As part of this article, we first introduce the online portal that can assist with registering, followed by the three step process for registering. Each step is explained in detail. We also include: How to calculate. We conclude with the time it takes to receive an Udyam certificate.

Overview:

Udyam registration is a portal by the Government of India for MSME registration. As of July 1, 2020, enterprises can obtain a Udyam Certificate, and the Udyam registration process encompasses activities such as Udyam Certificate download. This initiative, endorsed by the Union Ministry of Micro, Small, and Medium Enterprises (MSME), streamlines the classification and registration of enterprises through the Udyam portal, serving as the Government’s Single Window System for MSMEs.

Who Can Apply for Udyam Registration?

An individual intending to establish a small, medium, or small enterprise can file for Udyam registration online.

Udyam Certificate download – Revised MSME Classification

Small, micro, and medium enterprises are classified as per the following criteria.

| Classification | Investment in Equipment or Machinery | Turnover |

| Micro Enterprise | <INR 1 crore | <INR 5 crore |

| Small Enterprise | <INR 10 crore | <INR 50 crore |

| Medium Enterprise | <INR 50 crore | <INR 250 crore |

What is the Process of Udyam Registration Online?

You can file for Udyam registration by logging in to the government portal and following the steps given below:

- Step 1: Apply for Udyam registration online

- Step 2: Get the Udyam registration number

- Step 3: Issuance of the Udyam certificate

Mentioned here under is the detailed Procedure for each Step.

- Apply for Udyam Registration Online

An individual who wants to establish micro, small, or medium enterprises needs to apply for online registration through the Udyam registration portal. The registration process is dependent on self-declaration with no requirement to upload any proof like documents, certificates, papers, etc.

- Get the Udyam Registration Number

Every enterprise gets a unique Udyam registration number or a permanent identification number on the successful submission of the application.

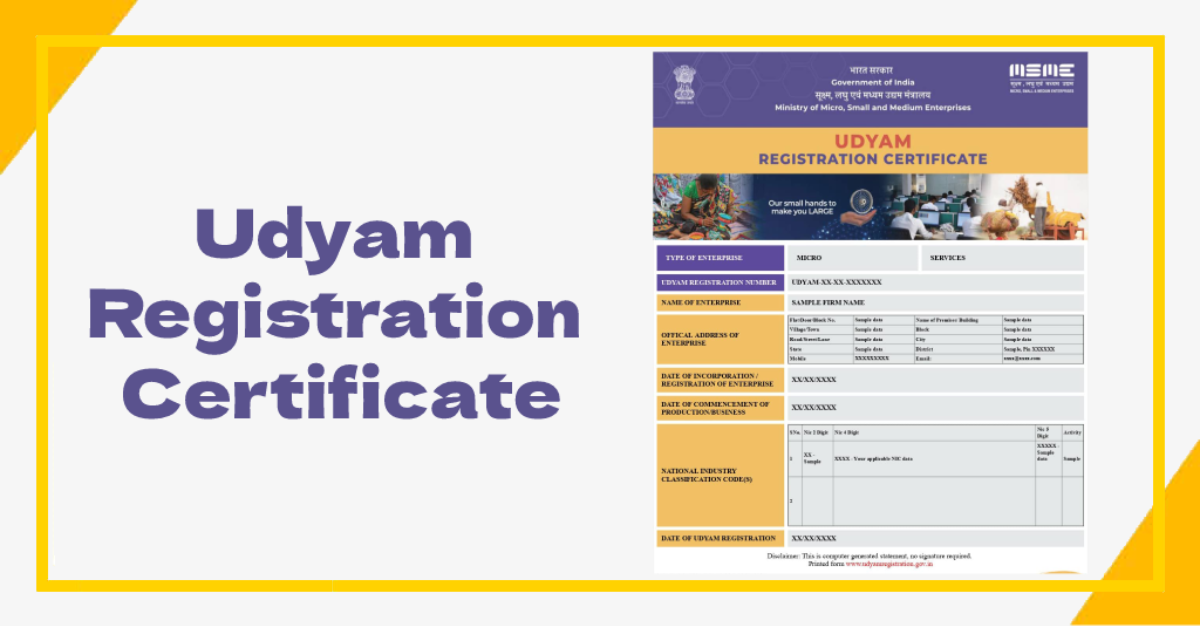

- Issuance of Udyam Certificate

An e-certificate called the Udyam registration certificate gets issued to the enterprise on completion of the registration process.

Udyam Certificate Download: Things to Keep in mind Applying for Udyam

The registration process for the Udyam certificate is quite straightforward. However, you must keep the following things in mind when applying for the same.

- The form of registration is available only on the Udyam registration portal.

- There is no fee for filing for Udyam registration.

https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm - Aadhar number is mandatory for the registration process.

- The Aadhar number must belong to the owner of a proprietary firm, the managing partner of a partnership firm, or the Karta of a Hindu Undivided Family (HUF).

- The organisation or the authorised signatory must provide its PAN and GSTIN along with the Aadhar number if it is a company, cooperative society, trust, or limited liability partnership.

- If an enterprise has already registered as an Udyam with PAN, it must fill up the deficiency of information for the previous years based on self-declaration.

- No one should apply for more than one Udyam registration. Enterprises must specify the number of activities like manufacturing and service during the registration process.

- If someone misrepresents or suppresses the self-declared facts and figures in the Udyam registration portal, the individual will be liable to a penalty as specified under section 27 of the act.

What Is the Process of Udyam Registration for Existing Enterprises?

- The existing enterprises registered under UAM or EM-Part-II can register at the Udyam registration portal. This regulation came into being after the changes were introduced in the registration process on July 1, 2020.

- All enterprises registered till June 30, 2020, were reclassified based on the notification.

- An enterprise registered with any other organisation under the Ministry of Micro, Small, and Medium Enterprise can register at the Udyam registration portal.

What Are the Benefits of Udyam Registration?

Udyam Certificate Download – An enterprise can avail of multiple benefits by registering with Udyam. Mentioned hereunder are some of the benefits of filing for registration in the portal.

- Get an easy bank loan of up to INR 1 crore without a mortgage or collateral.

- Special preference in the procurement of government tenders.

- 1 % exemption on the interest rate of bank overdraft (OD).

- Concession in electricity bills.

- Protection against delay in payments from the buyers.

- Refunds on taxes.

- 50 % discount on government fees for patents and trademarks.

- Fast resolution of disputes.

- Lower rate of interest for loans from the partner bank.

- Subsidies from the National Small Industries Corporation and other government entities.

- Reimbursement of costs involved in getting the ISO certification.

- Special excise exemption scheme and other tax exemptions.

What Is the Calculation Process for MSMEs to Register With the Udyam Portal?

We will be discussing the calculation process of investment in machinery, plant, or equipment below.

- The calculation of investment in machinery, plant, or equipment is linked to the Income Tax Return (ITR) of the previous year under the Income Tax Act of 1961.

- A new enterprise does not have any previous ITRs. So, its investment depends on a self-declaration of the enterprise’s promoter. However, the relaxation ends after March 31 of each financial year when it gets to file its first ITR.

- The cost of research and development, pollution control, industrial safety devices, etc., shall be excluded when calculating the investment of machinery, plant, or equipment. The terms may get specified to the enterprises through a notification.

Guide on the Calculation of the Turnover of MSMEs:

- Information on import and export turnover for an enterprise is linked to the Central Goods and Services (CGST) Act or the Income Tax Act and GSTIN.

- Export of goods and services is excluded during the turnover calculation of any enterprise (micro, small, or medium) for classification.

- The turnover-related figures of an enterprise that does not have a PAN will be considered based on a self-declaration up to March 31 of that particular year. However, GSTIN and PAN will be mandatory once the financial year gets over.

Udyam Certificate Download: How Long Does It Take To Get the Udyam Certificate?

Generally, it takes around four to five days to get the Udyam certificate after applying. The enterprise will receive an email notification with a registration number once the e-certificate is issued. However, the process may take more than 15 days to complete sometimes.

Why Vakilsearch?

We are a technology-driven platform that offers legal services to both startups and established businesses. Incorporation, government registrations and filings, accounting, documentation, and annual compliances are just a few of the services we offer. Furthermore, we provide a variety of services to individuals, such as property agreements and tax filings. Our mission is to provide individuals and businesses with one-click access to all of their legal and professional needs.