Did you know that any income earned by a minor Children should be added to their parent's income as per Section 64(1A) of the Income Tax Act. If you didn’t, this article is definitely worth the read.

Since technology is advancing at a rapid pace, children are learning at a faster pace too. Earlier,Minor children were not exposed to as many opportunities as they are now. These days, teenagers are doing various odd jobs and earning money for themselves. Many youngsters have even started their own businesses.

If a minor (below the age of 18) earns an income above the Income Tax Slab, then it is the responsibility of the minor’s parent/guardian to file taxes on behalf of the earning child. This is because there is no minimum age bar on filing Income tax return.

Minor need to file their taxes if they have an income that amounts to more than ₹1500 per month. The income can be earned or unearned, it makes no difference. In this article, we will divulge under what circumstances a parent can claim his child’s income tax return.

Types of Income Receivable By a Minor

There are two types of income that can be received by a minor. They are, namely, earned money and unearned money.

Earned Money

If a minor participates in any TV show, competition, or sports tournament and wins the allowed prize sum, or if they earn money through part-time jobs or their own business, the income is classified as earned money.

Unearned Money

If a minor does not earn money through their own efforts and labor but instead receives money as a gift for any celebratory occasion, festival, or birthday, from well-wishers such as his/her relatives, family friends, and grandparents, the income received is classified as unearned money.

What Does the Term ‘Clubbing Money’ Mean?

Clubbing a parent’s income with their child’s income is only possible if the latter has not yet attained majority. The term ‘clubbing the money’ refers to the act of pooling the income of the parents and their children. According to the Income Tax Act, if a kid earns money from his/her own business or a part-time job, the money earned can be combined with the income of their parents. If both the parents of the minor work, the minor’s earnings must be clubbed with the earnings of the parent who earns the higher income.

Does My Child Have to File Income Tax Returns Even if I Claim for Him/Her?

There are two situations in play here –

In case the child is below the age of 18

An earning child who is below the age of 18 has to file their own income taxes. But since the child is the liability of the parent, the parents can also file on their behalf. Simply put, if your child has not attained majority yet and earns more than ₹1500 a month, you may pay their taxes on their behalf.

However, there are a few exceptions where, even if the child is a minor, the parent cannot claim the child’s income tax returns (ITR).

In case the child is above the age of 18

An earning child over the age of 18 is required to file their own income taxes. They are no longer their parent’s liability and, as a result, they have to file their own Income taxes. If your child has attained majority, you can no longer claim this ITR Preparation

Vakilsearch’s Income Tax Calculator India allows you to calculate your taxes quickly and submit them online.

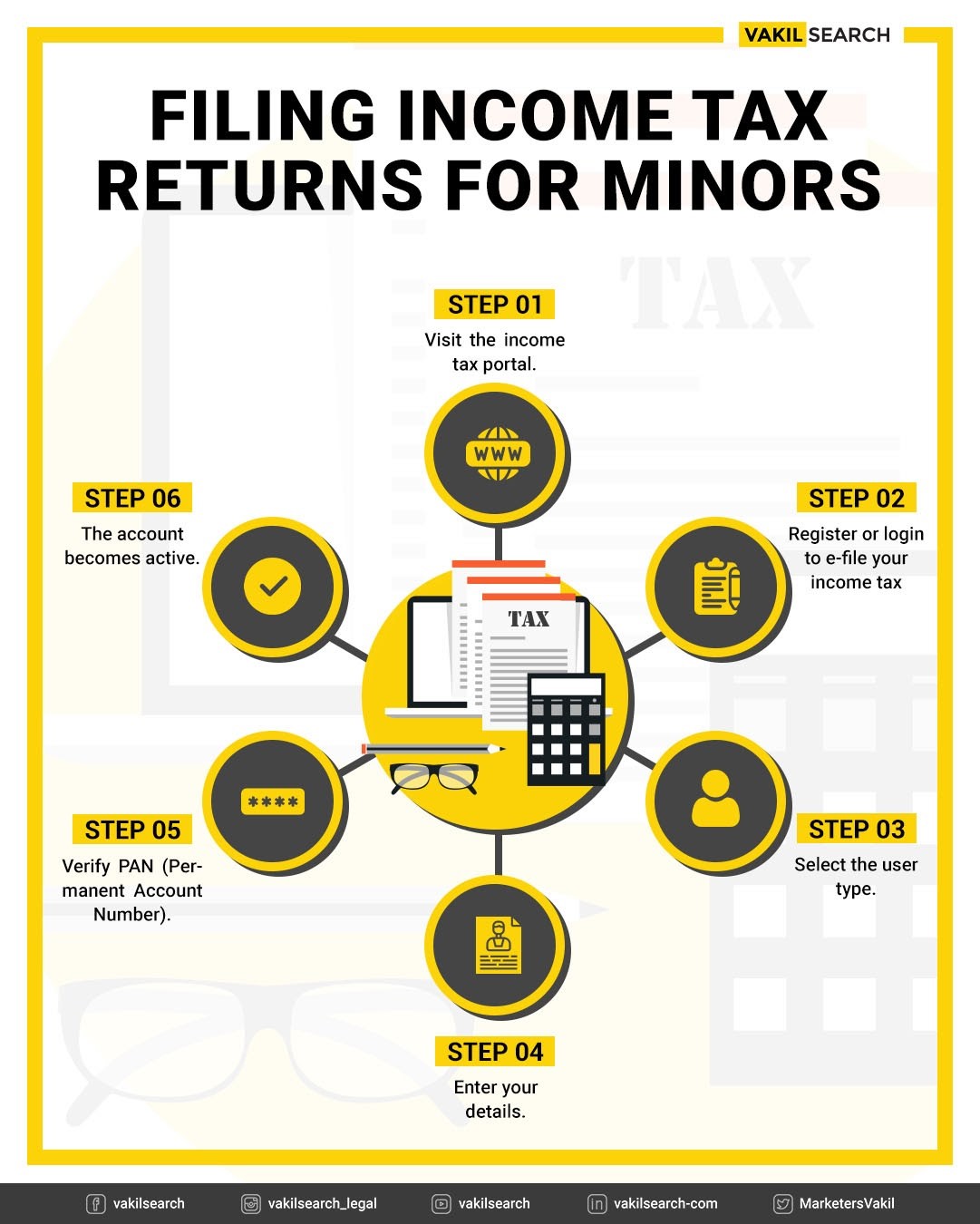

Essential Things to Know Before a Minor Files Their Own Income Tax Return

- Terms such as gross earnings, taxable income, pension fund, medical insurance, and so on and so forth, should be explained to minors before they file their own tax returns

- Minor must sign their own tax return forms

- Children must save a copy of their expenses and earnings during every financial year for reference and safety purposes

- The taxpayer name and the tax identification number must be accurately inputted in the returns form

- Children must be made aware that tax records are highly confidential

- Engaging the services of a tax specialist is the most viable and reliable method of filing ITR for minors.

Conclusion

You can also contact Vakilsearch to have all of your questions answered. Our team of taxation experts can offer insightful explanations on the subjects. To speak with our specialists, schedule a consultation slot. Taxation for minors made easy! Get help from the tax experts at Vakilsearch today!

Also, Read More:

- Income of Minor Child Is Exempted

- What is the meaning of Self Assessment Tax?

- Details about FD Tax exemption

- Depreciation Rate as per Income Tax Act for Annual Year 2021-22

- What is Long Term Capital Gain on Shares in IT returns?

- What to Know About Form 29B

- Types of Income Tax Assessment

- Income Tax Exemptions for Government Employees

- How to Update Dsc in Income Tax Portal