Now you’ll get to know how TDS works when it comes to selling property in India. Read along to know more about this topic in detail and depth.

In India, the real estate sector is the most well-known. It is expected to increase from 12,000 crores in 2019 to 65,000 crores in 2020. Assume that the acquisition and sale of immovable property will rise at a rapid pace. Furthermore, the budget for 2022 was focused on capital investment. It implies that the government is also investing in infrastructure development.

Because the acquisition and sale of real estate is such a typical transaction, the tax implications are often the first thing that sellers and purchasers consider. Because this market is prone to substantial tax evasion, the government has made it mandatory for buyers to deduct TDS, or Tax Deducted at Service at the rate of 1% when completing seller payments.

Who Is Obligated to Deduct TDS?

Under the Income Tax Act (Section 194-IA), buyers are obliged to deduct TDS at a 1% rate if the selling consideration is ₹50 lakhs or over that.

However, from 1 April 2022, TDS is also needed if the stamp duty of the total worth of the property is ₹50 lakhs or more than that. It implies that TDS must be deducted if the stamp duty value of the property or selling consideration exceeds ₹50,00,000.

Except for agricultural land, TDS must be deducted on every property, whether commercial, residential, flat, vacant, building, or industrial plot.

It should be noted that if the property’s sale price goes over ₹50,00,000, TDS is levied on the full amount, not just the differential amount.

For example, consider a property that is being sold for ₹60,00,000. As a result, TDS will be levied on the entire ₹60,00,000, rather than on the difference of ₹10,00,000 (60,00,000 – 50,00,000).

The following is an illustration of TDS on the sale of property:

| Sale Amount | TDS Applicable between 14.05.2020 & 31.03.2021 (0.75%) | TDS Applicable from 1.04.2021 (1%) |

| ₹45,00,000 | 0 | 0 |

| ₹50,00,000 | 0 | 0 |

| ₹50,01,000 | ₹37,508 | ₹50,010 |

| ₹55,00,000 | ₹41,250 | ₹55,000 |

It’s also critical for the buyer to obtain the seller’s PAN details. A TDS of 20% of the selling amount is applicable if the seller’s PAN details are not furnished.

Paying TDS Amount: How to Do it?

TDS payment consists of two primary steps:

- TDS payment using Application Form No. 26QB

- Using TRACES to generate a TDS Certificate (Application Form No. 16B)

Paying TDS via Application Form No. 26QB

Listed below is the procedure for paying the TDS amount via Application Form No. 26QB:

Step 1:

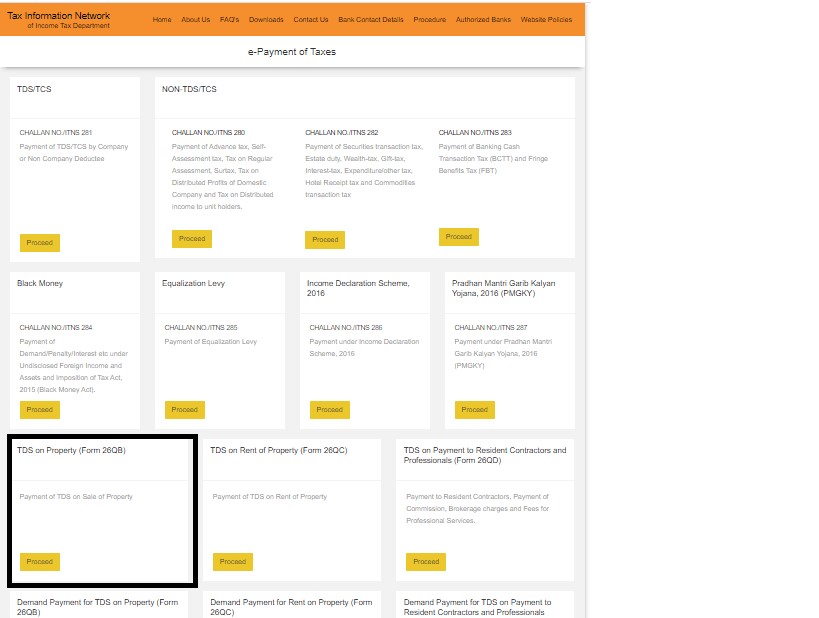

- Navigate to the TIN (Tax Information Network) official website.

- Look for the “TDS in Property” option.

- Be prepared with the following information before selecting “Proceed”, as the next stages are time-limited for 30 minutes:

- PAN Card information for both the buyer and the seller

- Contact information for both the buyer and the seller

- Specifics about the property being purchased

- The TDS amount that is deducted

- Proceed by clicking the button.

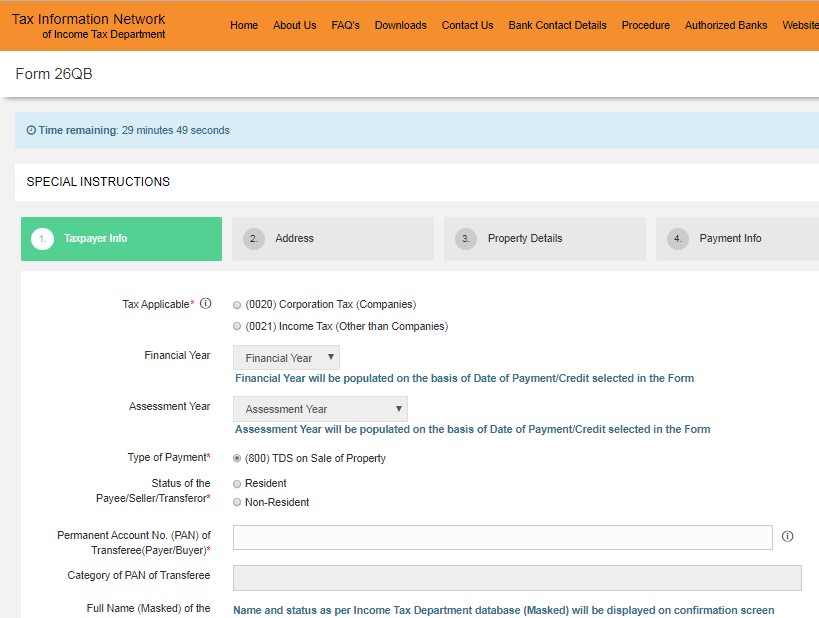

Step 2:

Fill out the information requested in each tab. After you’ve completed all of the fields, click Next.

Step 3:

- Pay the TDS amount.

The TDS amount payment can be made both offline and online.

Paying TDS Amount Online

Listed below is the procedure for paying the TDS amount online:

- Choose the “e-tax payment” option. Pick between Debit Card and Net Banking as your payment method.

- Make the payment by clicking the “Proceed” button.

- You must first choose the bank from which you wish to make the payment. If your bank isn’t on the list, you must make an offline payment.

- After you have completed your online payment, select the option “Print Challan 280”. This acknowledgement can be printed or downloaded.

- If online banking is not accessible, you must pay the sum by visiting the selected bank’s nearest branch.

- Choose the option of “e-tax payment” at a later date. Proceed by clicking the button.

- Select “Print Form 26QB”.

- It’s a transaction acknowledgement. Print this and bring it to the bank from where you made the payment. Pay the sum via demand draft or cheque at the bank branch and collect the payment counterfoil. This particular foil would serve as the receipt of the payment.

- Payment must be made in person at the bank branch within ten days of printing Application Form No. 26QB.

Generating Application Form No. 16B (TDS Certificate) via TRACES

Listed below is the procedure for paying the TDS amount via Application Form No. 16B (TRACES):

Step 1:

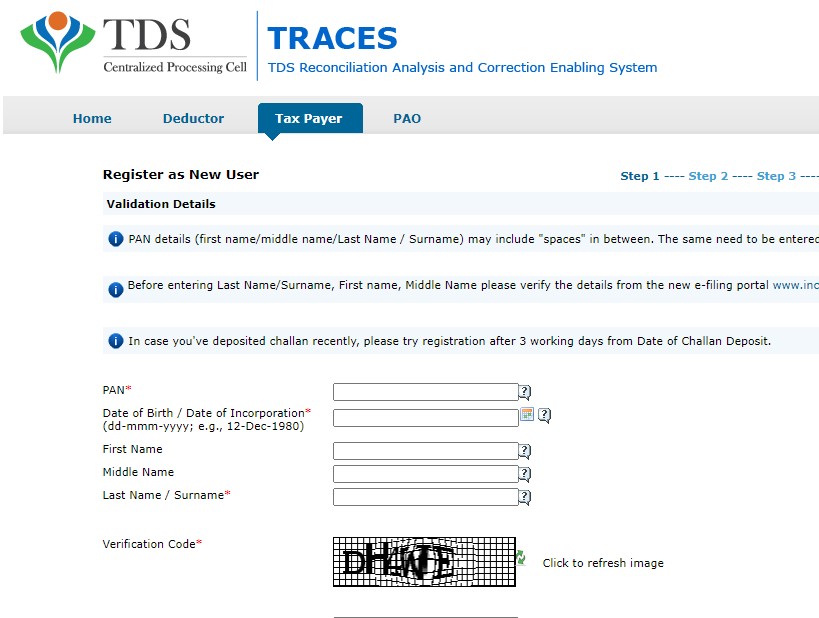

- Visit the TRACES web portal: https://contents.tdscpc.gov.in/

- You can register after 3 days post submission of the Challan with the bank.

- Input the buyer’s PAN details.

- Select the “Proceed” option.

Additionally, you need to register as a new user by filling out Option Nos. 1,2,3, or 4.

- Select the “Next” button.

- After inputting your information and establishing your password, you will be sent an OTP to confirm. Enter the OTP you got.

- You would then receive two additional OTPs, one through email and one via the registered cellphone number. Type in both OTPs and confirm your account.

Step 2:

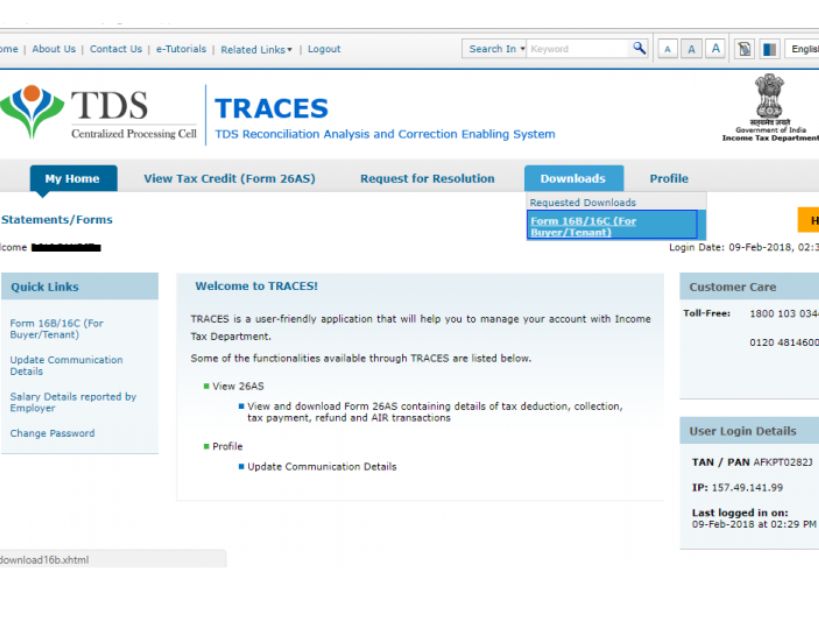

- Download Application Form No. 16B from your registered TRACES account.

- Once registered, go into your user profile and see if the TDS payment is recorded on Application Form No 26AS. It might take a maximum of 7 business days from the payment date.

- You need to sign in with your username (as per PAN) and the password you generated.

- Select Form No. 16B/16C/16D (buyer/tenant/payer)

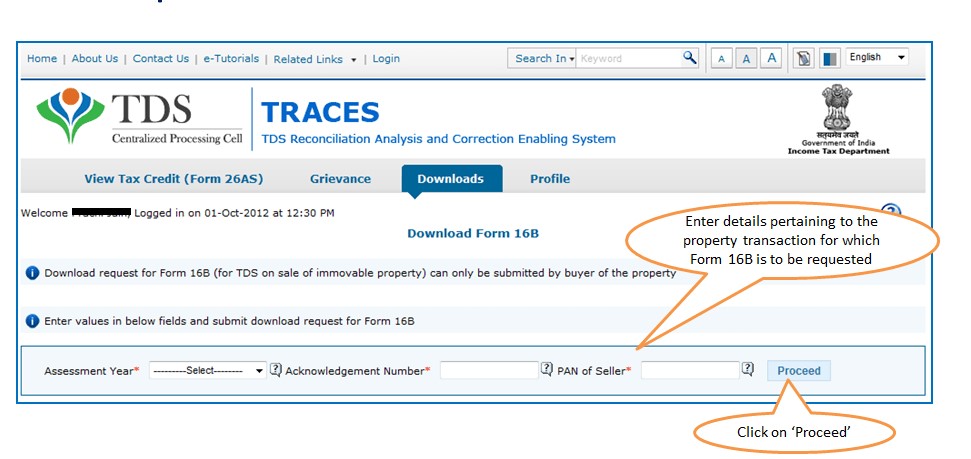

- Input the Form Type, the year of assessment, the Acknowledgement number obtained by Application Form No. 26AS), as well as the seller’s PAN.

- Select the “Proceed” option after successfully completing the steps above.

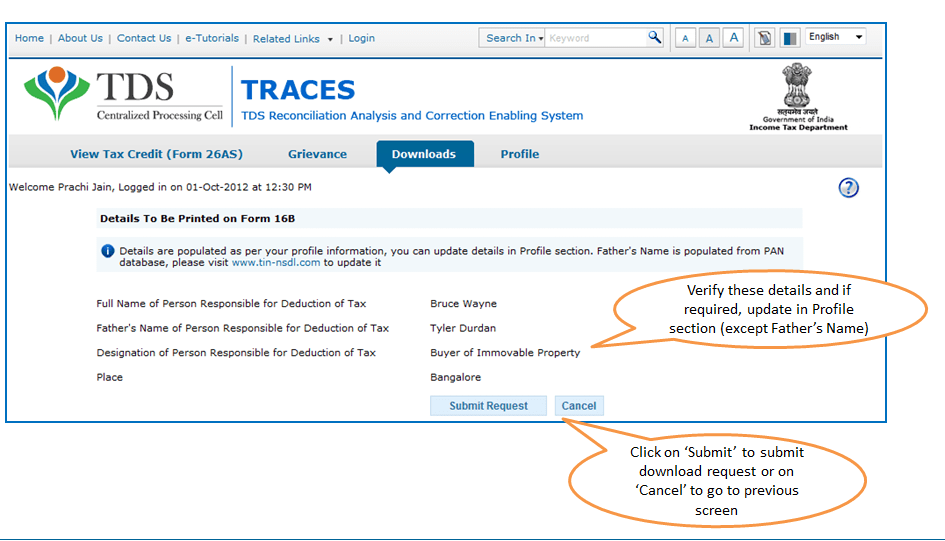

- When you click Proceed, a new tab will appear with the title Details to be Printed on Form 16B. Check the buyer, seller, and location information. Click the Submit Request button.

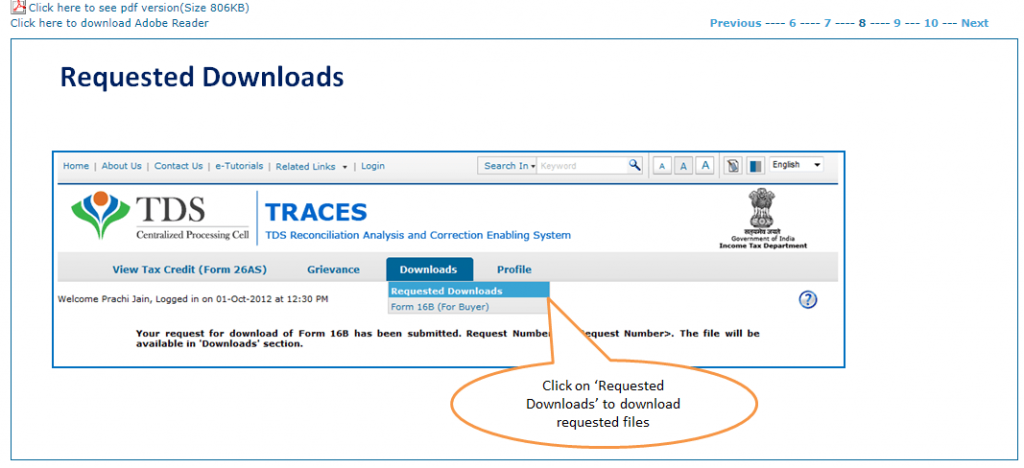

- TRACES would handle this Form 16B request within a few hours. Application Form 16B would be accessible for download under the Requested Downloads page once completed.

- Fill out Form 16B and provide it to the selling party.

Conclusion

The TDS deducted, which is indicated on Buyer’s Form-26AS, an individual can claim a refund or amend their tax due when completing his return. The government has placed a responsibility to deduct on buyers in order to trace high-value transactions and restrict the movement of illegal money. The budget 2022 adjustment is meant to achieve equivalence between sections 50C, 43CA, as well as 194IA. This will result in a bigger tax collection, but it will have to be reimbursed if the buyer claims exemptions.

For more information regarding TDS on property sale, purchase, or rent, you can consult the legal matter experts of Vakilsearch to get a more clear view and understanding of the overall process and subject matter. We are always ready to assist you in all such legal matters.

Must Read Topics: