The introduction of the Goods and Service Tax has transformed India’s taxation system by streamlining it and eliminating the cascading effect of taxes. The government wesite enables individuals and businesses to pay their liabilities and file the required returns.

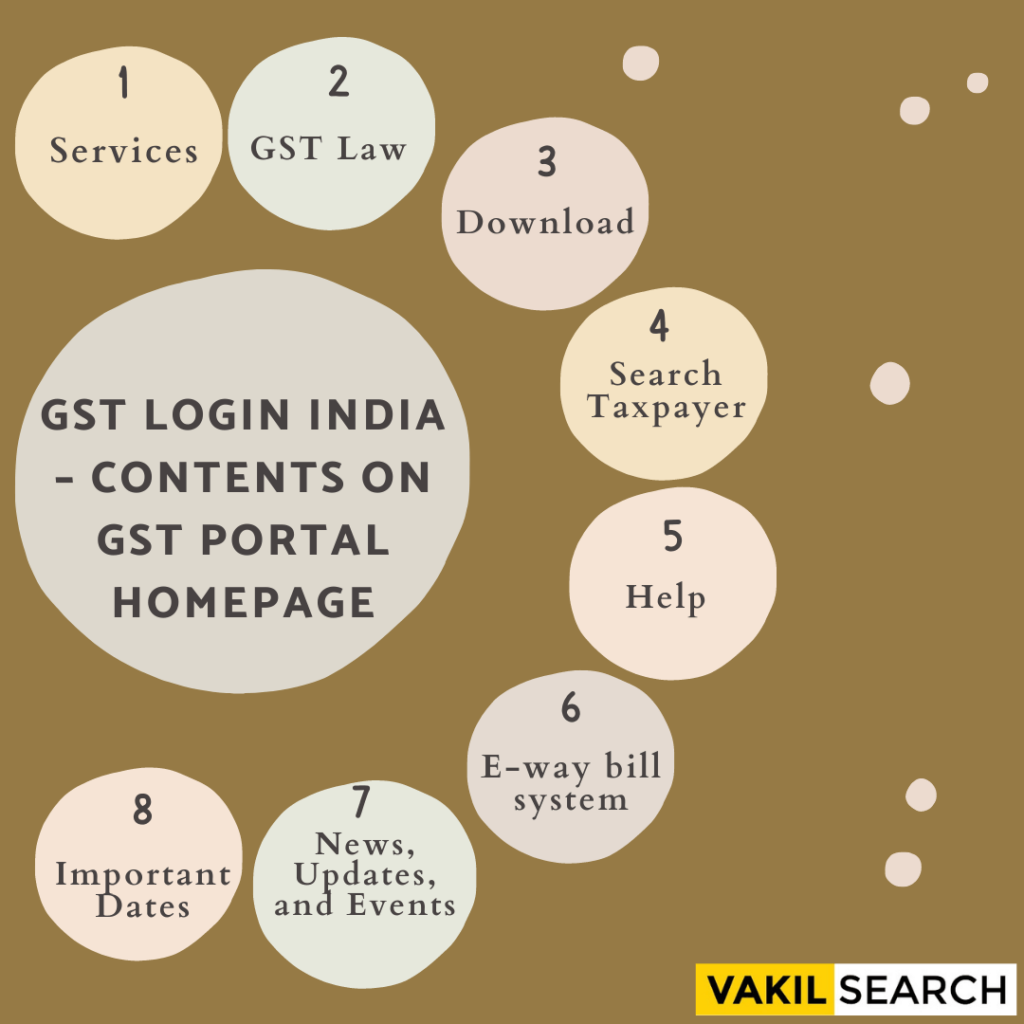

Contents on Portal Homepage

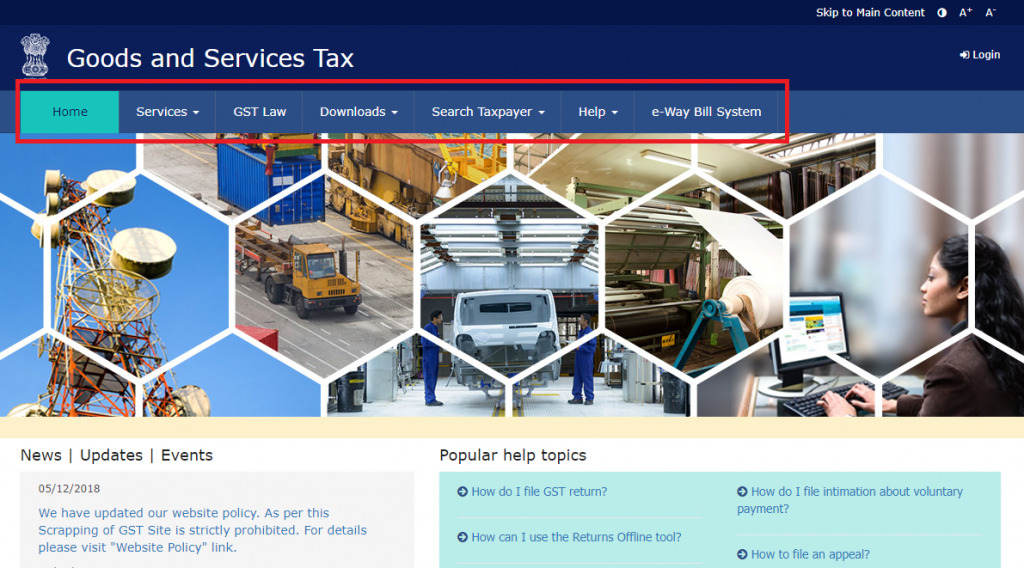

The two main subparts of the government homepage are as follows:

- Before login: provides eight options on the menu bar, which we will discuss in detail below

- After login: provides two main options, which we will discuss in detail below

Before Login

1. Services

Provides links for registration. After applying, users can also track the application status of their registration online through this tab. It also allows the creation of challans and tracking of refund applications. Additionally, it also enables taxpayers to locate practitioners nearby.

2. Law

This section contains details regarding laws, rules, and guidelines. It includes the CGST Act, SGST Act, and all other relevant rulings and guidelines. Additionally, all notifications, circulars and amendments concerning the will be available under this tab.

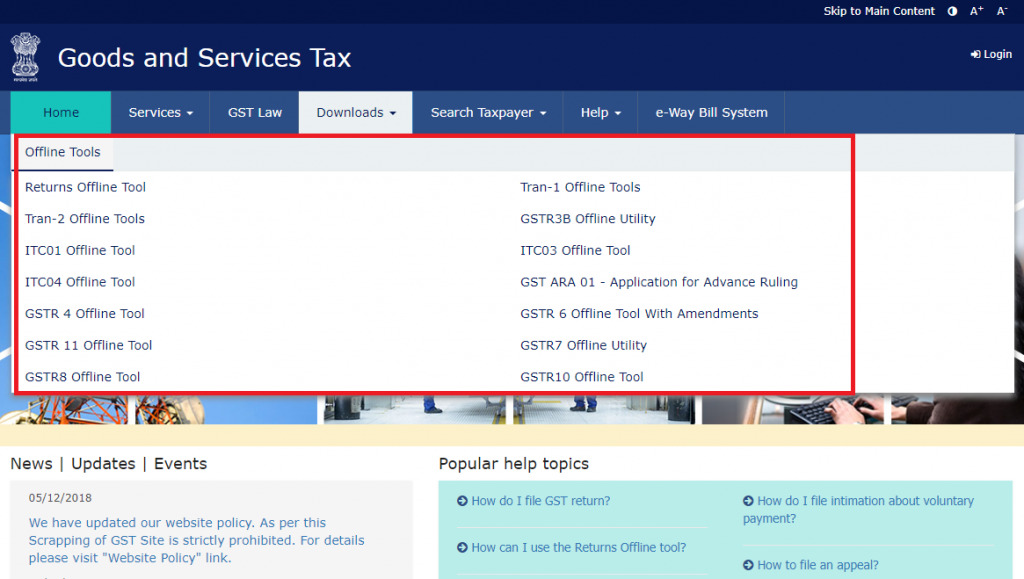

3. Download

The Indian government offers individuals both offline and online. This tab allows taxpayers to download.

4. Search Taxpayer

This feature allows users to search for registered taxpayers using their GSTN or PAN number. It helps registered dealers verify the details provided by potential buyers and sellers. Additionally, it allows taxpayers to search for dealers who work under the Composition Scheme.

5. Help

This section helps address common questions that users have regarding how to use the portal. It also features several guides, how-to manual, FAQs, system requirements, and user manuals. Additionally, it contains videos that help explain how to use the portal, ensuring complete resolution of user queries and doubts.

6. E-way bill system

This section serves as a guide to using the eWay Bill portal and contains FAQs and user manuals regarding the same.

7. News, Updates, and Events

This tab helps users keep themselves updated regarding news and events. Through this section, taxpayers can stay abreast regarding changes in due dates, processes and rates.

After Login

- Dashboard: The first option on the top bar, the dashboard displays all prominent information regarding your profile. This screen also enables taxpayers to create challans and file their returns.

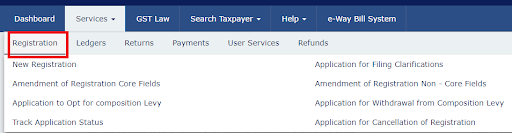

- Services: One of the most integral tabs on the portal is the services tab which users can access after logging in to the portal. Here’s a quick look at the various services users can access through this tab:

- Registration tab

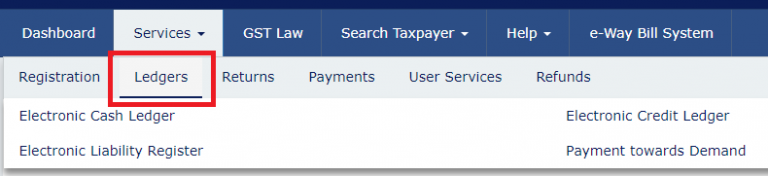

2. Ledgers tab

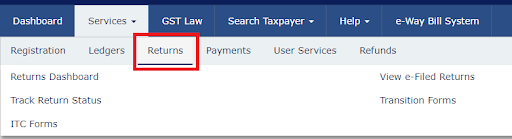

3. Returns tab

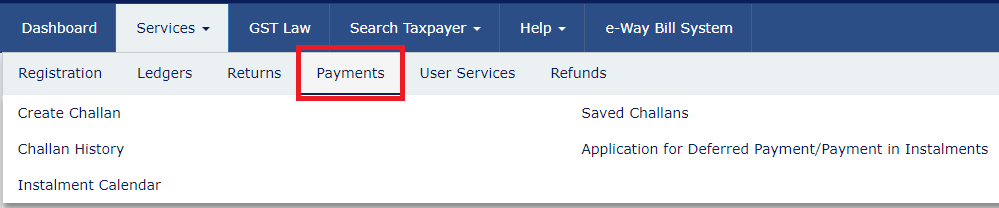

4. Payments tab

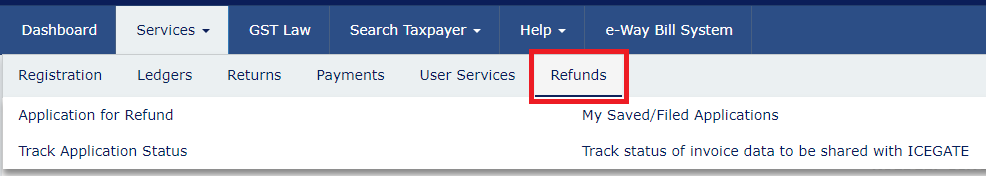

5. Refunds tab

What is the e-way Bill System?

The e-way bill system, also known as the e-way bill portal, can be accessed at https://ewaybillgst.gov.in/. It is an electronic document that transporters must carry when moving goods worth over ₹50,000 from one place to another.

The e-way bill system generates a unique e-way bill number for every invoice used by the transporter, recipient, and supplier during the transportation of goods from the origin to the destination within the e-way bill’s validity period. Prior to it, waybills were generated in each state. However, with the implementation, e-way invoices are generated and accepted throughout all states and Union Territories.

What is the Goods and Service Tax Login Procedure for Existing Users?

Step 1: Go to the official website at www.gst.gov.in and click on the ‘www.gst.gov.in login dashboard’ button in the homepage’s top right-hand corner.

Step 2: Enter your username, password, and the captcha code, then click on the ‘LOGIN’ button.

Step 3: Upon successful Login, you will be directed to your dashboard. Your dashboard will display a summary of your credits, the ‘FILE RETURNS’ tab, the ‘PAY TAX’ tab, and Annual Aggregate Turnover (AATO), along with notices/orders received and saved forms.

What is the Login Procedure for First-Time Users?

Step 1: Go to the home page and click on the ‘Login’ button in the top right-hand corner.

Step 2: Click on the link in the instructions below the login button that says, “First-time login: If you are logging in for the first time, click here to log in.”

Step 3: Enter your provisional ID/UIN and the password you received on your registered email address. Then enter the captcha and click on the “Login” button.

Step 4: The credentials page will appear. Enter the username and password of your choice. Re-confirm the password and click on the “Submit” button.

Step 5: A success message will be displayed once you have successfully created your username and password. You can now log in using these credentials.

Step 6: Upon your first login, you will be prompted to file a non-core amendment application to submit bank account details. Click on the ‘FILE AMENDMENT’ button.

Step 7: The application form for editing will appear, and the non-core fields will be available in editable form. Edit the details in the bank accounts tab by clicking the ‘ADD NEW’ button and submitting the application.

How to Check Your Status?

- Visit the official portal at www.gst.gov.in login dashboard.

- Click on the Services tab and select ‘Registration’ from the drop-down menu.

- Click on ‘Track Application Status’.

- Enter your ARN (Application Reference Number) in the given field and click the ‘SEARCH’ button.

- The status of your registration application will be displayed on the screen.

Other services include:

- Changing core and non-core fields

- Searching for notices accepted

- Filing ITC forms

- Engage or disengage practitioner

Conclusion:

In case you have any queries regarding how to Login, feel free to reach out to Vakilsearch. We also provide various services to help companies stay compliant at all times. Partner with us to build a sustainable, compliant, and successful business!

FAQ:

1. What is Login ID for income tax portal?

The Login ID for the income tax portal is the PAN number for individuals.

2. How do I find my income tax portal account?

To find your income tax portal account, you need to visit the e-Filing Portal homepage and click on the Login button. Then, enter your user ID and password to access your account.

3. Can I e-verify ITR without logging in on income tax portal?

No, you cannot e-verify ITR without logging in on the income tax portal. You need to log in to your account to e-verify your ITR.

4. Can I login to my income tax account through net banking?

Yes, you can log in to your income tax account through net banking.

5. How to login income tax without password?

To log in to the income tax portal without a password, you can use the Aadhaar OTP option if you have enabled it. Otherwise, you will need to reset your password using the 'Forgot Password' option.

6. How to change registered mobile numbers in income tax without login?

You cannot change the registered mobile number in the income tax portal without logging in. You need to log in to your account and go to the 'Profile Settings' to change your registered mobile number.