NPS scheme is a pension benefit scheme that was launched by the Government of India in 2016. Read on to know more about National Pension Scheme.

Planning retirement is a crucial part of every employee’s life. When you retire you will need a pension scheme to sustain life after retirement. An NPS Scheme is a retirement saving scheme launched by the Government of India. NPS provides many tax benefits and interest benefits which are beneficial for the employees.

NPS Scheme (National Pension Scheme)

The National Pension Scheme (NPS) is a government-backed retirement savings program that aims to provide a secure financial future for individuals in their post-employment years. It offers several benefits and advantages, including tax benefits under Section 80C of the Income Tax Act, 1961, and an exclusive deduction of up to Rs. 50,000 under Section 80CCD(1B).

The scheme provides easy access to account information and transactions through online portals and mobile applications, allowing participants to monitor their investments, contribute funds, and make changes to their investment preferences conveniently.

Eligibility for NPS Scheme

While the National Pension Scheme is available for employees working in India, there are some rules about when you can start investing in the NPS.

The following are the eligibility criteria that needs to be met inorder for one to qualify for the NPS Scheme:

- Should be an Indian citizen(occupant or non-resident) or an Overseas citizen of India( OCI).

- Age should be between 18 – 70 years.

- Should comply with the Know Your customer( KYC) norms detailed in the operation form.

- Should be fairly competent to execute a contract as per the Indian Contract Act.

- Persons of Indian Origin( PIOs) and Hindu Undivided Families( HUFs) aren’t eligible to subscribe to NPS.

- NPS is an individual pension account, therefore it can not be opened on behalf of a third person.

Benefits and Advantages of NPS Scheme

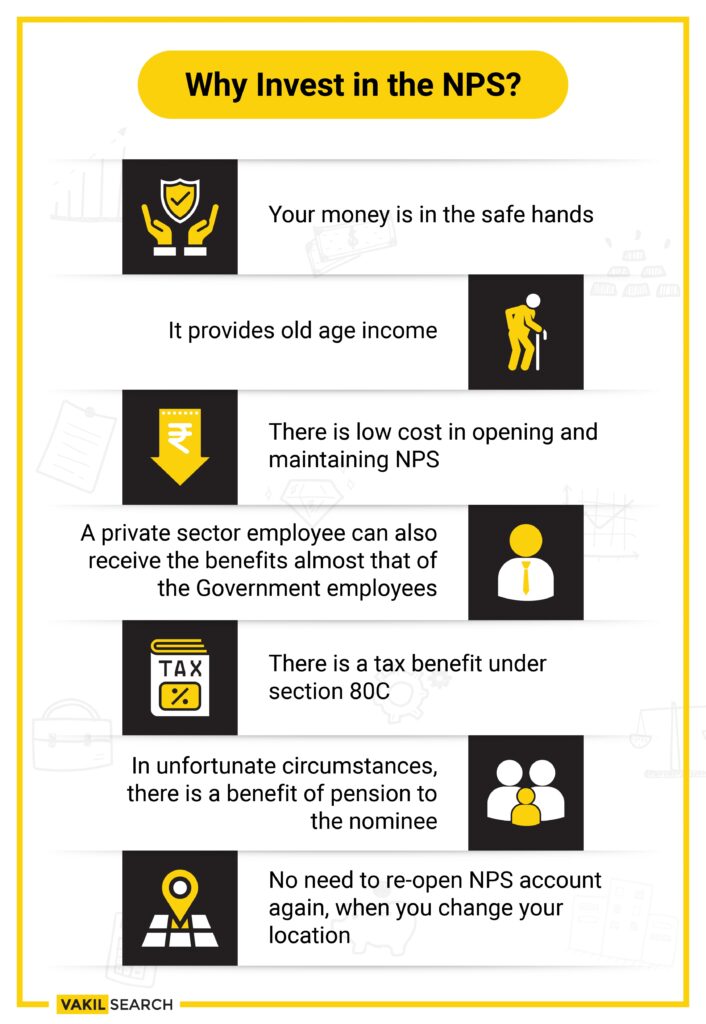

The NPS is promoted as an alternative to the traditionally defined benefit schemes, which are no longer viable due to changes in retirement age and life expectancy. These schemes will be advantageous to The employees in the long run.

Tax Benefits: NPS provides attractive tax benefits to individuals. Contributions made towards the scheme are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. Moreover, additional deductions of up to Rs. 50,000 are also available under Section 80CCD(1B), making it an excellent tax-saving instrument.

Higher Returns: Investments made in NPS accounts tend to give higher returns compared to traditional savings instruments like savings accounts.

Low-Cost Investment: NPS is one of the lowest-cost investment products available, making it an economical choice for retirement planning.

Flexibility: NPS offers flexibility in selecting or changing the Point of Presence (POP), investment pattern, and fund manager, allowing subscribers to optimise returns based on their comfort with various asset classes and fund managers.

Easy Access: The scheme provides easy access to account information and transactions through online portals and mobile applications, allowing participants to monitor their investments, contribute funds, and make changes to their investment preferences from the comfort of their homes or offices.

How to Open an NPS Account

The Pension Fund Regulatory and Development Authority(PFRDA) regulates the operations of the NPS, and they offer both an online as well as an offline means to open this account.

NPS Scheme Account – Offline Process

To open an NPS account offline or manually, you’ll have to find a PoP – Point of Presence, registered with the PFRDA. Collect a subscriber form from your nearest PoP and submit it along with the KYC papers. Ignore if you’re formerly KYC- compliant with that bank. Once you make the original investment in the NPS scheme (not lower than Rs.500 or Rs.250 monthly orRs.1000 yearly), the PoP will shoot you a PRAN – Permanent Retirement Account Number. This number and the encrypted passcode in your sealed hello tackle will help you operate your account. There’s a one- time enrollment figure of Rs.125 for this process.

NPS Scheme Account – Online Process

It’s now possible to open an NPS account in lower than half an hour. Opening an account online(enps.nsdl.com) is easy, if you link your account to your visage, Aadhaar and mobile number. You can validate the NPS Scheme enrollment using the OTP transferred to your mobile. This will induce a PRAN( Permanent Retirement Account Number), which you can use for NPS login.

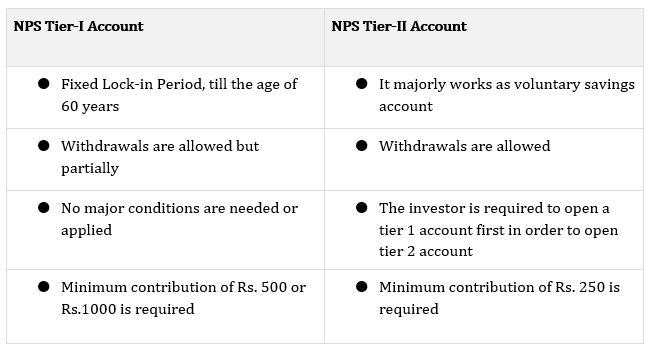

Types of NPS Account

The two major account types under the NPS scheme are as follows,

- Tier I

- Tier II

The former is the dereliction(default) account while the latter is a voluntary addition.

NPS Funds

Equity Funds: NPS offers investment options in equity funds, providing exposure to the stock market. The returns from equity funds are market-linked and depend on the performance of the broader market.

Corporate Bond Funds: NPS includes corporate bond funds for fixed-income investments. These funds invest in highly-rated corporate bonds, providing stable returns with relatively lower risk compared to equity investments.

Government Bond Funds: The scheme offers government bond funds, providing exposure to sovereign debt securities. These funds are considered relatively low-risk investments and offer stable returns.

Alternative Investment Funds: NPS may provide options for alternative investment funds, subject to regulatory guidelines. These funds offer diversification and the potential for higher returns, albeit with higher risk.

Fund Allocation and Expected Returns: The allocation of funds in NPS depends on the chosen investment strategy. The expected returns are market-linked and vary based on the performance of the underlying assets. The NPS funds are managed by professional fund managers to optimise returns while managing risk.

NPS Pension Calculator

Calculation of Monthly Pension: The NPS pension calculator helps individuals estimate their monthly pension based on their contributions, investment strategy, and annuitization options.

Factors Affecting Pension Amount: Various factors, including the contribution amount, investment strategy, and annuitization options, can impact the pension amount.

Present Value of Pension: The present value of the pension can be calculated using the NPS pension calculator, considering the time value of money and the chosen annuity plan.

Contribution Estimation: The calculator assists in estimating the required contributions to achieve a desired pension amount, taking into account the individual’s age, investment horizon, and risk tolerance.

Benefits of Pension Calculator: The NPS pension calculator provides individuals with insights into their retirement planning and helps in making informed decisions regarding their pension contributions and expected post-retirement income.

Features of NPS

NPS Lite: NPS Lite is a simplified version of the NPS, designed to cater to the needs of individuals in the unorganised sector. It offers a low-cost and easy-to-access pension solution.

NPS Advisor: The NPS offers access to advisors who can provide guidance on investment strategies and retirement planning, helping individuals make informed decisions about their NPS contributions and fund allocation.

Nomination: NPS allows subscribers to nominate beneficiaries to receive the accumulated corpus in the event of the subscriber’s demise, ensuring financial security for their loved ones.

Portfolio Statement: NPS provides regular portfolio statements to subscribers, offering transparency and visibility into their investments, contributions, and fund performance.

Grievance Redressal: The scheme has mechanisms in place for addressing subscriber grievances and ensuring a smooth experience, providing confidence and trust in the NPS system.

Charges Associated With NPS

Subscriber Registration Charges: The charges for subscriber registration vary based on the type of PRAN card (Physical or ePRAN) and the Central Record Keeping Agency (CRA). The charges range from Rs. 15.00 to Rs. 40.00 for PRAN opening.

Account Opening Charges: The account opening charges for NPS range from Rs. 200 to Rs. 400, depending on the intermediary and the type of account.

Transaction Charges: The charges for non-financial transaction processing are around Rs. 30 per transaction, and financial transaction processing charges range from Rs. 3.36 to Rs. 3.75 per transaction, depending on the CRA.

Exit or Withdrawal Charges: The processing charge for exit or withdrawal is 0.125% of the corpus, with a minimum of Rs. 125 and a maximum of Rs. 500.

Fund Management Charges: The Pension Fund Manager (PFM) charges an asset management fee, which varies based on the assets under management (AUM) slab. The charges range from 0.03% to 0.09% of the AUM.

Annual Maintenance Charges: The annual maintenance charges per account range from Rs. 57.63 to Rs. 69.00, depending on the CRA.

Other Charges: There are charges for PRAN generation, persistence, and reimbursement of expenses, which are levied by different intermediaries involved in the NPS.

Mode of Payment Charges: Charges for different modes of payment such as RuPay Debit Card, UPI, Net Banking, and Credit Card vary, with some modes having no charges and others having a percentage-based charge or a flat rate charge

NPS with Banks and Brokers

- Several banks offer NPS services, providing individuals with the convenience of managing their NPS accounts alongside their other banking activities.

- Online brokers may also offer NPS services, catering to individuals who prefer a digital investment experience.

- Investing through banks and brokers offers individuals access to a range of financial services and investment products, including the NPS.

- Banks and brokers typically provide a streamlined process for opening NPS accounts, with clear guidelines and documentation requirements.

- Individuals can compare the NPS with other investment options to assess its suitability based on their financial goals and risk preferences.

Logging on into Your NPS Scheme Account

- Step 1 In order to log into your NPS account, you must have a 12- number Permanent Retirement Account Number(PRAN). Submit the necessary attestation on the NSDL website or at the Point of Presence( POP) service providers to mileage PRAN.

- Step 2 Visit the sanctioned gate of NSDL CRA.

- Step 3 Enter your PRAN, Date of birth, new passcode, confirm passcode and enter the captcha. After you have entered all the details in the NPS Scheme portal, click on the submit button.

- Step 4 An IPIN will be generated, which you can use for logging into the NSDL gate.

- Step 5 Log in to the NSDL eNPS runner and click on ‘ Login with PRAN/ IPIN ’.

- Step 6 On the coming runner, use PRAN and IPIN to subscribe into your NPS account.

What’s the Login ID for NPS Scheme Login?

Your Permanent Retirement Account Number(PRAN) that’s offered on enrollment for the NPS account will be your login ID to log in to the eNPS- NSDL website.

NPS Interest Rate

The interest rate in the NPS Scheme is proportional to the performance of the means and asset. Therefore, the quantum of return entered upon withdrawal can not be determined beforehand. NPS is a market- linked product where you can invest in a blend of equity, government debt, commercial debt, and alternative means. Once you decide on the asset blend and fund director, the plutocrat is invested in specific schemes investing in these 4 asset classes.

Withdrawal Rules and Regulations

Premature Withdrawal: NPS allows for premature partial withdrawals under special cases, subject to certain conditions. A maximum of 25% of the accumulated amount can be partially withdrawn before the age of 60.

Partial Withdrawal: NPS subscribers can opt for partial withdrawal from the Tier 1 corpus in certain circumstances such as treatment of critical illnesses, higher education, or marriage of children. The conditions stipulate that the investor should be invested in NPS for at least 3 years.

Annuitization Rules: Upon attaining the age of 60, NPS subscribers can withdraw up to 60% of the accumulated corpus as a lump sum, and the remaining 40% must be used to purchase an annuity plan offered by NPS. However, 100% is allowed if the total accumulated corpus is up to Rs 5 lakh.

Tax Implications: NPS returns are market-linked, and the returns depend on the performance of the broader market. Returns earned on NPS investments are entirely tax-exempt. Tax benefits on maturity allow for the withdrawal of 60% of the accumulated corpus at the age of 60, with the remaining 40% being mandatory to invest in an annuity.

Lump-Sum Withdrawal: If the corpus is less than Rs. 2 lakh, complete withdrawal is allowed. In the event of the subscriber’s demise, the nominee can receive 100% of the NPS pension wealth in a lump sum.

Top NPS Schemes in India

If you want to start the National Pension Scheme investment and are looking for a fund manager then you must know how difficult it is to choose the right one.

There are many banks that are providing fund management for NPS and it might be confusing sometimes. To help the investors here we are providing the top NPS scheme among those that are available for employees. You can go through the list and choose the best fund manager for your NPS investment.

Click here to know about NPS Scheme Calculator

Here’s the list of the top 5 fund managers for NPS investment in India.

-

HDFC Pension Management

HDFC provides an amazing return of 17.14% after 5 years in the NPS Tier-1 Returns. This makes it an amazing option for many people.

-

LIC Pension Fund

LIC Pension Fund is a Government scheme for NPS investment, and it has been ranked number one on the yearly returns of NPS funds continuously for 3 years. LIC provided the best returns in the year 2017-18 and 19.

-

ICICI Prudential Pension Fund management

ICICI Pension Fund among other NPS scheme facilitators give amazing results for NPS Tier -2 returns. In the first year ICICI Pension Fund gives returns of 26.29%, after 3 years it gives returns of 17.58%, and after 5 years it gives returns of 16.21%.

-

SBI Pension Fund

SBI gives decent results for both years one and TL 2 schemes. It gives returns of 15.47% after 5 years in NPS to your tour Returns and it gives a 15.39% return interior 2 scheme.

-

UTI Retirement Solutions

UTI is a central government scheme that gives returns of 6.81% after the first year, 10.47% after 3 years and 9.05% after 5 years. UTI has produced the best returns in the year 2021. This can be an amazing option for many people.

You can go through these fund managers of different NPS Scheme facilitators and choose the one that suits you the best. You can also take help from the experts at Vakilsearch. There is a team of experienced lawyers and legal Advisors who will guide you through the process and tell you which option is suitable for you.

Option to change the Fund Manager of the Scheme

With NPS scheme, you have the provision to change the pension scheme or the fund director/manager if you aren’t happy with their performance. This option is available for both category I and II accounts.

Conclusion

The National Pension Scheme is a retirement savings scheme in India. It was announced by the Government of India on 8th January 2016. The National Pension Scheme aims at providing financial security to every Indian citizen who has contributed towards the country’s growth.

If you’re planning your retirement it is important that you know all about the NPS scheme. You can contact Vakilsearch if you have any confusion or questions. Vakilsearch is an online platform that has a team of expert and experienced lawyers and legal advisors. They will guide you through the application process as well as suggest investment options suitable for you.

Also, Read: