The Goods and Services Tax Identification Number (GST number) is a 15-digit number assigned to each taxpayer under the GST system (GSTIN). Apply for GST in India with the help of experts at Vakilsearch.

Importance: Apply for GST Number in India

-

- A valid GST number permits a business entity to be legally recognised as a provider of goods and services

- This allows a company to build trust with its consumers and contributes to the company’s success

- A person with a valid GSTIN number can claim input credit for purchases made on their own behalf

- When compared to a small firm, you will be able to boost your competitiveness with a GSTIN number because purchasing from them would secure input credit.

- Moreover, businesses can also avoid interstate sales limits by using their GST Identification Number

- You will be able to expand the scope of your business by registering on e-commerce sites or creating your own eCommerce website.

GST State and Union Territory Code in India

Apply for GST Number in India – The state and union territory code is represented by a GSTIN’s first two digits. Determining GST jurisdiction is critical for the efficient processing of returns, applications, and assessments, as well as the rendering of facilities under the legislation. To make GST Registration Process easier for companies and professionals, the government has classified jurisdictions based on geographical region, PIN numbers of separate locales, and unique districts.

| Union Territory | TIN | UT Code |

| Andaman and Nicobar Islands | 35 | AN |

| Chandigarh | 04 | CH |

| Dadra & Nagar Haveli and Daman & Diu | 26 | DNHDD |

| Ladakh | 38 | LA |

| Other Territory | 97 | OT |

| State | TIN | State Code |

| Andhra Pradesh | 37 | AD |

| Arunachal Pradesh | 12 | AR |

| Assam | 18 | AS |

| Bihar | 10 | BR |

| Chattisgarh | 22 | CG |

| Delhi | 07 | DL |

| Goa | 30 | GA |

| Gujarat | 24 | GJ |

| Haryana | 06 | HR |

| Himachal Pradesh | 02 | HP |

| Jammu and Kashmir | 01 | JK |

| Jharkhand | 20 | JH |

| Karnataka | 29 | KA |

| Kerala | 32 | KL |

| Lakshadweep Islands | 31 | LD |

| Madhya Pradesh | 23 | MP |

| Maharashtra | 27 | MH |

| Manipur | 14 | MN |

| Meghalaya | 17 | ML |

| Mizoram | 15 | MZ |

| Nagaland | 13 | NL |

| Odisha | 21 | OD |

| Pondicherry | 34 | PY |

| Punjab | 03 | PB |

| Rajasthan | 08 | RJ |

| Sikkim | 11 | SK |

| Tamil Nadu | 33 | TN |

| Telangana | 36 | TS |

| Tripura | 16 | TR |

| Uttar Pradesh | 09 | UP |

| Uttarakhand | 05 | UK |

| West Bengal | 19 | WB |

Before registering for GST, Calculate GST Amount that needs to be paid using our GST calculator.

Apply for GST Number in India: Decoding the GST Number

A GST number is a unique 15-digit number assigned to businesses registered under the Goods and Services Tax (GST) regime. The GST number is used to track the movement of goods and services across the country and to ensure that businesses pay the correct amount of GST.

The first two digits of the GST number represent the state in which the business is registered. The next ten digits are the PAN number of the business. The thirteenth digit is a check digit, which is used to verify the accuracy of the GST number. The fourteenth and fifteenth digits are alphabetic characters, which are used to distinguish between different businesses with the same PAN number.

Here’s a breakdown of the GSTIN format:

- The first two characters represent the state code as per Indian Census 2011. Each state has a unique two-digit code.

- The next ten characters are the PAN (Permanent Account Number) of the taxpayer.

- The 13th character indicates the number of registrations a business entity has within a state for the same PAN. It is an alphabet (A-Z) based on the number of registrations.

- The 14th character is by default ‘Z.’

- The last character is a check digit, which can be a number or an alphabet. It is used for error detection.

For example, let’s take a hypothetical GSTIN: 12ABCDE1234Z1ZA

- The first two characters ’12’ represent the state code (e.g., 12 corresponds to a particular state).

- The next ten characters ‘ABCDE1234Z’ represent the PAN of the taxpayer.

- The 13th character ‘1’ indicates the number of registrations the taxpayer has within the state for the same PAN.

- The 14th character is always ‘Z.’

- The last character ‘A’ is the check digit.

Apply for GST Number in India: Types of GST

Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services. There are mainly four types of GST in India:

- Central Goods and Services Tax (CGST): CGST is a component of GST that is levied by the Central Government on the intra-state supply of goods and services. The revenue collected through CGST goes to the Central Government.

- State Goods and Services Tax (SGST): SGST is another component of GST that is levied by the State Governments on the intra-state supply of goods and services. The revenue collected through SGST goes to the respective State Governments.

- Integrated Goods and Services Tax (IGST): IGST is applicable to the inter-state supply of goods and services or in cases where the location of the supplier and the place of supply are in different states or Union Territories. It is levied and collected by the Central Government, and the revenue is shared between the Central and State Governments based on predefined formulas.

- Union Territory Goods and Services Tax (UTGST): UTGST is similar to SGST but applicable to the supply of goods and services within Union Territories of India. The revenue collected through UTGST goes to the Union Territory’s administration.

Benefits of GST Registration

Apply for GST Number in India – GST registration offers several benefits to businesses and individuals in India. Some of the key advantages of GST registration are:

- Legally Recognized Entity: GST registration makes a business a legally recognized entity in the eyes of the law. It becomes a GST-registered taxpayer, which enhances its credibility and facilitates easier access to loans and credit from financial institutions.

- Input Tax Credit (ITC): One of the significant benefits of GST registration is the ability to claim Input Tax Credit. Businesses can offset the GST they have paid on inputs (purchases) against the GST they collect on outputs (sales). This helps in reducing the overall tax liability and lowers the cost of doing business.

- Inter-State Operations: GST registration is mandatory for businesses engaged in inter-state transactions. It enables them to make inter-state supplies without restrictions and avail the benefits of IGST (Integrated Goods and Services Tax).

- Threshold Exemption: Businesses with a turnover below a certain threshold (as per the law, it is subject to changes) may be exempted from GST registration. However, registering voluntarily can still be beneficial to claim ITC and enhance business credibility.

- Legally Compliant: GST registration ensures that the business complies with the legal requirements and helps in avoiding penalties or legal implications for non-compliance.

- Expansion Opportunities: GST registration is often mandatory for participation in tenders and government contracts. It opens up opportunities for businesses to expand their operations and cater to a broader customer base.

- E-commerce Advantages: E-commerce platforms require their sellers to be GST registered. Being registered allows businesses to sell their products and services on various online platforms.

- Seamless Input Tax Credit Chain: GST registration helps in creating a seamless chain of input tax credit from suppliers to the end consumers, eliminating the cascading effect of taxes.

- Business Competitiveness: GST registration can lead to a more transparent and efficient tax system, which promotes competitiveness in the market.

- Compliance Rating: GST registration helps in improving the compliance rating of the business, which can positively impact its reputation and relationships with suppliers and customers.

- Reduced tax burden: GST has simplified the tax system and reduced the overall tax burden on businesses.

- Improved cash flow: GST has improved the cash flow of businesses by eliminating the need to pay multiple taxes.

- Increased transparency: GST has increased transparency in the tax system by making it easier to track the movement of goods and services.

Steps for obtaining GSTIN Registration in India

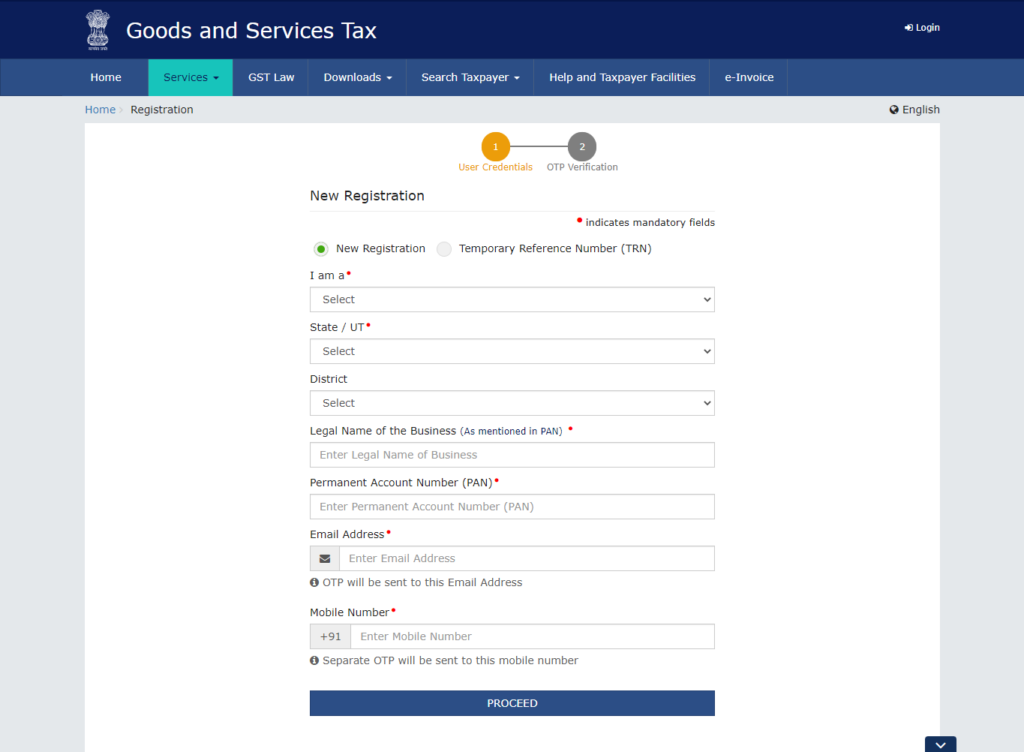

- Visit the online GST registration portal. Thereafter, you must undergo new user registration to obtain a valid TRN

- Log in using the TRN and Captcha code. From the ‘My Saved Application’ page, click the ‘Edit’ icon. Fill in the details required

- Then you must upload scanned copies of the required documentation

- Then you must visit the ‘verification’ page and check the declaration box

- After application submission, an ‘Application Reference Number’ (ARN) will be sent to your email ID and the registered mobile number. With the ARN, you can check the status of your application and GSTIN on the GST portal: https://reg.gst.gov.in/registration/

- Contact Vakilsearch right away for professional assistance in obtaining your GSTIN in India!

GST Registration Turnover Limit

The turnover limit for GST registration is ₹20 lakhs for general businesses and ₹10 lakhs for businesses located in special category states and union territories.

Penalty for NOT Obtaining GST Registration

Businesses that are required to register for GST but do not register may be liable to a penalty of up to 100% of the tax that should have been paid.

FAQs

How can I get a GST Number in India?

To obtain a GST number in India, you need to follow these steps:

✸ Visit the GST portal (www.gst.gov.in).

✸ Click on Services and then select Registration from the drop-down menu.

✸ Choose New Registration.

✸ Fill out the necessary details in the GST registration application form.

✸ Provide the required documents, such as PAN card, proof of business address, bank account details, and photographs.

✸ Submit the application with the relevant documents. After verification, you will receive your GSTIN (Goods and Services Tax Identification Number).

Can I apply for a GST Number Online?

Yes, you can apply for a GST number online through the GST portal. The entire GST registration process, from filling out the application to submission of documents and receiving the GSTIN, can be done online.

Is GST registration free?

No, GST registration is not free. There is no government fee for GST registration. However, if you require assistance from a GST Practitioner or a Chartered Accountant to complete the registration process, they may charge a fee for their services.

How much does it cost to get a GST number in India?

Get in touch with a Vakilsearch expert to know more.

What is the cost of a GST number?

As mentioned earlier, the cost of obtaining a GST number is generally free as there is no government fee for the registration process. However, if you choose to engage a GST Practitioner or a Chartered Accountant to help you with the registration, they might charge a fee for their services.

What are the 3 types of GST registration?

The three types of GST registration in India are as follows:

✸ Regular GST Registration: This type of registration is applicable to businesses with a turnover above the prescribed threshold limit (as per the law, subject to changes).

✸ Composition Scheme Registration: Small businesses with a turnover below the prescribed threshold can opt for this registration to avail of certain benefits, but they have to comply with certain restrictions.

✸ Casual Taxable Person Registration: This type of registration is for individuals or businesses engaged in occasional or seasonal transactions in a state where they do not have a regular place of business.

What is a GST certificate in India?

A GST certificate is a unique 15-digit number that is assigned to businesses registered under the Goods and Services Tax (GST) regime. The GST certificate is used to track the movement of goods and services across the country and to ensure that businesses pay the correct amount of GST.

Who needs a GST certificate?

Any business that has a turnover of ₹20 lakhs or more in a financial year is required to register for GST and obtain a GST certificate. Businesses that are located in special category states and union territories are required to register for GST if their turnover is ₹10 lakhs or more in a financial year.

What is the minimum limit for GST registration?

The minimum limit for GST registration is ₹20 lakhs for general businesses and ₹10 lakhs for businesses located in special category states and union territories.

Can a person with no GST registration collect GST?

No, a person with no GST registration cannot collect GST. Businesses that are required to register for GST but do not register are liable to a penalty of up to 100% of the tax that should have been paid.

What is the penalty for not generating an E-way bill?

Businesses that are required to generate an E-way bill but do not generate one are liable to a penalty of ₹10,000 or 5% of the value of the consignment, whichever is greater.

What are the benefits of GST registration?

There are a number of benefits to GST registration, including:

● Reduced tax burden

● Improved cash flow

● Increased transparency

● Enhanced competitiveness

● Eligibility for input tax credit

● Access to a larger market

● Improved reputation

How can I apply for a GST certificate?

You can apply for a GST certificate online through the GST portal. The application process is simple and straightforward.

What documents do I need to apply for a GST certificate?

You will need to submit the following documents when applying for a GST certificate:

● PAN card

● Aadhaar card

● Bank statement

● Business address proof

● Proof of turnover

How long does it take to get a GST certificate?

It typically takes 3-7 working days to get a GST certificate.

What should I do if I have any questions about GST?

You can contact the GST helpline or visit the GST website for more information.