For the sale of goods, the state of Karnataka decided to raise the threshold limit to ₹40 lakhs. The threshold restrictions for service providers in the state of Karnataka, on the other hand, have remained unchanged at ₹20 lakhs.

Importance of Having a Valid GSTIN Number in Bangalore

A valid GSTIN number permits a business entity to be legally recognised as a provider of goods and services. Moreover, a business with a valid GSTIN number can claim input credit for purchases made on their behalf.

GST Threshold in Bangalore

An annual turnover of ₹20 lakhs was initially set as the threshold for to register for GST in Bangalore at the time of its commencement. However, states were given the option of opting for new restrictions or continuing with the old ones on the back of the 32nd GST Council Meeting held in January 2019. For the sale of goods, the state of Karnataka decided to raise the threshold limit to ₹ 40 lakhs. Furthermore, this new restriction becomes effective on 1 April 2019.

What Is Suo Moto GST Registration in Bangalore?

Suo moto registration or temporary ID generation is the act of authorized tax officials working to begin the process of generating and issuing a ‘Temporary ID’ for the purpose of depositing the money collected by tax officials from unregistered persons, particularly during enforcement proceedings initiated by Karnataka’s GST enforcement wing.

Calculate the GST amount that needs to be paid before registering for GST using our GST Calculator.

An individual must apply for a GST number: https://www.gst.gov.in/ within 90 days of receiving the suo moto registration. If necessary, an applicant may file an appeal against this registration and ask for a suo moto cancellation of the GST registration.

Steps Involved in Applying for a GST Number in Bangalore

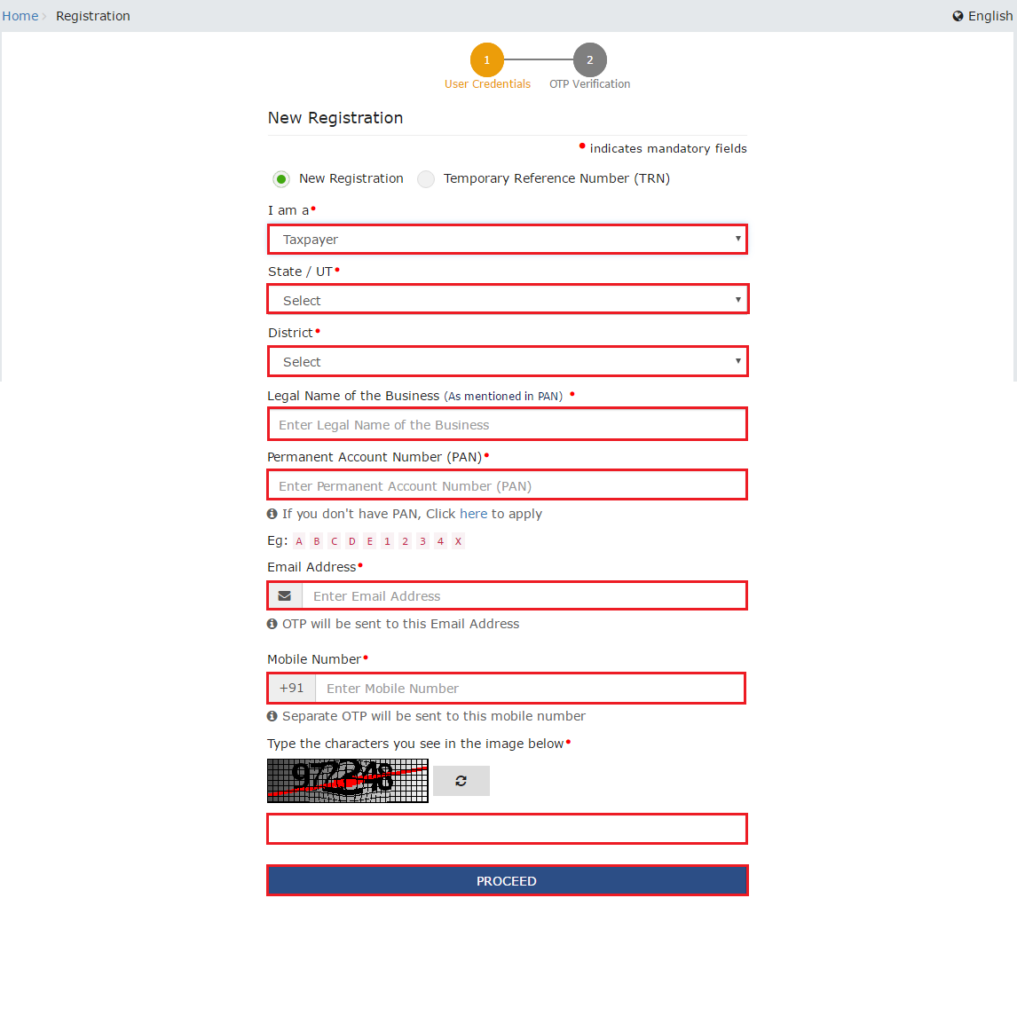

- Go to the GST registration website to get started. After that, you’ll need to register as a new user to get a valid TRN.

- Then you must log in with the TRN and Captcha code once you’ve completed the new user registration.

- Click the ‘Edit’ icon on the ‘My Saved Application’ page. In each of the ten sections in front of you, fill in all of the relevant information.

- Fill in the principal location of business’ and commodity details fields as well. ‘Save & Continue’ should be selected.

- Fill up your bank account information after selecting the proper HSN code.

- Then you must scan and upload scanned copies of all required documents.

- Then go to the verification page and check the box next to the declaration. You can then submit your application using the e-Sign method, which requires the ‘OTP’ to be sent to the mobile number associated with your Aadhaar card, or the EVC method, which requires the ‘Electronic Verification Code’ sent to your registered mobile number.

- An ‘Application Reference Number’ (ARN) will be issued to your email address and registered mobile number when you submit your application. On the GST portal, you can use the ARN to verify the status of your application and GSTIN.

- If everything is in order, you will obtain your GSTIN number within 7 working days after submitting your application