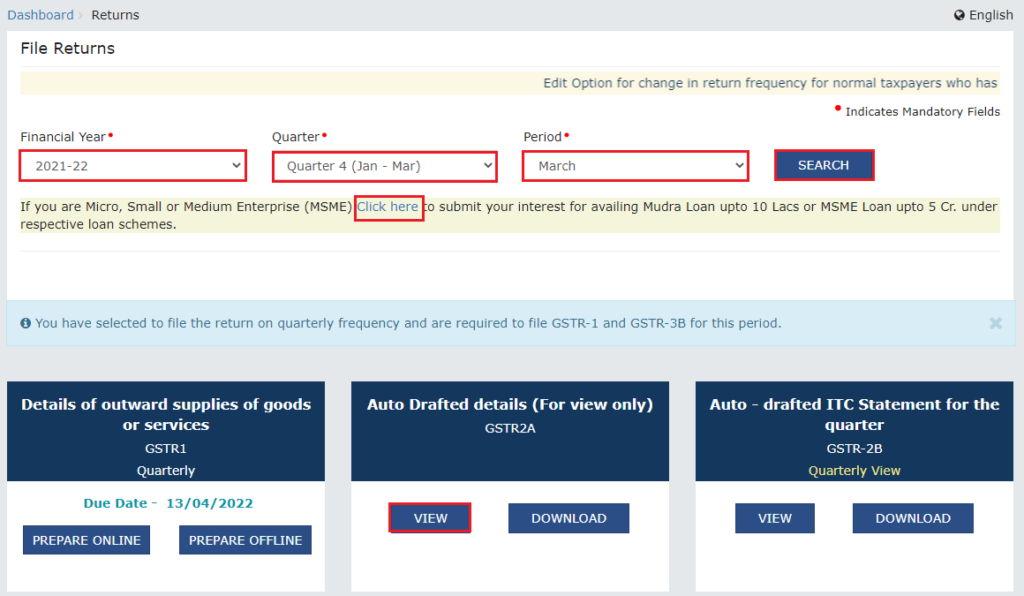

HSN – Wise Summary of Outward Supplies

On the GST portal, businesses can access an HSN-wise summary of their outward supplies. This feature provides a comprehensive overview of the goods and services supplied, categorised by their respective HSN codes. This summary is a valuable tool for businesses to review their sales data and ensures accurate reporting of HSN codes in their GST returns.

Checking the HSN Code on the GST portal is a proactive measure that businesses can take to enhance accuracy in tax reporting and ensure seamless compliance with the GST framework.

How Does the HSN Code Work?

It consists of around 5,000 commodity categories, each with its own six-digit code and organised in a legal and logical framework. It is backed by well-defined rules in order to achieve uniform classification.

GST Portal – How to Find HSN/Sac Tax Rates?

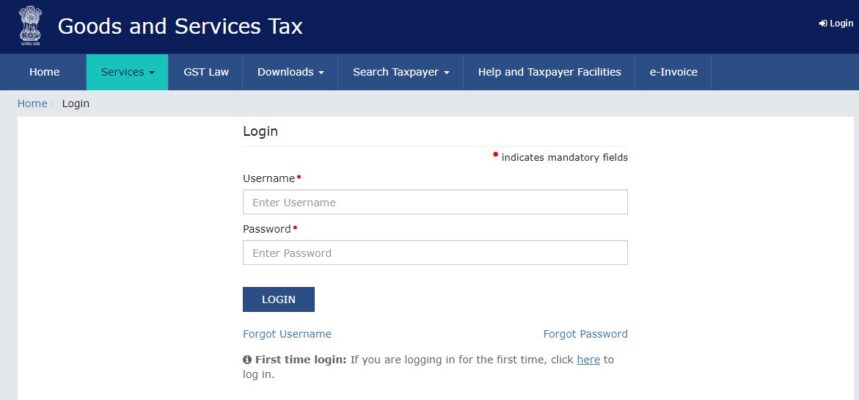

Navigate to the GST Portal’s Home Page

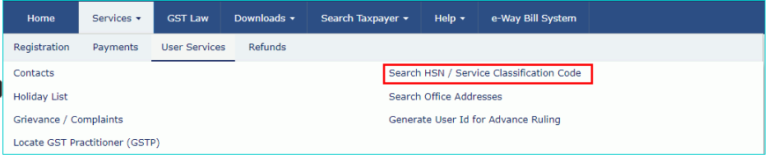

- Navigate to the HSN code in GST Portal homepage and sign in with your valid credentials. Select Services > User Services > Search HSN/SAC Code from the menu

- When it comes to HSN Codes, To begin, select the checkbox contain HSN

- Choose a tax type. Second, under the Tax-Type drop-down list, choose the tax type you’re looking for

- HSN Chapter Search by Name or Code. In addition, in the box labelled ‘Search HSN Chapter by Name or Code,’ type in the HSN code or the chapter’s name whose rates you are interested in

- Lookup for the HSN Code Additionally, in the section labelled ‘Search HSN Code,’ enter the HSN code for the items whose tax rates you wish to find up

- Choose the right dates- Choose the appropriate dates from the calendar in the ‘Effective Period’ category

- Select the ‘Search’ option. Finally, once all of the details have been entered, select ‘Search’

- Choose a State-If you choose SGST from the Tax Type option, you must additionally choose the State for which you want to examine the tax rate

- When it comes to SAC Codes. To begin, select the SAC checkbox

- Choose a tax type. Second, under the Tax-Type drop-down list, choose the tax type you’re looking for

- Enter your Service Classification Code here (SAC).In addition, in the field labelled ‘Service by Name or Code,’ type in the Service Classification Code (SAC) for the prices you are interested in

- Make sure you pick the proper dates. Choose the necessary dates from the calendar and enter them into the ‘Effective Period’ section of the form

- Click the ‘Search’ button. Finally, select ‘Search’ from the drop-down menu. Following completion of the procedure that came before, the user will then be given access to the specifics. You can make GST Check Online from our Portal also.

Once the procedure that came before it has been finished, the details will be made available to the user.

HSN International

Over two hundred countries and economies make use of the HSN system for a variety of purposes, including the following:

- Classification that is consistent

- Customs tariffs are based on this

- International trade statistics collection

Over 98 percent of international trade items are categorised using the HSN.

For each commodity, most countries accept the Harmonised System of Nomenclature number.The HSN number is the same across the board for virtually all different types of goods. However, the HSN numbers used in various nations vary little depending on the type of the commodities categorised.

There Is a Lot of Interest in HSN

Since 1971, India has been an engaged contributor to the work of the World Customs Organisation (WCO).In the past, the HSN numbers used to classify goods for purposes of Customs and Central Excise were composed of six digits. In the end, Customs and Excise decided to add two more digits to the numbers in order to make them more accurate, which resulted in an eight-digit categorisation system.

Use our GST calculator Online to determine the exact amount of GST to be paid before registering for GST.

Acquiring Knowledge of the HSN Code

The HSN organisational structure includes 21 divisions, 99 chapters, 1,244 headings, and 5,224 subheadings in total

- Each Section is further subdivided into Chapters. Headings are used to splitting each Chapter. Each Heading is further subdivided into its own Subheadings.

- Section and Chapter names represent broad groups of items, whereas headers and subheadings identify specific products

As an Example

Textile topics handkerchiefs 62.13.90

- The first two digits, 62, indicate the chapter number for articles of clothing and clothing accessories that are not knitted or crocheted. This includes a wide variety of items.

- The following two digits (13) represent the handkerchief heading number

- The last two numbers, 90, denote the product code for a wide variety of handkerchiefs made of textile materials. These handkerchiefs can be used for a variety of purposes.

India has two more numbers for a more detailed categorisation.

The HSN code for handkerchiefs made of synthetic fibre is 62.13.90.10.

Structure of HSN Code in GST Portal – India

GST Services Accounting Code (SAC)

Services, like things, are systematically categorised for identification, measurement, and taxes. Services Accounting Codes, or SACs, are codes for services.

- For instance, 998213 provides legal documentation and certification services for intellectual property rights such as patents, copyrights, and other forms of intellectual property

- For all services, the first two digits, 99, are the same

- The following two digits (82) reflect the primary type of service, in this example, legal services

- The following two digits define the specific nature of the service, such as legal paperwork for patents, etc., and the number 13 indicates this information.

The HSN Code for the Declaration of Goods and Services

On April 1, 2021, the following HSN codes will be announced

(See CGST notification number 78/2020, issued October 15, 2020.)

| Transaction Charges | Type of Invoice document | No. of digits of HSN to be declared |

| Up to 5 crore | Mandatory for B2B tax invoices | 4 |

| Optional for B2C tax invoices | 4 | |

| More than 5 crore | Mandatory for all invoices | 4 |

*Annual aggregate turnover for the prior fiscal year. For example, if you are reporting invoices for the fiscal year 2021-22, your turnover must be from the previous fiscal year, which is FY 2020-21.

- These HSN codes must be mentioned in every GST tax invoice produced by the taxpayer.In the context of the Goods and Services Tax (GST), it is necessary to provide all eight digits of the HSN code.

In the Context of the GST, Why Is the HSN So Important?

The Goods and Services Tax (GST): https://www.gst.gov.in/ is intended to be more organised and broadly understood thanks to the utilization of HSN codes. HSN codes will eliminate the need to supply a full product description. Because of the computerization of GST returns, this will save time and make the filing process easier.

If a dealer or service provider’s turnover falls within the aforesaid slabs, he must supply an HSN/SAC-by-SAC summary of sales in his GSTR-1. Vakilsearch establishes connections between you and reputable professionals and collaborates with them to fulfil all of your tax requirements, including GST, HSN, CGST, and others.

Frequently Asked Questions

How Can I Find My Product in HSN List and Its Relevant HSN Code?

To locate your product in the HSN list and find its relevant code, you can use the search function on the GST portal. Enter a brief description of your product, and the portal will provide the corresponding HSN code, ensuring accurate classification for GST compliance.

What is UQC?

UQC stands for Unit Quantity Code. It is a code used to specify the unit of measurement for a product or service. The UQC helps standardise and categorise the quantity measurement associated with an HSN or SAC code, facilitating uniformity in reporting across different products and services.

What is the Difference Between an HSN Code and a SAC Code?

The HSN (Harmonized System of Nomenclature) code is used for the classification of goods, while the SAC (Service Accounting Code) is utilised for classifying services. HSN codes are numerical identifiers for goods, and SAC codes perform a similar function for services, providing a systematic framework for tax assessment in the GST regime.